Answered step by step

Verified Expert Solution

Question

1 Approved Answer

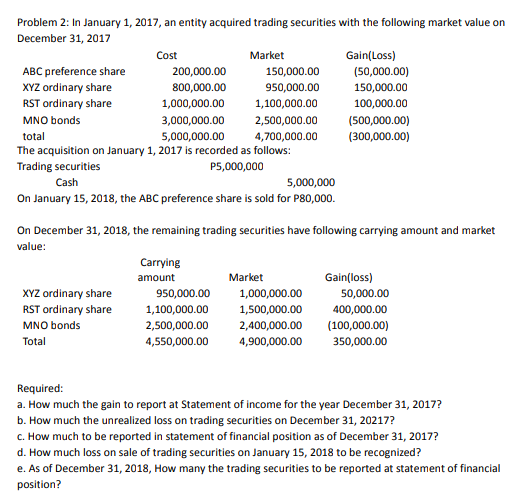

Problem 2: In January 1, 2017, an entity acquired trading securities with the following market value on December 31, 2017 Cost 200,000.00 800,000.00 ABC

Problem 2: In January 1, 2017, an entity acquired trading securities with the following market value on December 31, 2017 Cost 200,000.00 800,000.00 ABC preference share XYZ ordinary share RST ordinary share 1,000,000.00 MNO bonds 3,000,000.00 total 5,000,000.00 The acquisition on January 1, 2017 is recorded as follows: Trading securities P5,000,000 Cash XYZ ordinary share RST ordinary share MNO bonds Total Market 5,000,000 On January 15, 2018, the ABC preference share is sold for P80,000. 150,000.00 950,000.00 1,100,000.00 2,500,000.00 4,700,000.00 Carrying amount 950,000.00 1,100,000.00 2,500,000.00 4,550,000.00 On December 31, 2018, the remaining trading securities have following carrying amount and market value: Gain(Loss) Market (50,000.00) 150,000.00 100,000.00 (500,000.00) (300,000.00) Gain(loss) 1,000,000.00 50,000.00 1,500,000.00 400,000.00 2,400,000.00 (100,000.00) 4,900,000.00 350,000.00 Required: a. How much the gain to report at Statement of income for the year December 31, 2017? b. How much the unrealized loss on trading securities on December 31, 20217? c. How much to be reported in statement of financial position as of December 31, 2017? d. How much loss on sale of trading securities on January 15, 2018 to be recognized? e. As of December 31, 2018, How many the trading securities to be reported at statement of financial position?

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a The gain to report at the Statement of Income for the year December 31 2017 is P500000 This amount is calculated by taking the total difference betw...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started