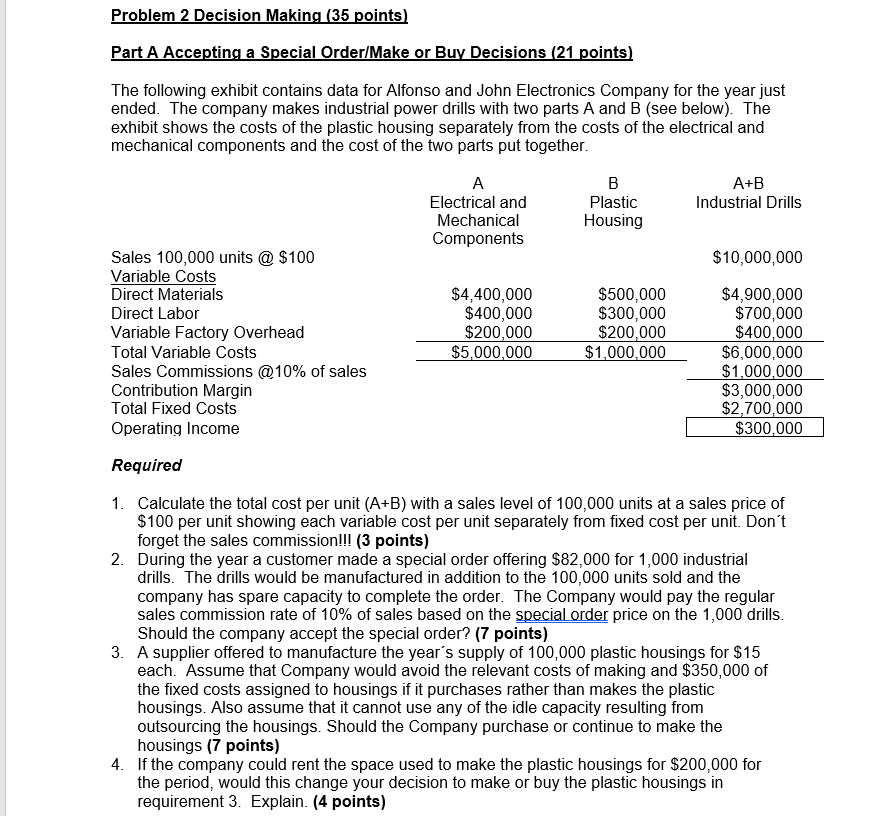

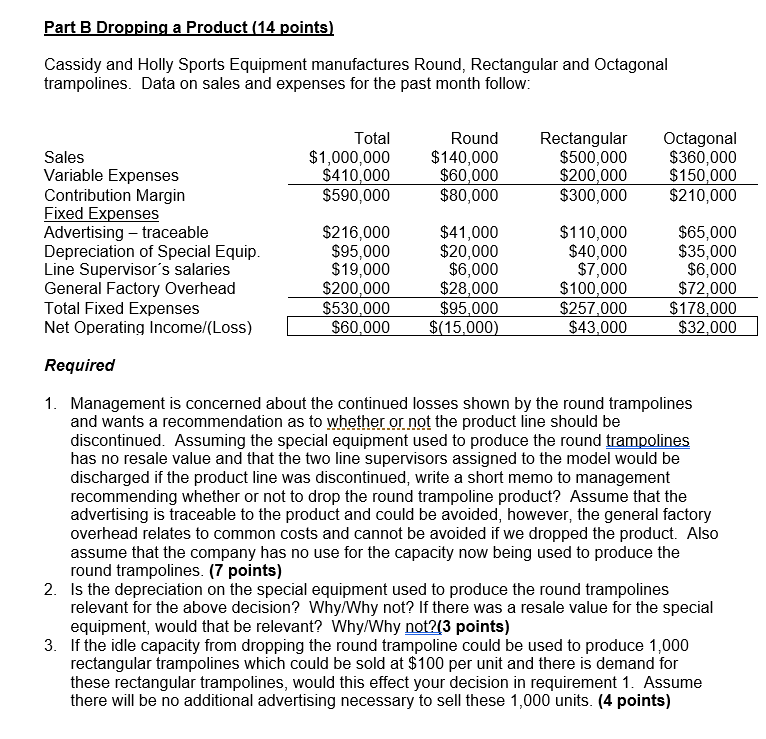

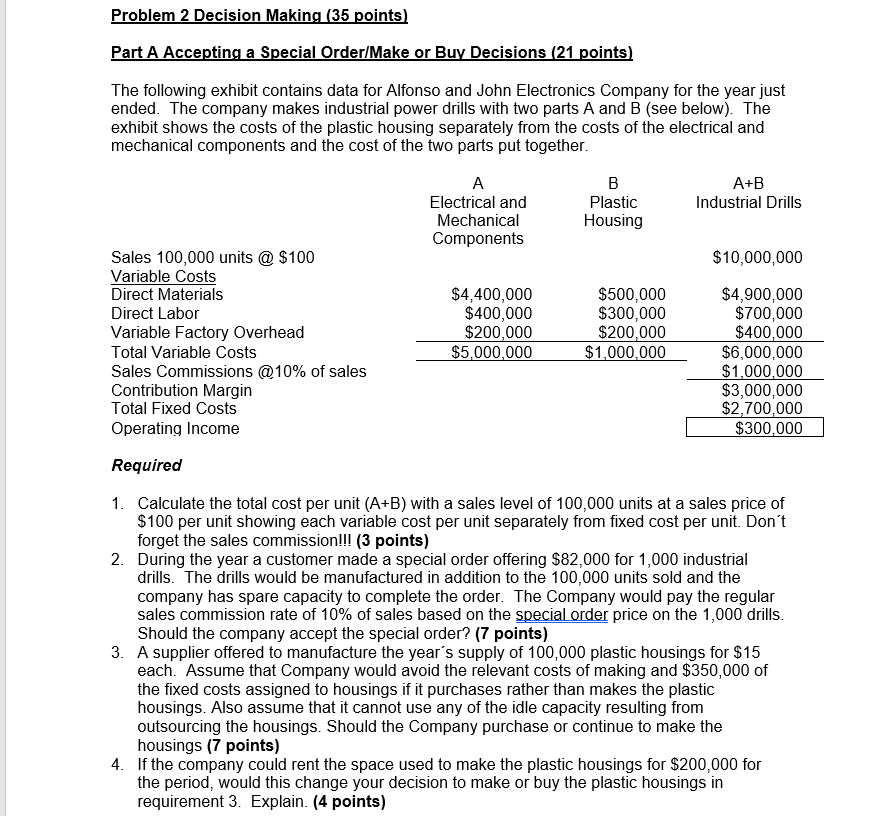

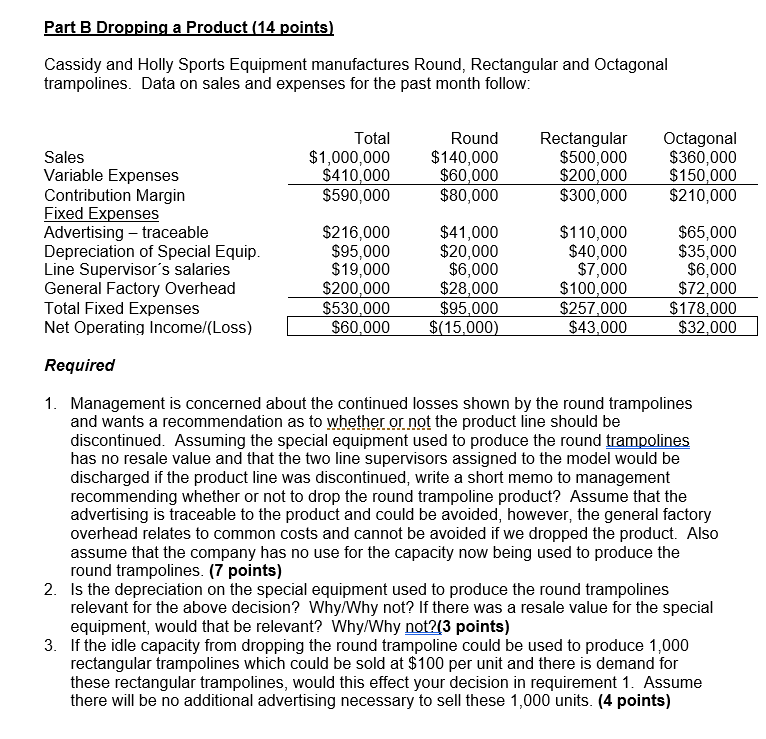

Problem 2 Decision Making (35 points) Part A Accepting a Special Order/Make or Buy Decisions (21 points) The following exhibit contains data for Alfonso and John Electronics Company for the year just ended. The company makes industrial power drills with two parts A and B (see below). The exhibit shows the costs of the plastic housing separately from the costs of the electrical and mechanical components and the cost of the two parts put together. A+B Industrial Drills Electrical and Mechanical Components Plastic Housing $10,000,000 Sales 100,000 units @ $100 Variable Costs Direct Materials Direct Labor Variable Factory Overhead Total Variable Costs Sales Commissions @10% of sales Contribution Margin Total Fixed Costs Operating Income $4,400,000 $400,000 $200,000 $5,000,000 $500,000 $300,000 $200,000 $1,000,000 $4,900.000 $700,000 $400,000 $6,000,000 $1,000,000 $3,000,000 $2,700,000 $300,000 Required 1. Calculate the total cost per unit (A+B) with a sales level of 100,000 units at a sales price of $100 per unit showing each variable cost per unit separately from fixed cost per unit. Don't forget the sales commission!!! (3 points) 2. During the year a customer made a special order offering $82,000 for 1,000 industrial drills. The drills would be manufactured in addition to the 100,000 units sold and the company has spare capacity to complete the order. The Company would pay the regular sales commission rate of 10% of sales based on the special order price on the 1,000 drills. Should the company accept the special order? (7 points) 3. A supplier offered to manufacture the year's supply of 100,000 plastic housings for $15 each. Assume that Company would avoid the relevant costs of making and $350,000 of the fixed costs assigned to housings if it purchases rather than makes the plastic housings. Also assume that it cannot use any of the idle capacity resulting from outsourcing the housings. Should the Company purchase or continue to make the housings (7 points) 4. If the company could rent the space used to make the plastic housings for $200,000 for the period, would this change your decision to make or buy the plastic housings in requirement 3. Explain. (4 points) Part B Dropping a Product (14 points) Cassidy and Holly Sports Equipment manufactures Round, Rectangular and Octagonal trampolines. Data on sales and expenses for the past month follow: Total $1,000,000 $410,000 $590,000 Round $140,000 $60,000 $80,000 Rectangular $500,000 $200,000 $300,000 Octagonal $360,000 $150,000 $210,000 Sales Variable Expenses Contribution Margin Fixed Expenses Advertising - traceable Depreciation of Special Equip. Line Supervisor's salaries General Factory Overhead Total Fixed Expenses Net Operating Income/(Loss) $216,000 $95,000 $19,000 $200,000 $530,000 $60,000 $41,000 $20.000 $6,000 $28,000 $95,000 $(15,000) $110,000 $40,000 $7,000 $100,000 $257,000 $43,000 $65,000 $35.000 $6,000 $72,000 $178,000 $32,000 Required 1. Management is concerned about the continued losses shown by the round trampolines and wants a recommendation as to whether or not the product line should be discontinued. Assuming the special equipment used to produce the round trampolines has no resale value and that the two line supervisors assigned to the model would be discharged if the product line was discontinued, write a short memo to management recommending whether or not to drop the round trampoline product? Assume that the advertising is traceable to the product and could be avoided, however, the general factory overhead relates to common costs and cannot be avoided if we dropped the product. Also assume that the company has no use for the capacity now being used to produce the round trampolines. (7 points) 2. Is the depreciation on the special equipment used to produce the round trampolines relevant for the above decision? Why/Why not? If there was a resale value for the special equipment, would that be relevant? Why/Why not?(3 points) 3. If the idle capacity from dropping the round trampoline could be used to produce 1,000 rectangular trampolines which could be sold at $100 per unit and there is demand for these rectangular trampolines, would this effect your decision in requirement 1. Assume there will be no additional advertising necessary to sell these 1,000 units. (4 points)