Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 2 (74 points) On January 1, 2016, Peace Parent Corporation acquired 100% of Serenity Subsidiary Company. The purchase price was $860,000 in excess

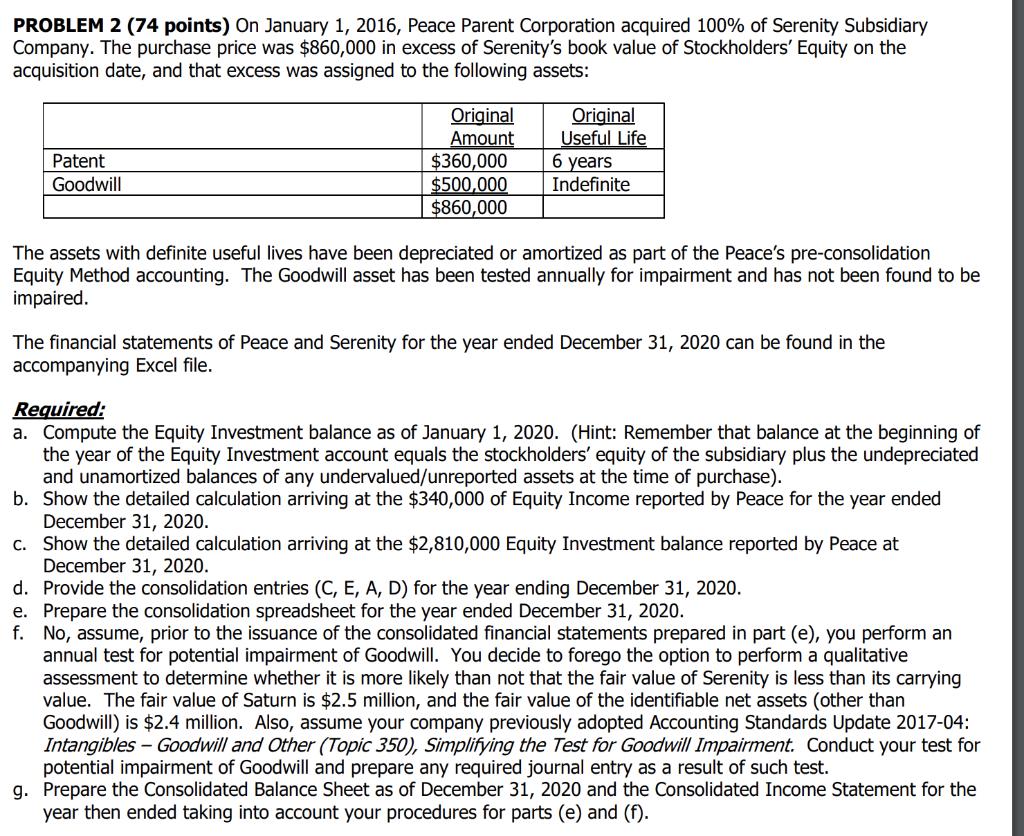

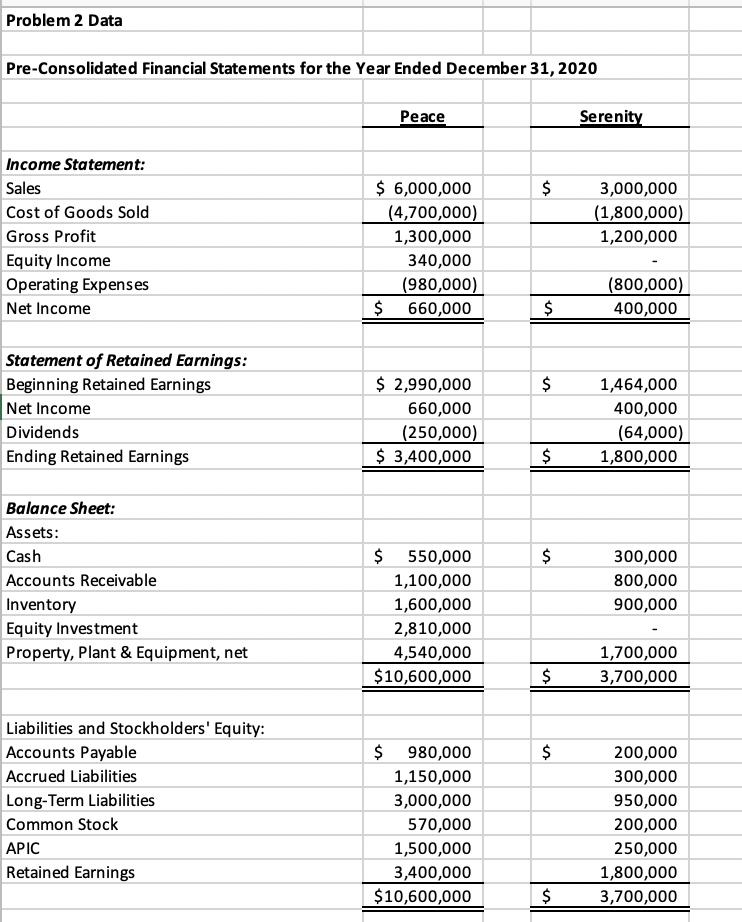

PROBLEM 2 (74 points) On January 1, 2016, Peace Parent Corporation acquired 100% of Serenity Subsidiary Company. The purchase price was $860,000 in excess of Serenity's book value of Stockholders' Equity on the acquisition date, and that excess was assigned to the following assets: Patent Goodwill Original Amount $360,000 $500,000 $860,000 Original Useful Life 6 years Indefinite The assets with definite useful lives have been depreciated or amortized as part of the Peace's pre-consolidation Equity Method accounting. The Goodwill asset has been tested annually for impairment and has not been found to be impaired. The financial statements of Peace and Serenity for the year ended December 31, 2020 can be found in the accompanying Excel file. Required: a. Compute the Equity Investment balance as of January 1, 2020. (Hint: Remember that balance at the beginning of the year of the Equity Investment account equals the stockholders' equity of the subsidiary plus the undepreciated and unamortized balances of any undervalued/unreported assets at the time of purchase). b. Show the detailed calculation arriving at the $340,000 of Equity Income reported by Peace for the year ended December 31, 2020. c. Show the detailed calculation arriving at the $2,810,000 Equity Investment balance reported by Peace at December 31, 2020. d. Provide the consolidation entries (C, E, A, D) for the year ending December 31, 2020. e. Prepare the consolidation spreadsheet for the year ended December 31, 2020. f. No, assume, prior to the issuance of the consolidated financial statements prepared in part (e), you perform an annual test for potential impairment of Goodwill. You decide to forego the option to perform a qualitative assessment to determine whether it is more likely than not that the fair value of Serenity is less than its carrying value. The fair value of Saturn is $2.5 million, and the fair value of the identifiable net assets (other than Goodwill) is $2.4 million. Also, assume your company previously adopted Accounting Standards Update 2017-04: Intangibles - Goodwill and Other (Topic 350), Simplifying the Test for Goodwill Impairment. Conduct your test for potential impairment of Goodwill and prepare any required journal entry as a result of such test. g. Prepare the Consolidated Balance Sheet as of December 31, 2020 and the Consolidated Income Statement for the year then ended taking into account your procedures for parts (e) and (f). Problem 2 Data Pre-Consolidated Financial Statements for the Year Ended December 31, 2020 Income Statement: Sales Cost of Goods Sold Gross Profit Equity Income Operating Expenses Net Income Statement of Retained Earnings: Beginning Retained Earnings Net Income Dividends Ending Retained Earnings Balance Sheet: Assets: Cash Accounts Receivable Inventory Equity Investment Property, Plant & Equipment, net Liabilities and Stockholders' Equity: Accounts Payable Accrued Liabilities Long-Term Liabilities Common Stock APIC Retained Earnings Peace $ 6,000,000 (4,700,000) 1,300,000 $ 340,000 (980,000) 660,000 $ 2,990,000 660,000 (250,000) $ 3,400,000 $ 550,000 1,100,000 1,600,000 2,810,000 4,540,000 $10,600,000 $ 980,000 1,150,000 3,000,000 570,000 1,500,000 3,400,000 $10,600,000 $ $ $ $ $ $ $ Serenity 3,000,000 (1,800,000) 1,200,000 (800,000) 400,000 1,464,000 400,000 (64,000) 1,800,000 300,000 800,000 900,000 1,700,000 3,700,000 200,000 300,000 950,000 200,000 250,000 1,800,000 $ 3,700,000

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Compute the Equity Investment balance as of January 1 2020 Hint Remember that balance at the beginning of the year of the Equity Investment account equals the stockholders equity of the subsidiary p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started