Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2. Consider the following table of Call/Put premia for maturity T=1 year: The current asset price is S0=102 and the continuously compounded interest rate

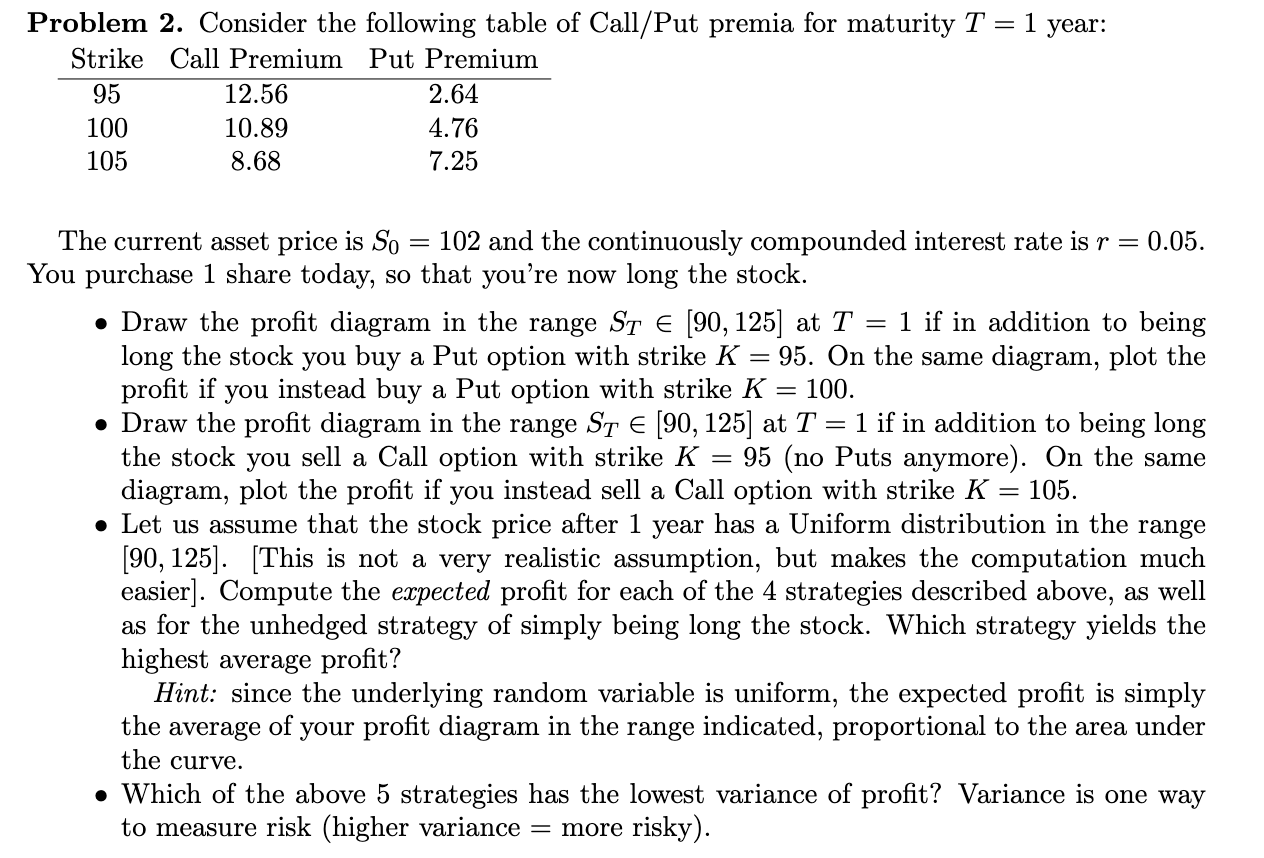

Problem 2. Consider the following table of Call/Put premia for maturity T=1 year: The current asset price is S0=102 and the continuously compounded interest rate is r=0.05. You purchase 1 share today, so that you're now long the stock. - Draw the profit diagram in the range ST[90,125] at T=1 if in addition to being long the stock you buy a Put option with strike K=95. On the same diagram, plot the profit if you instead buy a Put option with strike K=100. - Draw the profit diagram in the range ST[90,125] at T=1 if in addition to being long the stock you sell a Call option with strike K=95 (no Puts anymore). On the same diagram, plot the profit if you instead sell a Call option with strike K=105. - Let us assume that the stock price after 1 year has a Uniform distribution in the range [90,125]. [This is not a very realistic assumption, but makes the computation much easier]. Compute the expected profit for each of the 4 strategies described above, as well as for the unhedged strategy of simply being long the stock. Which strategy yields the highest average profit? Hint: since the underlying random variable is uniform, the expected profit is simply the average of your profit diagram in the range indicated, proportional to the area under the curve. - Which of the above 5 strategies has the lowest variance of profit? Variance is one way to measure risk (higher variance = more risky)

Problem 2. Consider the following table of Call/Put premia for maturity T=1 year: The current asset price is S0=102 and the continuously compounded interest rate is r=0.05. You purchase 1 share today, so that you're now long the stock. - Draw the profit diagram in the range ST[90,125] at T=1 if in addition to being long the stock you buy a Put option with strike K=95. On the same diagram, plot the profit if you instead buy a Put option with strike K=100. - Draw the profit diagram in the range ST[90,125] at T=1 if in addition to being long the stock you sell a Call option with strike K=95 (no Puts anymore). On the same diagram, plot the profit if you instead sell a Call option with strike K=105. - Let us assume that the stock price after 1 year has a Uniform distribution in the range [90,125]. [This is not a very realistic assumption, but makes the computation much easier]. Compute the expected profit for each of the 4 strategies described above, as well as for the unhedged strategy of simply being long the stock. Which strategy yields the highest average profit? Hint: since the underlying random variable is uniform, the expected profit is simply the average of your profit diagram in the range indicated, proportional to the area under the curve. - Which of the above 5 strategies has the lowest variance of profit? Variance is one way to measure risk (higher variance = more risky) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started