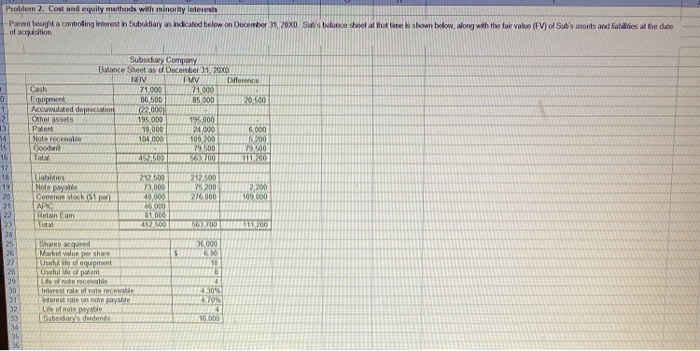

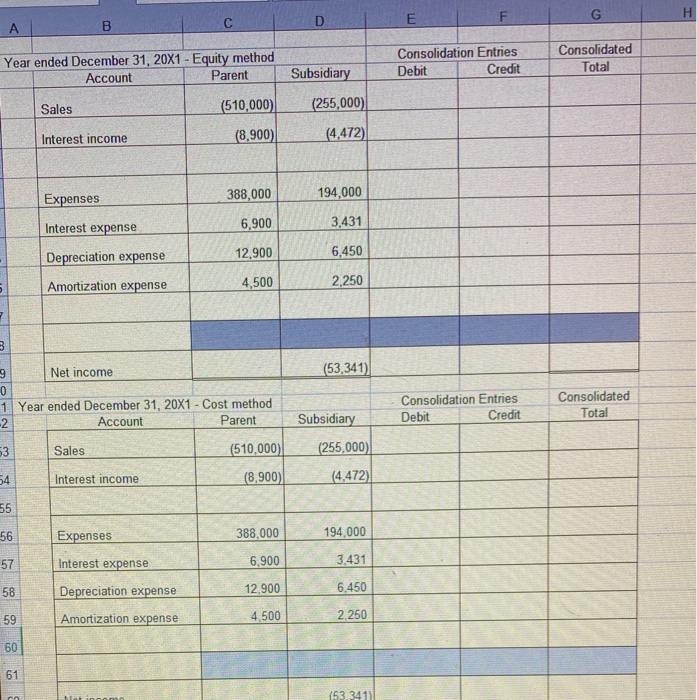

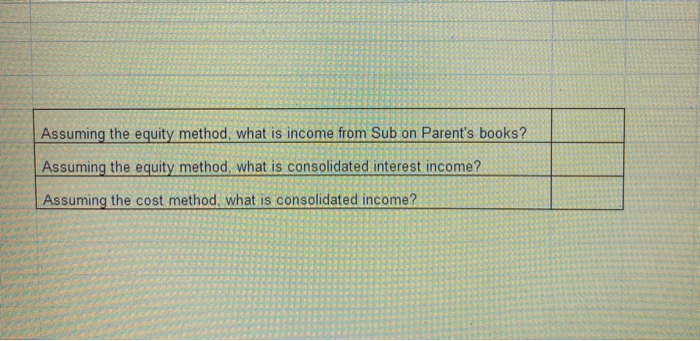

Problem 2. Cost and equily methods with minority interests Parent bought a controlling invest in Subaliary as indicated below on December 31, 20XD Sue's balance sheet times shown below, along with the fair value (FV) of Sub's assets and Natalities at the date of acquisition Subsidy Company Balance Sheet as of December 31, 2020 NAV FMV Difference Canh 71.000 71,000 Equipment 86.500 85,000 20.000 1 Accumulated depreciation 22.000 2 Other sets 195.000 195.000 13 PMR 18,000 24.000 6,000 74 Note recentio 105.000 109 200 5200 15 79500 1990 TOLE 42,505 56700 111.200 17 11 Kibitis 21200 2125.00 Notepayable 73,000 75200 2,200 20 Como to 40.000 276.000 10.000 21 NRC 46.000 22 BOLO Total 03/00 24 25thwes cured 36000 26 Market value per shave 690 27 Use we loqupment 10 Ushule patent 16 29 Ile of not receive 4 30 Imerest rate of role recevable 430% 31 restale on note payable 32 ile of note payable 4 33 Subsidiary's didende 16000 34 35 36 D A E B Year ended December 31, 20X1 - Equity method Account Parent Consolidation Entries Debit Credit Consolidated Total Subsidiary Sales (510,000) (255,000) Interest income (8,900) (4,472) Expenses 388,000 194,000 Interest expense 6,900 3,431 12,900 6,450 Depreciation expense Amortization expense 4,500 2,250 3 (53,341) 9 Net income 0 1 Year ended December 31, 20X1 - Cost method -2 Account Parent Consolidation Entries Debit Credit Consolidated Total Subsidiary 53 Sales (510,000) (255,000) (4,472) 54 Interest income (8,900) 555 56 Expenses 388,000 194,000 57 Interest expense 6,900 3.431 58 Depreciation expense 12.900 6.450 59 Amortization expense 4,500 2.250 60 61 (53.3411 Assuming the equity method, what is income from Sub on Parent's books? Assuming the equity method, what is consolidated interest income? Assuming the cost method, what is consolidated income? Problem 2. Cost and equily methods with minority interests Parent bought a controlling invest in Subaliary as indicated below on December 31, 20XD Sue's balance sheet times shown below, along with the fair value (FV) of Sub's assets and Natalities at the date of acquisition Subsidy Company Balance Sheet as of December 31, 2020 NAV FMV Difference Canh 71.000 71,000 Equipment 86.500 85,000 20.000 1 Accumulated depreciation 22.000 2 Other sets 195.000 195.000 13 PMR 18,000 24.000 6,000 74 Note recentio 105.000 109 200 5200 15 79500 1990 TOLE 42,505 56700 111.200 17 11 Kibitis 21200 2125.00 Notepayable 73,000 75200 2,200 20 Como to 40.000 276.000 10.000 21 NRC 46.000 22 BOLO Total 03/00 24 25thwes cured 36000 26 Market value per shave 690 27 Use we loqupment 10 Ushule patent 16 29 Ile of not receive 4 30 Imerest rate of role recevable 430% 31 restale on note payable 32 ile of note payable 4 33 Subsidiary's didende 16000 34 35 36 D A E B Year ended December 31, 20X1 - Equity method Account Parent Consolidation Entries Debit Credit Consolidated Total Subsidiary Sales (510,000) (255,000) Interest income (8,900) (4,472) Expenses 388,000 194,000 Interest expense 6,900 3,431 12,900 6,450 Depreciation expense Amortization expense 4,500 2,250 3 (53,341) 9 Net income 0 1 Year ended December 31, 20X1 - Cost method -2 Account Parent Consolidation Entries Debit Credit Consolidated Total Subsidiary 53 Sales (510,000) (255,000) (4,472) 54 Interest income (8,900) 555 56 Expenses 388,000 194,000 57 Interest expense 6,900 3.431 58 Depreciation expense 12.900 6.450 59 Amortization expense 4,500 2.250 60 61 (53.3411 Assuming the equity method, what is income from Sub on Parent's books? Assuming the equity method, what is consolidated interest income? Assuming the cost method, what is consolidated income