Answered step by step

Verified Expert Solution

Question

1 Approved Answer

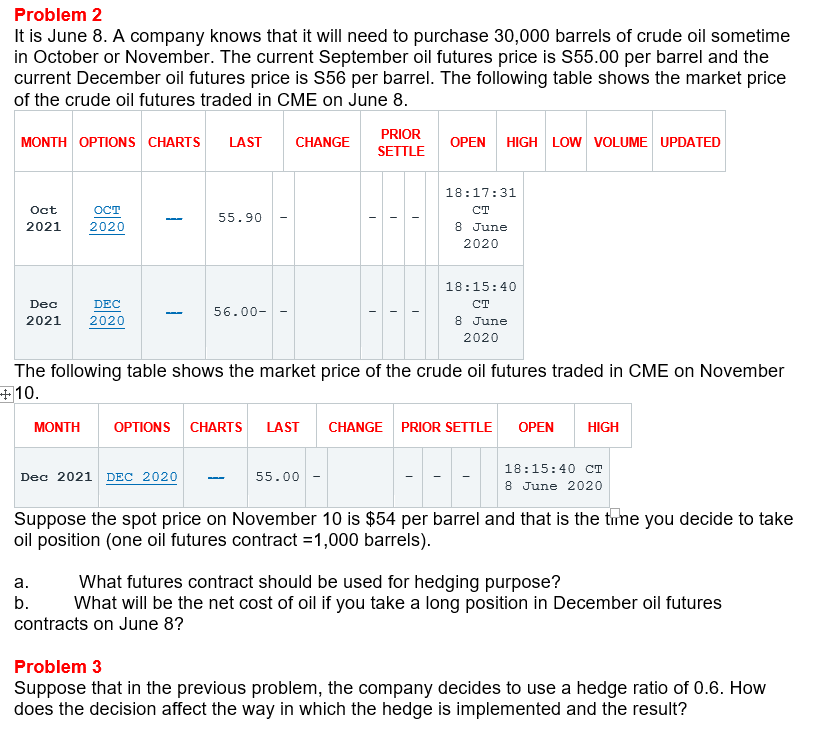

Problem 2 It is June 8. A company knows that it will need to purchase 30,000 barrels of crude oil sometime in October or November.

Problem 2 It is June 8. A company knows that it will need to purchase 30,000 barrels of crude oil sometime in October or November. The current September oil futures price is $55.00 per barrel and the current December oil futures price is S56 per barrel. The following table shows the market price of the crude oil futures traded in CME on June 8. PRIOR MONTH OPTIONS CHARTS LAST CHANGE OPEN HIGH LOW VOLUME UPDATED SETTLE Oct 2021 OCT 2020 55.90 18:17:31 8 June 2020 Dec 2021 DEC 2020 56.00- 18:15:40 CT 8 June 2020 The following table shows the market price of the crude oil futures traded in CME on November +10. MONTH OPTIONS CHARTS LAST CHANGE PRIOR SETTLE OPEN HIGH Dec 2021 DEC 2020 55.00 18:15:40 CT 8 June 2020 Suppose the spot price on November 10 is $54 per barrel and that is the tune you decide to take oil position (one oil futures contract =1,000 barrels). What futures contract should be used for hedging purpose? b. What will be the net cost of oil if you take a long position in December oil futures contracts on June 8? a. Problem 3 Suppose that in the previous problem, the company decides to use a hedge ratio of 0.6. How does the decision affect the way in which the hedge is implemented and the result

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started