Question

Problem 2: MKE Printing Company purchased a new 3D printer on July 1, 2022 for $250,000. To pay for the printer, MKE Printing issues

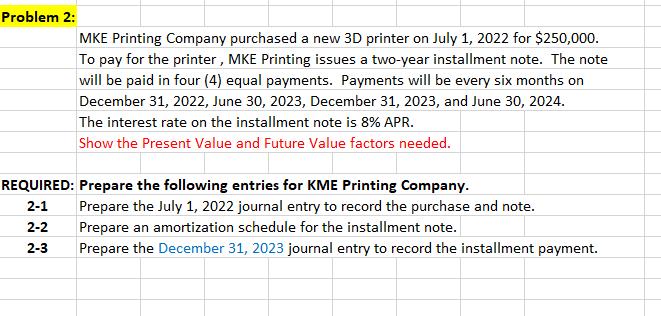

Problem 2: MKE Printing Company purchased a new 3D printer on July 1, 2022 for $250,000. To pay for the printer, MKE Printing issues a two-year installment note. The note will be paid in four (4) equal payments. Payments will be every six months on December 31, 2022, June 30, 2023, December 31, 2023, and June 30, 2024. The interest rate on the installment note is 8% APR. Show the Present Value and Future Value factors needed. REQUIRED: Prepare the following entries for KME Printing Company. 2-1 2-2 2-3 Prepare the July 1, 2022 journal entry to record the purchase and note. Prepare an amortization schedule for the installment note. Prepare the December 31, 2023 journal entry to record the installment payment.

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

16th edition

0077664078, 978-0077664077, 78111048, 978-0078111044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App