Answered step by step

Verified Expert Solution

Question

1 Approved Answer

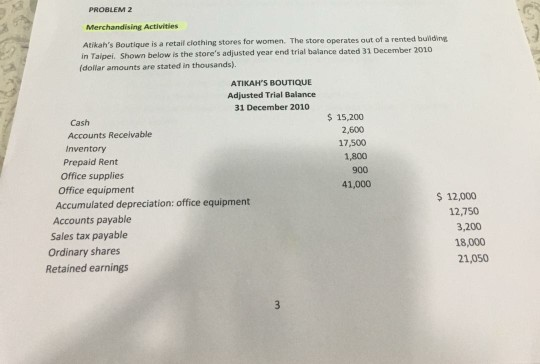

PROBLEM 2 Merchandising Activities Atikah's Boutique is a retail clothing stores for women. The store operates out of a rented building in Taipei Shown below

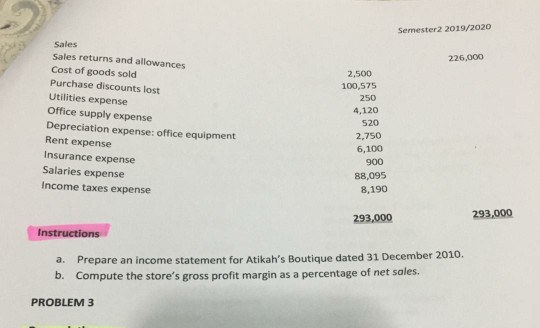

PROBLEM 2 Merchandising Activities Atikah's Boutique is a retail clothing stores for women. The store operates out of a rented building in Taipei Shown below is the store's adjusted year end trial balance dated 31 December 2010 (dollar amounts are stated in thousands). ATIKAH'S BOUTIQUE Adjusted Trial Balance 31 December 2010 Cash $ 15,200 Accounts Receivable 2,600 Inventory 17,500 Prepaid Rent 1,800 office supplies 900 Office equipment 41,000 Accumulated depreciation: office equipment $ 12,000 Accounts payable 12,750 Sales tax payable 3,200 Ordinary shares 18,000 Retained earnings 21,050 3 Semester2 2019/2020 226,000 Sales Sales returns and allowances Cost of goods sold Purchase discounts lost Utilities expense Office supply expense Depreciation expense: office equipment Rent expense Insurance expense Salaries expense Income taxes expense 2,500 100,575 250 4,120 520 2,750 6,100 900 88,095 8,190 293,000 293,000 Instructions a. Prepare an income statement for Atikah's Boutique dated 31 December 2010. b. Compute the store's gross profit margin as a percentage of net sales. PROBLEM 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started