Answered step by step

Verified Expert Solution

Question

1 Approved Answer

13 PROBLEM 4. Houself Technologies, Inc. (HT) operates several divisions. HT has a desired rate of return of 13 percent. The operating assets and

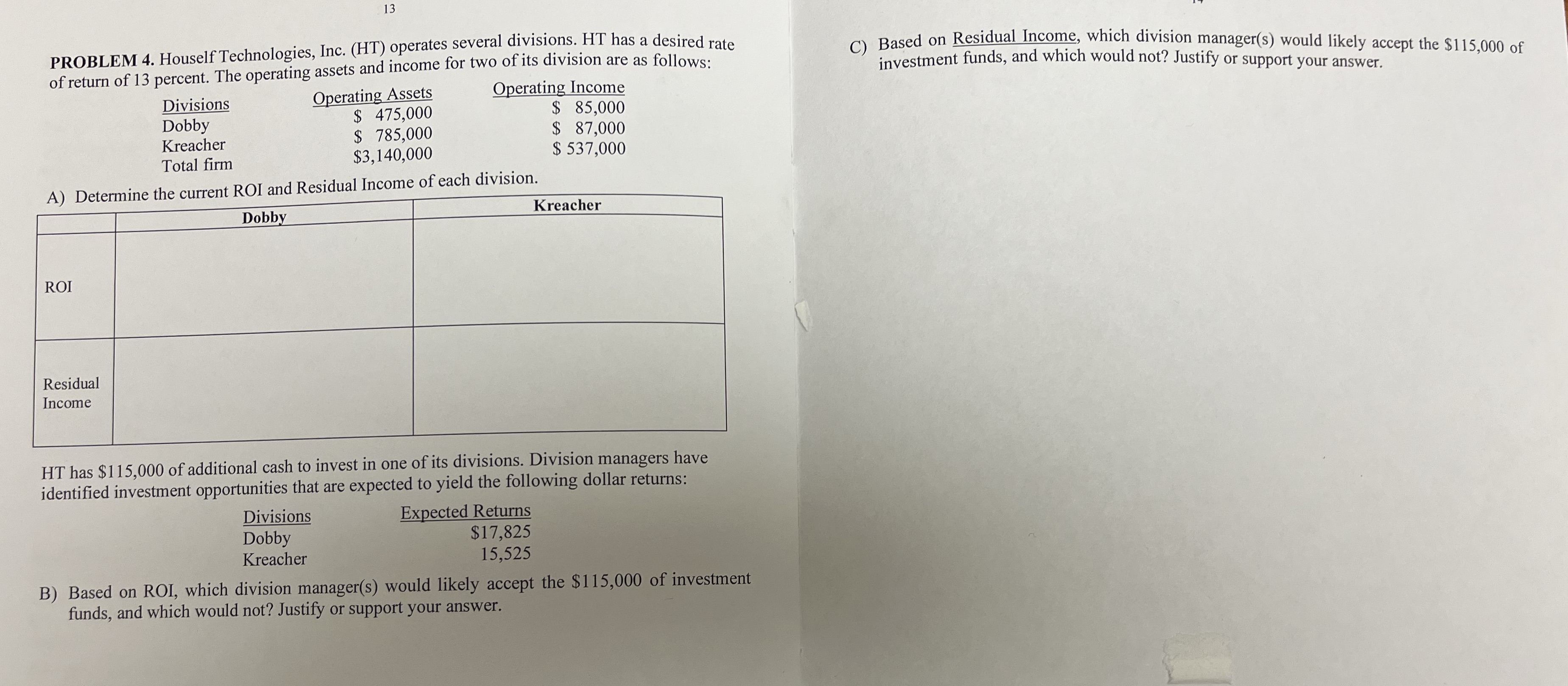

13 PROBLEM 4. Houself Technologies, Inc. (HT) operates several divisions. HT has a desired rate of return of 13 percent. The operating assets and income for two of its division are as follows: Divisions Dobby Kreacher Total firm Operating Assets $ 475,000 $ 785,000 $3,140,000 Operating Income $ 85,000 $ 87,000 $ 537,000 C) Based on Residual Income, which division manager(s) would likely accept the $115,000 of investment funds, and which would not? Justify or support your answer. A) Determine the current ROI and Residual Income of each division. ROI Residual Income Dobby Kreacher HT has $115,000 of additional cash to invest in one of its divisions. Division managers have identified investment opportunities that are expected to yield the following dollar returns: Divisions Dobby Expected Returns $17,825 Kreacher 15,525 B) Based on ROI, which division manager(s) would likely accept the $115,000 of investment funds, and which would not? Justify or support your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started