Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lebanon Metal Company (LMC), a manufacturer of various metal parts, must decide whether to enter the competition to become the supplier of transmission housings

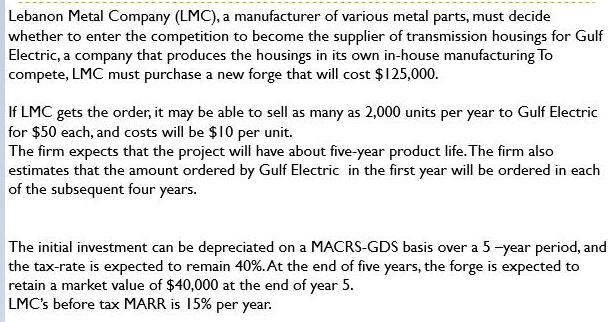

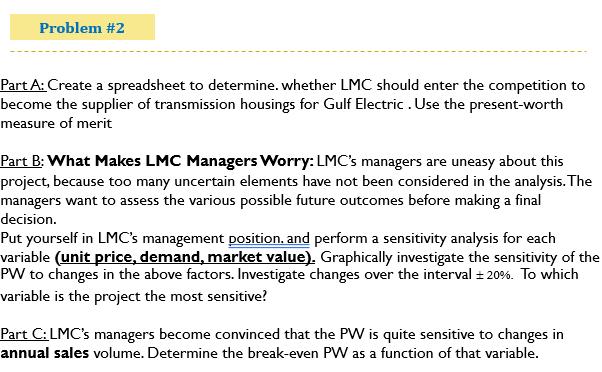

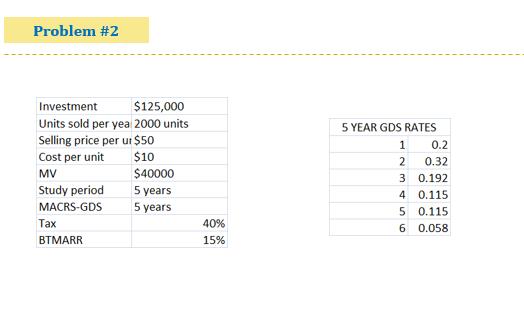

Lebanon Metal Company (LMC), a manufacturer of various metal parts, must decide whether to enter the competition to become the supplier of transmission housings for Gulf Electric, a company that produces the housings in its own in-house manufacturing To compete, LMC must purchase a new forge that will cost $125,000. If LMC gets the order, it may be able to sell as many as 2,000 units per year to Gulf Electric for $50 each, and costs will be $10 per unit. The firm expects that the project will have about five-year product life. The firm also estimates that the amount ordered by Gulf Electric in the first year will be ordered in each of the subsequent four years. The initial investment can be depreciated on a MACRS-GDS basis over a 5-year period, and the tax-rate is expected to remain 40%. At the end of five years, the forge is expected to retain a market value of $40,000 at the end of year 5. LMC's before tax MARR is 15% per year. Problem #2 Part A: Create a spreadsheet to determine. whether LMC should enter the competition to become the supplier of transmission housings for Gulf Electric. Use the present-worth measure of merit Part B: What Makes LMC Managers Worry: LMC's managers are uneasy about this project, because too many uncertain elements have not been considered in the analysis. The managers want to assess the various possible future outcomes before making a final decision. Put yourself in LMC's management position. and perform a sensitivity analysis for each variable (unit price, demand, market value). Graphically investigate the sensitivity of the PW to changes in the above factors. Investigate changes over the interval = 20%. To which variable is the project the most sensitive? Part C: LMC's managers become convinced that the PW is quite sensitive to changes in annual sales volume. Determine the break-even PW as a function of that variable. Problem #2 Investment $125,000 Units sold per yea 2000 units Selling price per ur $50 $10 5 YEAR GDS RATES 1 0.2 Cost per unit 0.32 MV $40000 3 0.192 5 years 5 years Study period 4 0.115 MACRS-GDS 5 0.115 x 40% 6 0.058 BTMARR 15% Lebanon Metal Company (LMC), a manufacturer of various metal parts, must decide whether to enter the competition to become the supplier of transmission housings for Gulf Electric, a company that produces the housings in its own in-house manufacturing To compete, LMC must purchase a new forge that will cost $125,000. If LMC gets the order, it may be able to sell as many as 2,000 units per year to Gulf Electric for $50 each, and costs will be $10 per unit. The firm expects that the project will have about five-year product life. The firm also estimates that the amount ordered by Gulf Electric in the first year will be ordered in each of the subsequent four years. The initial investment can be depreciated on a MACRS-GDS basis over a 5-year period, and the tax-rate is expected to remain 40%. At the end of five years, the forge is expected to retain a market value of $40,000 at the end of year 5. LMC's before tax MARR is 15% per year. Problem #2 Part A: Create a spreadsheet to determine. whether LMC should enter the competition to become the supplier of transmission housings for Gulf Electric. Use the present-worth measure of merit Part B: What Makes LMC Managers Worry: LMC's managers are uneasy about this project, because too many uncertain elements have not been considered in the analysis. The managers want to assess the various possible future outcomes before making a final decision. Put yourself in LMC's management position. and perform a sensitivity analysis for each variable (unit price, demand, market value). Graphically investigate the sensitivity of the PW to changes in the above factors. Investigate changes over the interval = 20%. To which variable is the project the most sensitive? Part C: LMC's managers become convinced that the PW is quite sensitive to changes in annual sales volume. Determine the break-even PW as a function of that variable. Problem #2 Investment $125,000 Units sold per yea 2000 units Selling price per ur $50 $10 5 YEAR GDS RATES 1 0.2 Cost per unit 0.32 MV $40000 3 0.192 5 years 5 years Study period 4 0.115 MACRS-GDS 5 0.115 x 40% 6 0.058 BTMARR 15% Lebanon Metal Company (LMC), a manufacturer of various metal parts, must decide whether to enter the competition to become the supplier of transmission housings for Gulf Electric, a company that produces the housings in its own in-house manufacturing To compete, LMC must purchase a new forge that will cost $125,000. If LMC gets the order, it may be able to sell as many as 2,000 units per year to Gulf Electric for $50 each, and costs will be $10 per unit. The firm expects that the project will have about five-year product life. The firm also estimates that the amount ordered by Gulf Electric in the first year will be ordered in each of the subsequent four years. The initial investment can be depreciated on a MACRS-GDS basis over a 5-year period, and the tax-rate is expected to remain 40%. At the end of five years, the forge is expected to retain a market value of $40,000 at the end of year 5. LMC's before tax MARR is 15% per year. Problem #2 Part A: Create a spreadsheet to determine. whether LMC should enter the competition to become the supplier of transmission housings for Gulf Electric. Use the present-worth measure of merit Part B: What Makes LMC Managers Worry: LMC's managers are uneasy about this project, because too many uncertain elements have not been considered in the analysis. The managers want to assess the various possible future outcomes before making a final decision. Put yourself in LMC's management position. and perform a sensitivity analysis for each variable (unit price, demand, market value). Graphically investigate the sensitivity of the PW to changes in the above factors. Investigate changes over the interval = 20%. To which variable is the project the most sensitive? Part C: LMC's managers become convinced that the PW is quite sensitive to changes in annual sales volume. Determine the break-even PW as a function of that variable. Problem #2 Investment $125,000 Units sold per yea 2000 units Selling price per ur $50 $10 5 YEAR GDS RATES 1 0.2 Cost per unit 0.32 MV $40000 3 0.192 5 years 5 years Study period 4 0.115 MACRS-GDS 5 0.115 x 40% 6 0.058 BTMARR 15% Lebanon Metal Company (LMC), a manufacturer of various metal parts, must decide whether to enter the competition to become the supplier of transmission housings for Gulf Electric, a company that produces the housings in its own in-house manufacturing To compete, LMC must purchase a new forge that will cost $125,000. If LMC gets the order, it may be able to sell as many as 2,000 units per year to Gulf Electric for $50 each, and costs will be $10 per unit. The firm expects that the project will have about five-year product life. The firm also estimates that the amount ordered by Gulf Electric in the first year will be ordered in each of the subsequent four years. The initial investment can be depreciated on a MACRS-GDS basis over a 5-year period, and the tax-rate is expected to remain 40%. At the end of five years, the forge is expected to retain a market value of $40,000 at the end of year 5. LMC's before tax MARR is 15% per year. Problem #2 Part A: Create a spreadsheet to determine. whether LMC should enter the competition to become the supplier of transmission housings for Gulf Electric. Use the present-worth measure of merit Part B: What Makes LMC Managers Worry: LMC's managers are uneasy about this project, because too many uncertain elements have not been considered in the analysis. The managers want to assess the various possible future outcomes before making a final decision. Put yourself in LMC's management position. and perform a sensitivity analysis for each variable (unit price, demand, market value). Graphically investigate the sensitivity of the PW to changes in the above factors. Investigate changes over the interval = 20%. To which variable is the project the most sensitive? Part C: LMC's managers become convinced that the PW is quite sensitive to changes in annual sales volume. Determine the break-even PW as a function of that variable. Problem #2 Investment $125,000 Units sold per yea 2000 units Selling price per ur $50 $10 5 YEAR GDS RATES 1 0.2 Cost per unit 0.32 MV $40000 3 0.192 5 years 5 years Study period 4 0.115 MACRS-GDS 5 0.115 x 40% 6 0.058 BTMARR 15%

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Operating and Maintenance Costs Direct Cost labour Material 30000 30000 30000 30000 30000 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started