Answered step by step

Verified Expert Solution

Question

1 Approved Answer

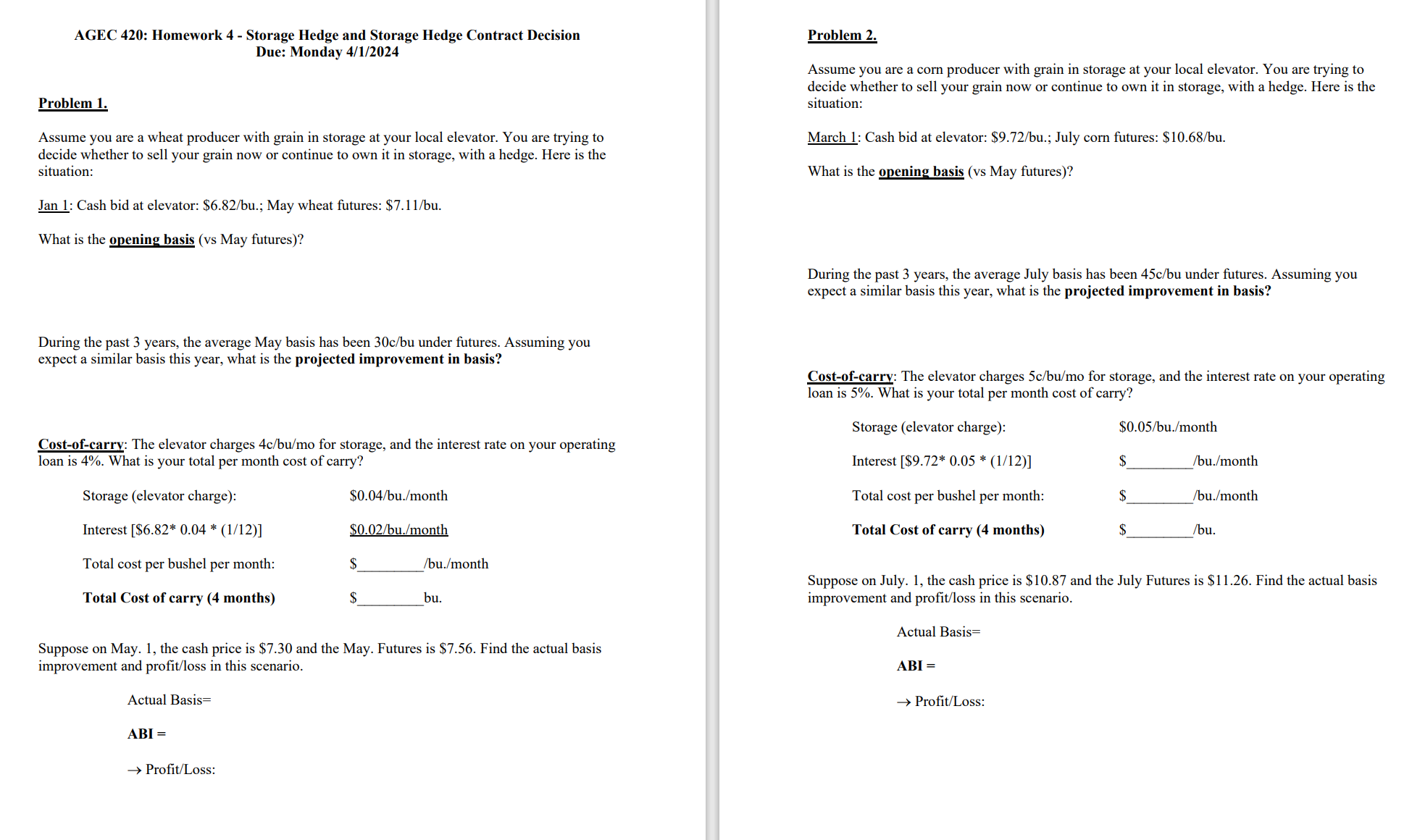

Problem 2 . Assume you are a corn producer with grain in storage at your local elevator. You are trying to decide whether to sell

Problem

Assume you are a corn producer with grain in storage at your local elevator. You are trying to

decide whether to sell your grain now or continue to own it in storage, with a hedge. Here is the

situation:

March : Cash bid at elevator: $ bu; July corn futures: $

What is the opening basis vs May futures

During the past years, the average July basis has been under futures. Assuming you

expect a similar basis this year, what is the projected improvement in basis?

Costofcarry: The elevator charges for storage, and the interest rate on your operating

loan is What is your total per month cost of carry?

Suppose on July. the cash price is $ and the July Futures is $ Find the actual basis

improvement and profitloss in this scenario.

Actual Basis

ABI

ProfitLoss:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started