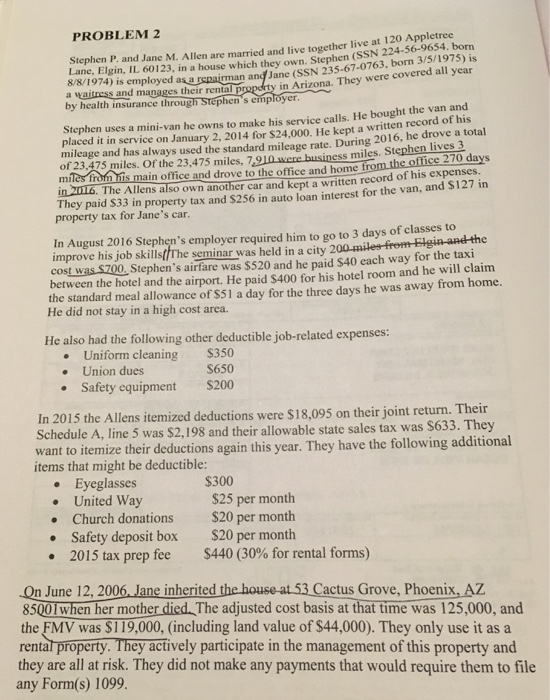

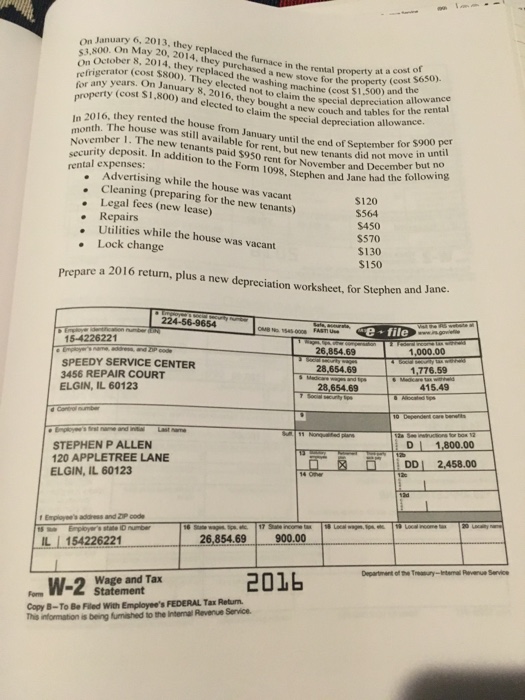

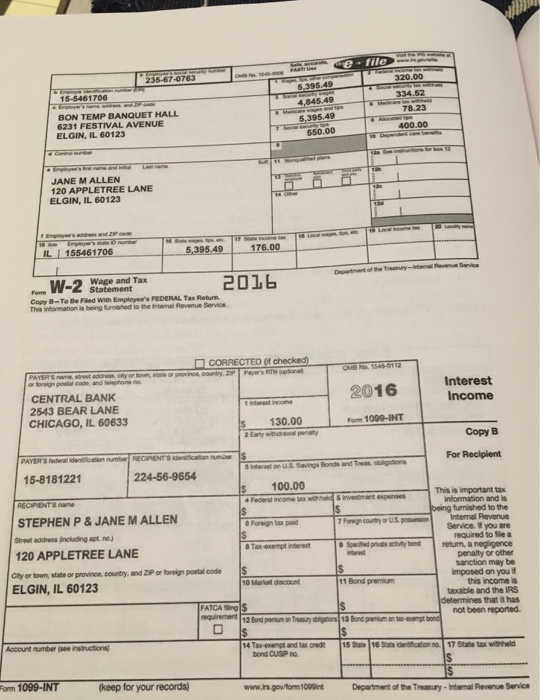

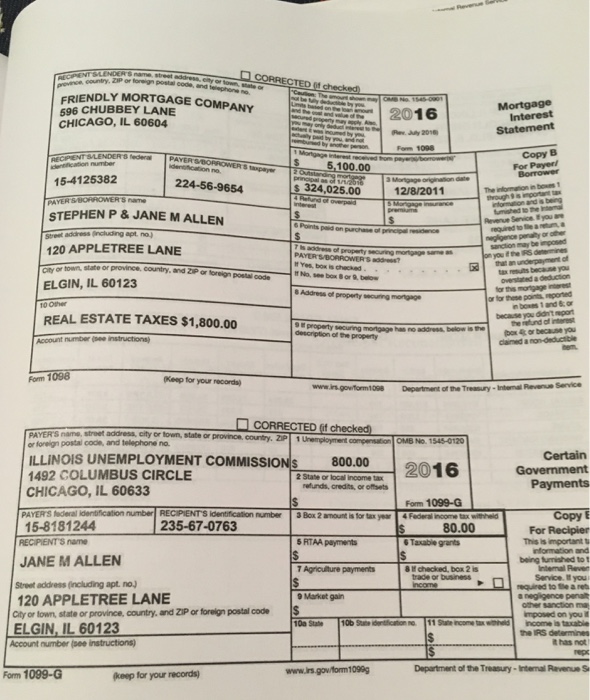

PROBLEM 2 at 120 Appletree Stephen P. and Jane M. Allen are married and live together Iiv N 224-56-9654. born man and Jane (SSN 235-67-0763, born 3/5/1975) is in Arizona. They were covered all year Lane, Elgin, IL 60123, in a house which they own. Stephen ( 8/8/1974) is employed a a vartress and manages their rental pr by health insurance through Stephen's employer and d of his Stephen uses a mini-van he owns to make his service calls. He bought the van placed it in service on January 2, 2014 for $24,000. He kept a written recor mileage and has always used the standard mileage rate. During 20 of 23,475 miles. Of the 23,475 miles, 7,910were business miles. Stephen lives miles from is main office and drove to the office and home t in 2016. The Allens also own another car and kept a written record of his expenses They paid $33 in property tax and $256 in auto loan interest for the van, and $127 in 16, he drove a total property tax for Jane's car In August 2016 Stephen's employer required him to go to 3 days of classes to improve his job skills(The seminar was held in a city 2 cost was SZ00, Stephen's airfare was $520 and he paid $40 each way for the taxi between the hotel and the airport. He paid $400 for his hotel room and he will claim the standard meal allowance of S51 a day for the three days he was away from home. He did not stay in a high cost area. He also had the following other deductible job-related expenses: $350 S650 .Uniform cleaning .Union dues Safety equipment $200 In 2015 the Allens itemized deductions were $18,095 on their joint return. Their Schedule A, line 5 was $2,198 and their allowable state sales tax was S633. They want to itemize items that might be deductible: their deductions again this year. They have the following additional . Eyeglasses $300 United Way Church donations$20 per month $25 per month . .Safety deposit box S20 per month 2015 tax prep fee $440 (30% for rental forms) On June 12, 2006 Jane inherited the house at 53 Cactus Grove, Phoenix, AZ 85001when her mother died. The adjusted cost basis at that time was 125,000, and the FMV was $119,000, (including land value of $44,000). They only use it as a rental property. They actively participate in the management of this property and they are all at risk. They did not make any payments that would require them to file any Form(s) 1099. PROBLEM 2 at 120 Appletree Stephen P. and Jane M. Allen are married and live together Iiv N 224-56-9654. born man and Jane (SSN 235-67-0763, born 3/5/1975) is in Arizona. They were covered all year Lane, Elgin, IL 60123, in a house which they own. Stephen ( 8/8/1974) is employed a a vartress and manages their rental pr by health insurance through Stephen's employer and d of his Stephen uses a mini-van he owns to make his service calls. He bought the van placed it in service on January 2, 2014 for $24,000. He kept a written recor mileage and has always used the standard mileage rate. During 20 of 23,475 miles. Of the 23,475 miles, 7,910were business miles. Stephen lives miles from is main office and drove to the office and home t in 2016. The Allens also own another car and kept a written record of his expenses They paid $33 in property tax and $256 in auto loan interest for the van, and $127 in 16, he drove a total property tax for Jane's car In August 2016 Stephen's employer required him to go to 3 days of classes to improve his job skills(The seminar was held in a city 2 cost was SZ00, Stephen's airfare was $520 and he paid $40 each way for the taxi between the hotel and the airport. He paid $400 for his hotel room and he will claim the standard meal allowance of S51 a day for the three days he was away from home. He did not stay in a high cost area. He also had the following other deductible job-related expenses: $350 S650 .Uniform cleaning .Union dues Safety equipment $200 In 2015 the Allens itemized deductions were $18,095 on their joint return. Their Schedule A, line 5 was $2,198 and their allowable state sales tax was S633. They want to itemize items that might be deductible: their deductions again this year. They have the following additional . Eyeglasses $300 United Way Church donations$20 per month $25 per month . .Safety deposit box S20 per month 2015 tax prep fee $440 (30% for rental forms) On June 12, 2006 Jane inherited the house at 53 Cactus Grove, Phoenix, AZ 85001when her mother died. The adjusted cost basis at that time was 125,000, and the FMV was $119,000, (including land value of $44,000). They only use it as a rental property. They actively participate in the management of this property and they are all at risk. They did not make any payments that would require them to file any Form(s) 1099