Answered step by step

Verified Expert Solution

Question

1 Approved Answer

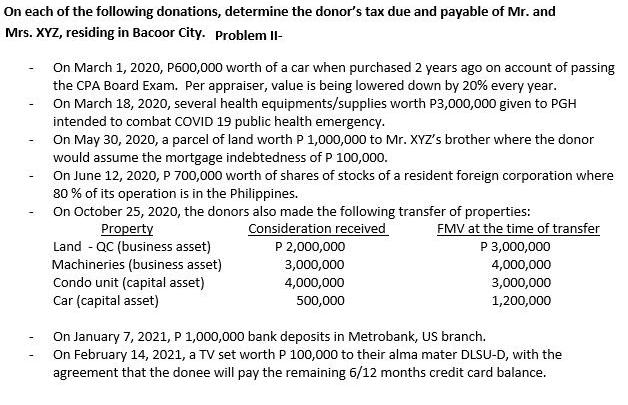

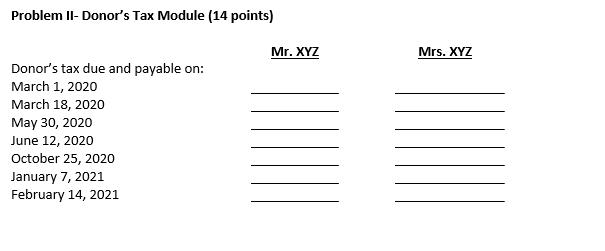

On each of the following donations, determine the donor's tax due and payable of Mr. and Mrs. XYZ, residing in Bacoor City. pProblem Il-

On each of the following donations, determine the donor's tax due and payable of Mr. and Mrs. XYZ, residing in Bacoor City. pProblem Il- On March 1, 2020, P600,000 worth of a car when purchased 2 years ago on account of passing the CPA Board Exam. Per appraiser, value is being lowered down by 20% every year. On March 18, 2020, several health equipments/supplies worth P3,000,000 given to PGH intended to combat COVID 19 public health emergency. On May 30, 2020, a parcel of land worth P 1,000,000 to Mr. XYZ's brother where the donor would assume the mortgage indebtedness of P 100,000. On June 12, 2020, P 700,000 worth of shares of stocks of a resident foreign corporation where 80 % of its operation is in the Philippines. On October 25, 2020, the donors also made the following transfer of properties: Consideration received P 2,000,000 FMV at the time of transfer P 3,000,000 Property Land - QC (business asset) Machineries (business asset) Condo unit (capital asset) Car (capital asset) 3,000,000 4,000,000 4,000,000 3,000,000 500,000 1,200,000 On January 7, 2021, P 1,000,000 bank deposits in Metrobank, US branch. On February 14, 2021, a TV set worth P 100,000 to their alma mater DLSU-D, with the agreement that the donee will pay the remaining 6/12 months credit card balance. Problem II- Donor's Tax Module (14 points) Mr. XYZ Mrs. XYZ Donor's tax due and payable on: March 1, 2020 March 18, 2020 May 30, 2020 June 12, 2020 October 25, 2020 January 7, 2021 February 14, 2021

Step by Step Solution

★★★★★

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started