Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 I A company is considering acquiring a piece of machinery to help them expand into a new product line. The machinery would cost

Problem

I

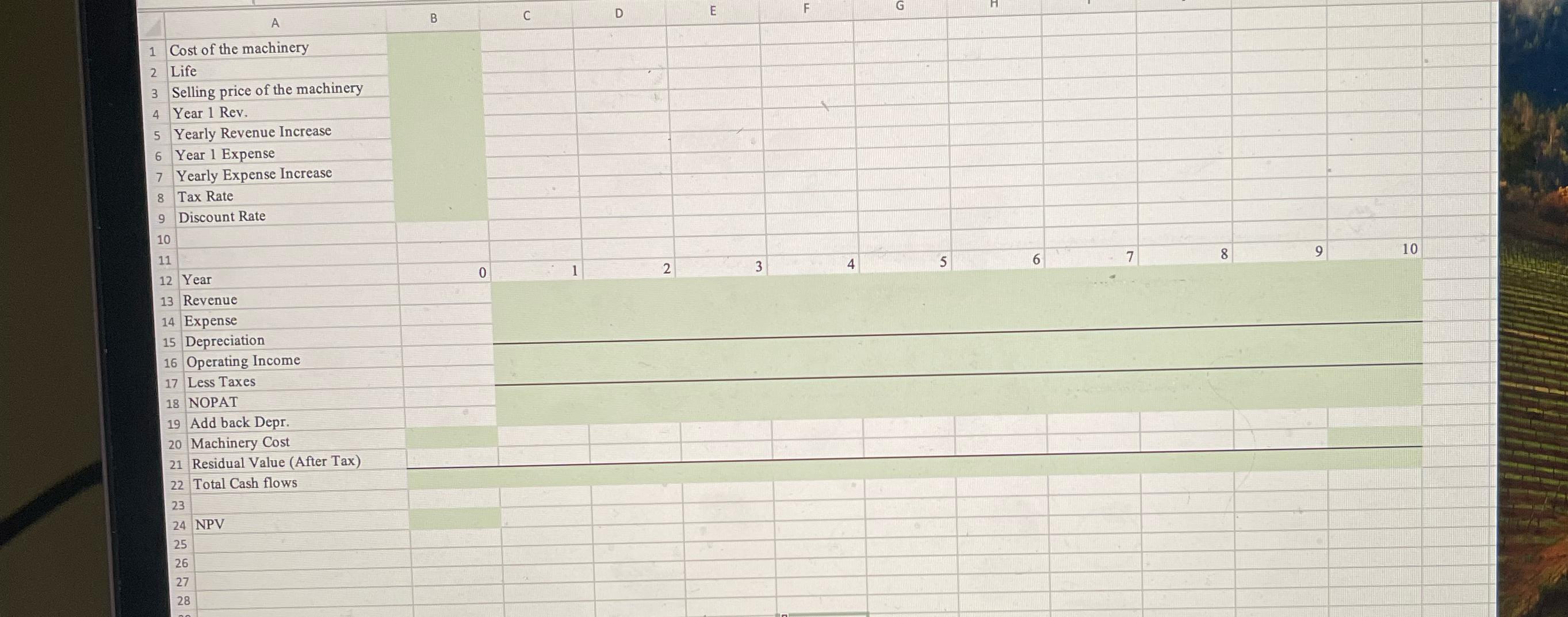

A company is considering acquiring a piece of machinery to help them expand into a new product line. The machinery would cost $ today Year and have a year life. It would be depreciated straight line over ten years, and assume there is no ending book value of the machinery. At the end of Year the machinery would be sold for $ Revenues from the product line would be $ in Year and increase by per year. Cash Expenses from the product line would be $ in Year and increase by per year. The tax rate is and the discount rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started