Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 2. Potato beetles are a major pest of potato crops Sprout BioScience invested $5 million in R&D over the last five years to

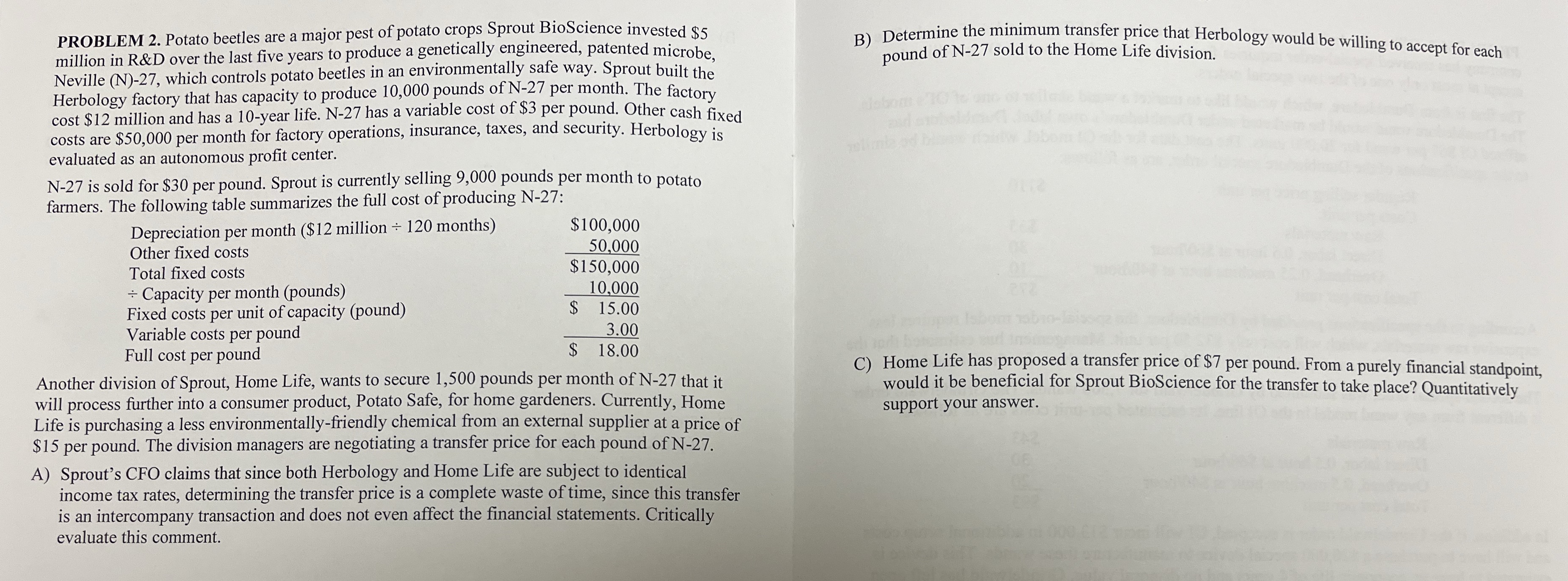

PROBLEM 2. Potato beetles are a major pest of potato crops Sprout BioScience invested $5 million in R&D over the last five years to produce a genetically engineered, patented microbe. Neville (N)-27, which controls potato beetles in an environmentally safe way. Sprout built the Herbology factory that has capacity to produce 10,000 pounds of N-27 per month. The factory cost $12 million and has a 10-year life. N-27 has a variable cost of $3 per pound. Other cash fixed costs are $50,000 per month for factory operations, insurance, taxes, and security. Herbology is evaluated as an autonomous profit center. N-27 is sold for $30 per pound. Sprout is currently selling 9,000 pounds per month to potato farmers. The following table summarizes the full cost of producing N-27: Depreciation per month ($12 million 120 months) Other fixed costs Total fixed costs Capacity per month (pounds) Fixed costs per unit of capacity (pound) Variable costs per pound Full cost per pound $100,000 50,000 $150,000 10,000 $ 15.00 3.00 $ 18.00 Another division of Sprout, Home Life, wants to secure 1,500 pounds per month of N-27 that it will process further into a consumer product, Potato Safe, for home gardeners. Currently, Home Life is purchasing a less environmentally-friendly chemical from an external supplier at a price of $15 per pound. The division managers are negotiating a transfer price for each pound of N-27. A) Sprout's CFO claims that since both Herbology and Home Life are subject to identical income tax rates, determining the transfer price is a complete waste of time, since this transfer is an intercompany transaction and does not even affect the financial statements. Critically evaluate this comment. B) Determine the minimum transfer price that Herbology would be willing to accept for each pound of N-27 sold to the Home Life division. elim C) Home Life has proposed a transfer price of $7 per pound. From a purely financial standpoint, would it be beneficial for Sprout BioScience for the transfer to take place? Quantitatively support your answer. 06

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started