Answered step by step

Verified Expert Solution

Question

1 Approved Answer

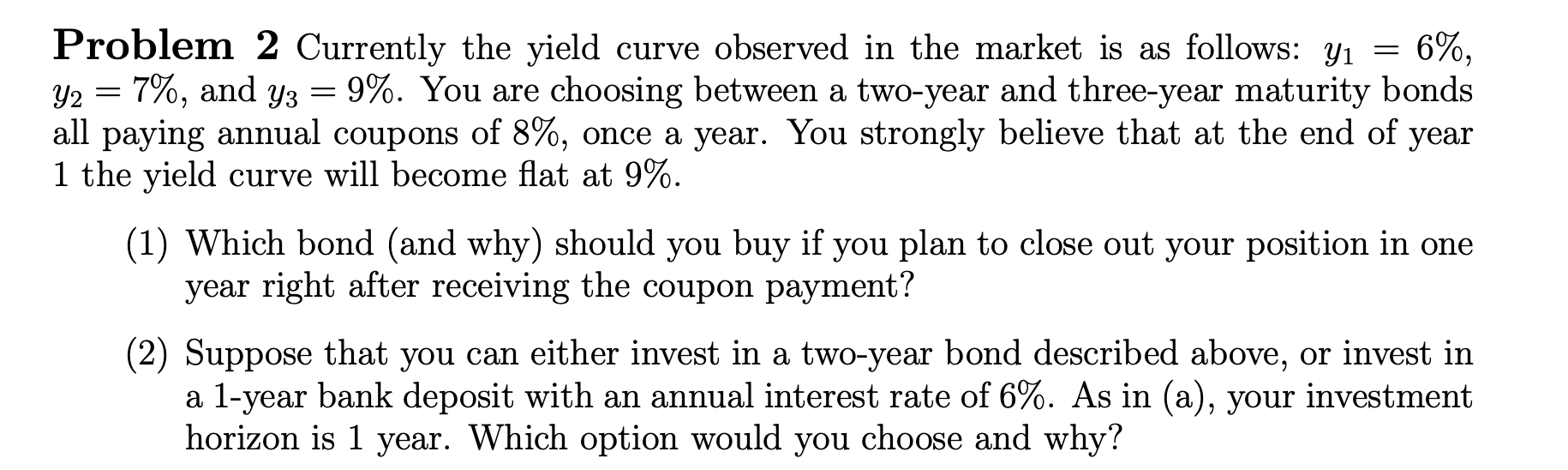

Problem 2 Currently the yield curve observed in the market is as follows: y 1 = 6 % , y 2 = 7 % ,

Problem Currently the yield curve observed in the market is as follows:

and You are choosing between a twoyear and threeyear maturity bonds

all paying annual coupons of once a year. You strongly believe that at the end of year

the yield curve will become flat at

Which bond and why should you buy if you plan to close out your position in one

year right after receiving the coupon payment?

Suppose that you can either invest in a twoyear bond described above, or invest in

a year bank deposit with an annual interest rate of As in a your investment

horizon is year. Which option would you choose and why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started