Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2: Pat and Chris Broderick have just purchased a home in Lincoln Park. The home's sale price was $549,000. As a veteran, Pat

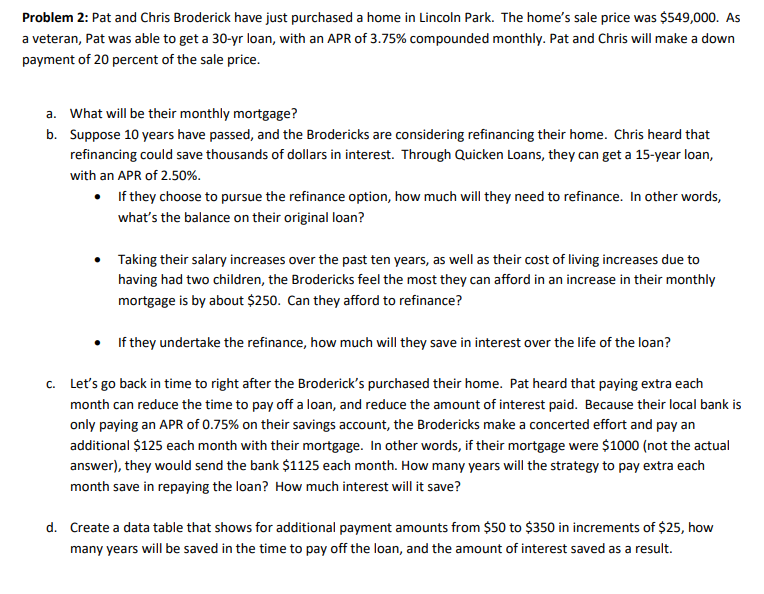

Problem 2: Pat and Chris Broderick have just purchased a home in Lincoln Park. The home's sale price was $549,000. As a veteran, Pat was able to get a 30-yr loan, with an APR of 3.75% compounded monthly. Pat and Chris will make a down payment of 20 percent of the sale price. a. What will be their monthly mortgage? b. Suppose 10 years have passed, and the Brodericks are considering refinancing their home. Chris heard that refinancing could save thousands of dollars in interest. Through Quicken Loans, they can get a 15-year loan, with an APR of 2.50%. If they choose to pursue the refinance option, how much will they need to refinance. In other words, what's the balance on their original loan? Taking their salary increases over the past ten years, as well as their cost of living increases due to having had two children, the Brodericks feel the most they can afford in an increase in their monthly mortgage is by about $250. Can they afford to refinance? If they undertake the refinance, how much will they save in interest over the life of the loan? c. Let's go back in time to right after the Broderick's purchased their home. Pat heard that paying extra each month can reduce the time to pay off a loan, and reduce the amount of interest paid. Because their local bank is only paying an APR of 0.75% on their savings account, the Brodericks make a concerted effort and pay an additional $125 each month with their mortgage. In other words, if their mortgage were $1000 (not the actual answer), they would send the bank $1125 each month. How many years will the strategy to pay extra each month save in repaying the loan? How much interest will it save? d. Create a data table that shows for additional payment amounts from $50 to $350 in increments of $25, how many years will be saved in the time to pay off the loan, and the amount of interest saved as a result.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the monthly mortgage payment for a 30year loan with an APR of 375 compounded monthly and a sale price of 549000 with a 20 down payment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started