Answered step by step

Verified Expert Solution

Question

1 Approved Answer

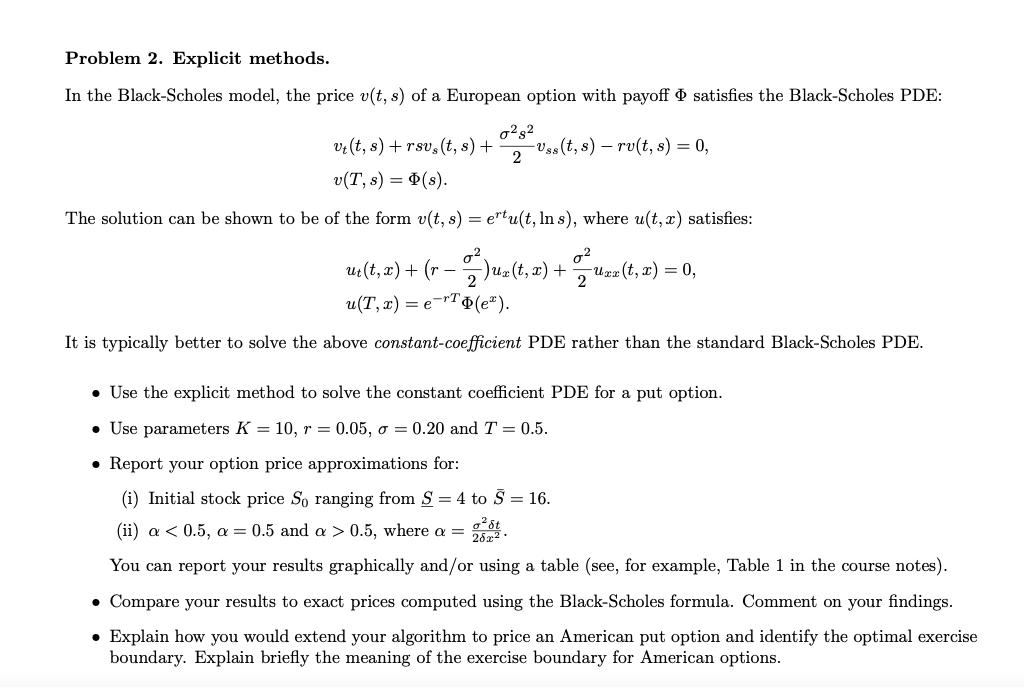

Problem 2. Explicit methods. In the Black-Scholes model, the price v(t, s) of a European option with payoff satisfies the Black-Scholes PDE: 082 vt(t,

Problem 2. Explicit methods. In the Black-Scholes model, the price v(t, s) of a European option with payoff satisfies the Black-Scholes PDE: 082 vt(t, s) +rsvs (t, s) + -Uss(t,s) - rv(t, s) = 0, 2 v(T, s) = (s). The solution can be shown to be of the form v(t, s) = ertu(t, lns), where u(t, x) satisfies: 0 2 ut(t, x) + (r- )u(t, x) + u(T, x) = e-To(e). It is typically better to solve the above constant-coefficient PDE rather than the standard Black-Scholes PDE. -Uxx (t, x) = 0, Use the explicit method to solve the constant coefficient PDE for a put option. Use parameters K = 10, r= 0.05, o= 0.20 and T = 0.5. Report your option price approximations for: (i) Initial stock price So ranging from S = 4 to 5 = 16. (ii) a < 0.5, a = 0.5 and a > 0.5, where a = You can report your results graphically and/or using a table (see, for example, Table 1 in the course notes). Compare your results to exact prices computed using the Black-Scholes formula. Comment on your findings. Explain how you would extend your algorithm to price an American put option and identify the optimal exercise boundary. Explain briefly the meaning of the exercise boundary for American options.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To solve the constant coefficient PDE for a put option using the explicit method we can discretize the time and stock price domains and iteratively ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started