Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 Problem 2 (15 points) A curt is self-employed as a real estate salesman and drives his car frequently to take clients to uently

Problem 2

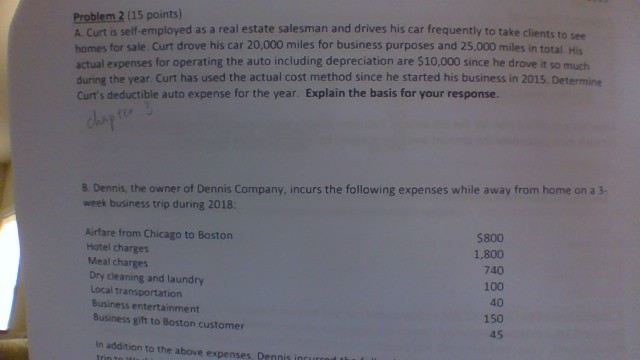

Problem 2 (15 points) A curt is self-employed as a real estate salesman and drives his car frequently to take clients to uently to take clients to see homes for sale Curt drove his car 20,000 miles for business purposes and 25,000 miles in total His actual expenses for operating the auto including depreciation are $10,000 since he drove it so much during the year. Curt has used the actual cost method since he started his business in 2015. Determine Curt's deductible auto expense for the year. Explain the basis for your response. 8.Dennis, the owner of Dennis Company, incurs the following expenses while away from home on a 3. week business trip during 2018: $800 1,800 740 Airfare from Chicago to Boston Hotel charges Meal charges Dry cleaning and laundry Local transportation Business entertainment Business gift to Boston customer 100 40 150 45 In addition to the above expenses, Dennis incurred TrintStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started