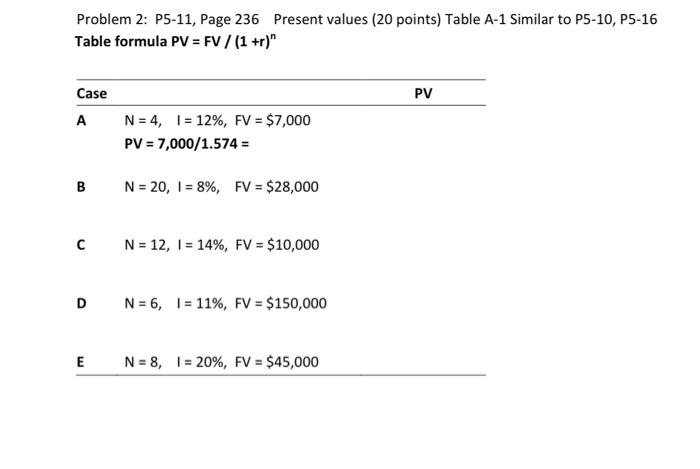

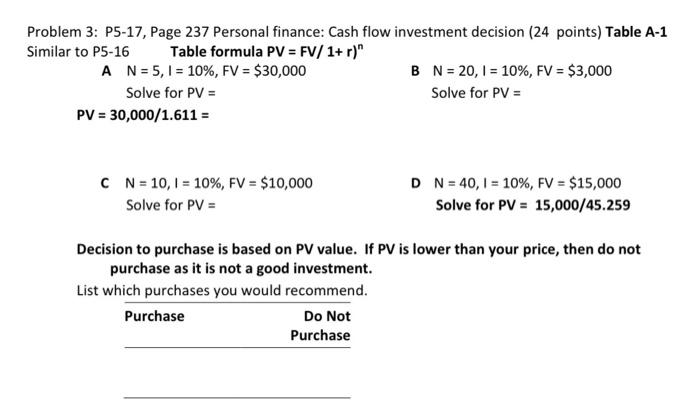

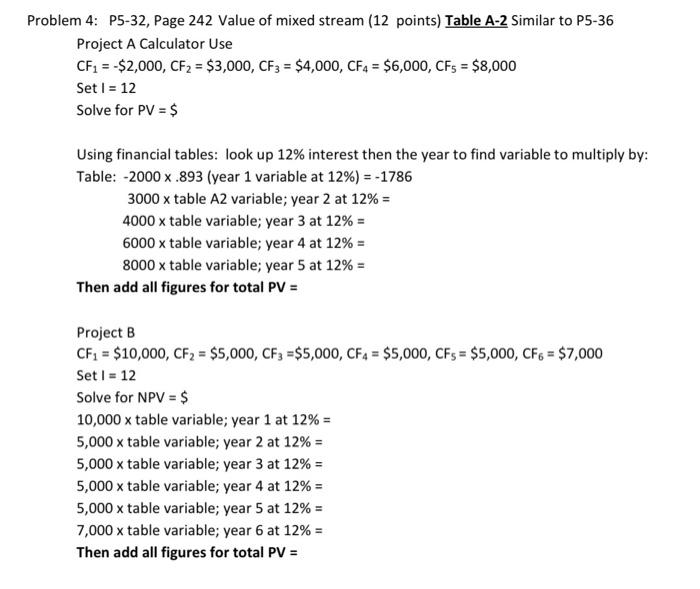

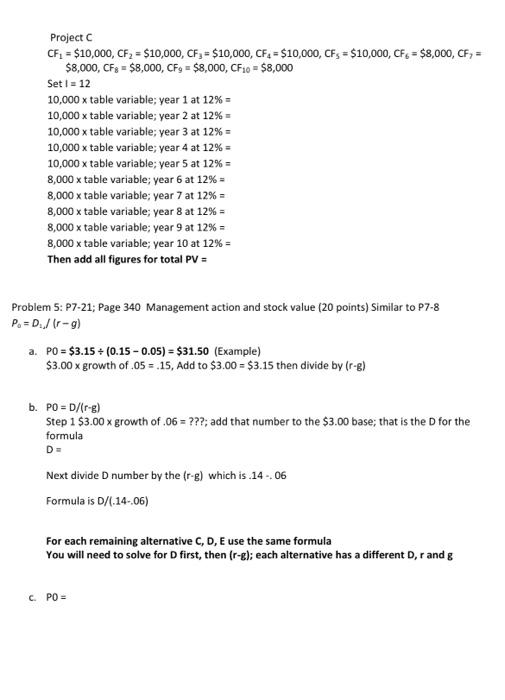

Problem 2: P5-11, Page 236 Present values (20 points) Table A-1 Similar to P5-10, P5-16 Table formula PV = FV / (1+r)" PV Case A N = 4,1 = 12%, FV = $7,000 PV = 7,000/1.574 = B N = 20, 1 = 8%, FV = $28,000 N = 12, I = 14%, FV = $10,000 DN=6, 1 = 11%, FV = $150,000 E E N = 8, 1= 20%, FV = $45,000 Problem 3: P5-17, Page 237 Personal finance: Cash flow investment decision (24 points) Table A-1 Similar to P5-16 Table formula PV = FV/ 1+r)" A N = 5,1 = 10%, FV = $30,000 B N = 20, 1 = 10%, FV = $3,000 Solve for PV = Solve for PV = PV = 30,000/1.611 = C N = 10,1 = 10%, FV = $10,000 Solve for PV = D N = 40,1 = 10%, FV = $15,000 Solve for PV = 15,000/45.259 Decision to purchase is based on PV value. If PV is lower than your price, then do not purchase as it is not a good investment. List which purchases you would recommend. Purchase Do Not Purchase Problem 4: P5-32, Page 242 Value of mixed stream (12 points) Table A-2 Similar to P5-36 Project A Calculator Use CF1 = -$2,000, CF2 = $3,000, CF3 = $4,000, CFA = $6,000, CF5 = $8,000 Set I = 12 Solve for PV = $ Using financial tables: look up 12% interest then the year to find variable to multiply by: Table: -2000 x .893 (year 1 variable at 12%) = -1786 3000 x table A2 variable; year 2 at 12% = 4000 x table variable; year 3 at 12% = 6000 x table variable; year 4 at 12% = 8000 x table variable; year 5 at 12% = Then add all figures for total PV = Project B CF, = $10,000, CF2 = $5,000, CF3 =$5,000, CFA = $5,000, CFs = $5,000, CF6 = $7,000 Set 1 = 12 Solve for NPV = $ 10,000 x table variable; year 1 at 12% = 5,000 x table variable; year 2 at 12% = 5,000 x table variable; year 3 at 12% = 5,000 x table variable; year 4 at 12% = 5,000 x table variable; year 5 at 12% = 7,000 x table variable; year 6 at 12% = Then add all figures for total PV = Project C CF, = $10,000, CF2 = $10,000, CF, = $10,000, CF4 = $10,000, CFs = $10,000, CF= $8,000, CF, = $8,000, CFs = $8,000, CF = $8,000, CF10 = $8,000 Set 1 = 12 10,000 x table variable; year 1 at 12% = 10,000 x table variable; year 2 at 12% = 10,000 x table variable: year 3 at 12% = 10,000 x table variable; year 4 at 12% = 10,000 x table variable; year 5 at 12%= 8,000 x table variable; year 6 at 12% 8,000 x table variable; year 7 at 12% 8,000 x table variable; year 8 at 12% 8,000 x table variable; year 9 at 12% = 8,000 x table variable; year 10 at 12% = Then add all figures for total PV = Problem 5: P7-21; Page 340 Management action and stock value (20 points) Similar to P7-8 P = D.,/ Ir-g) a. PO = $3.15 + (0.15 -0.05) = $31.50 (Example) $3.00 x growth of .05 = 15, Add to $3.00 = $3.15 then divide by (re) b. PO = D/rs) Step 1 $3.00 x growth of .06 = ???; add that number to the $3.00 base; that is the D for the formula D- Next divide D number by the (r-g) which is 14-06 Formula is D/(.14-.06) For each remaining alternative C, D, E use the same formula You will need to solve for D first, then (r-e); each alternative has a different Der and g CPO =