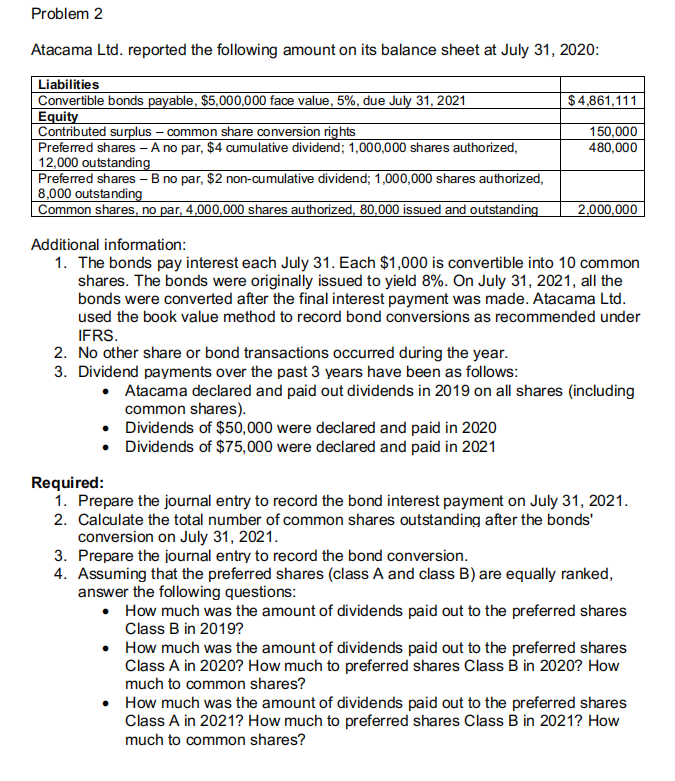

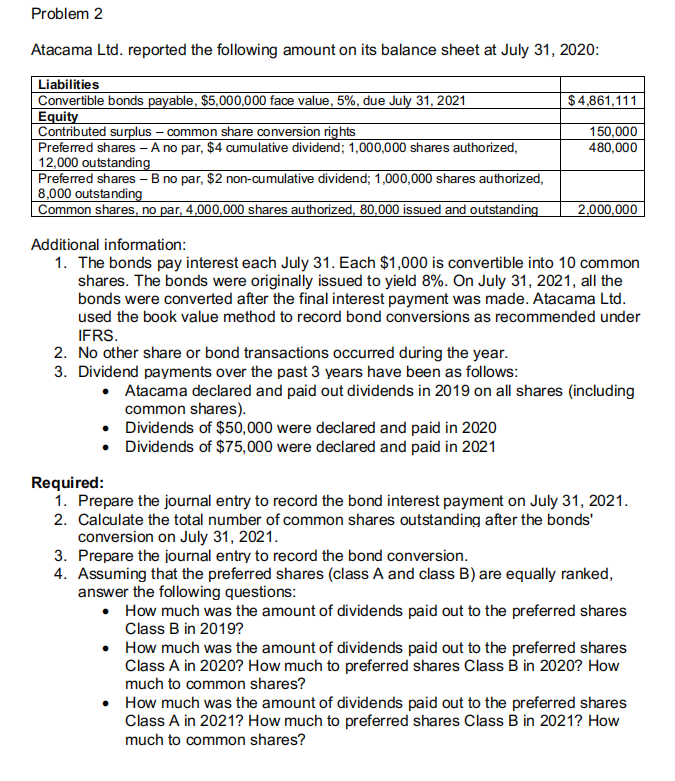

Problem 2 Atacama Ltd. reported the following amount on its balance sheet at July 31, 2020: $4,861,111 Liabilities Convertible bonds payable, $5,000,000 face value, 5%, due July 31, 2021 Equity Contributed surplus - common share conversion rights Preferred shares - A no par, $4 cumulative dividend; 1,000,000 shares authorized, 12,000 outstanding Preferred shares - B no par, $2 non-cumulative dividend; 1,000,000 shares authorized, 8,000 outstanding Common shares, no par, 4,000,000 shares authorized, 80,000 issued and outstanding 150,000 480,000 2,000,000 Additional information: 1. The bonds pay interest each July 31. Each $1,000 is convertible into 10 common shares. The bonds were originally issued to yield 8%. On July 31, 2021, all the bonds were converted after the final interest payment was made. Atacama Ltd. used the book value method to record bond conversions as recommended under IFRS. 2. No other share or bond transactions occurred during the year. 3. Dividend payments over the past 3 years have been as follows: Atacama declared and paid out dividends in 2019 on all shares (including common shares) Dividends of $50,000 were declared and paid in 2020 Dividends of $75,000 were declared and paid in 2021 Required: 1. Prepare the journal entry to record the bond interest payment on July 31, 2021. 2. Calculate the total number of common shares outstanding after the bonds' conversion on July 31, 2021. 3. Prepare the journal entry to record the bond conversion. 4. Assuming that the preferred shares (class A and class B) are equally ranked, answer the following questions: How much was the amount of dividends paid out to the preferred shares Class B in 2019? How much was the amount of dividends paid out to the preferred shares Class A in 2020? How much to preferred shares Class B in 2020? How much to common shares? How much was the amount of dividends paid out to the preferred shares Class A in 2021? How much to preferred shares Class B in 2021? How much to common shares? Problem 2 Atacama Ltd. reported the following amount on its balance sheet at July 31, 2020: $4,861,111 Liabilities Convertible bonds payable, $5,000,000 face value, 5%, due July 31, 2021 Equity Contributed surplus - common share conversion rights Preferred shares - A no par, $4 cumulative dividend; 1,000,000 shares authorized, 12,000 outstanding Preferred shares - B no par, $2 non-cumulative dividend; 1,000,000 shares authorized, 8,000 outstanding Common shares, no par, 4,000,000 shares authorized, 80,000 issued and outstanding 150,000 480,000 2,000,000 Additional information: 1. The bonds pay interest each July 31. Each $1,000 is convertible into 10 common shares. The bonds were originally issued to yield 8%. On July 31, 2021, all the bonds were converted after the final interest payment was made. Atacama Ltd. used the book value method to record bond conversions as recommended under IFRS. 2. No other share or bond transactions occurred during the year. 3. Dividend payments over the past 3 years have been as follows: Atacama declared and paid out dividends in 2019 on all shares (including common shares) Dividends of $50,000 were declared and paid in 2020 Dividends of $75,000 were declared and paid in 2021 Required: 1. Prepare the journal entry to record the bond interest payment on July 31, 2021. 2. Calculate the total number of common shares outstanding after the bonds' conversion on July 31, 2021. 3. Prepare the journal entry to record the bond conversion. 4. Assuming that the preferred shares (class A and class B) are equally ranked, answer the following questions: How much was the amount of dividends paid out to the preferred shares Class B in 2019? How much was the amount of dividends paid out to the preferred shares Class A in 2020? How much to preferred shares Class B in 2020? How much to common shares? How much was the amount of dividends paid out to the preferred shares Class A in 2021? How much to preferred shares Class B in 2021? How much to common shares