Answered step by step

Verified Expert Solution

Question

1 Approved Answer

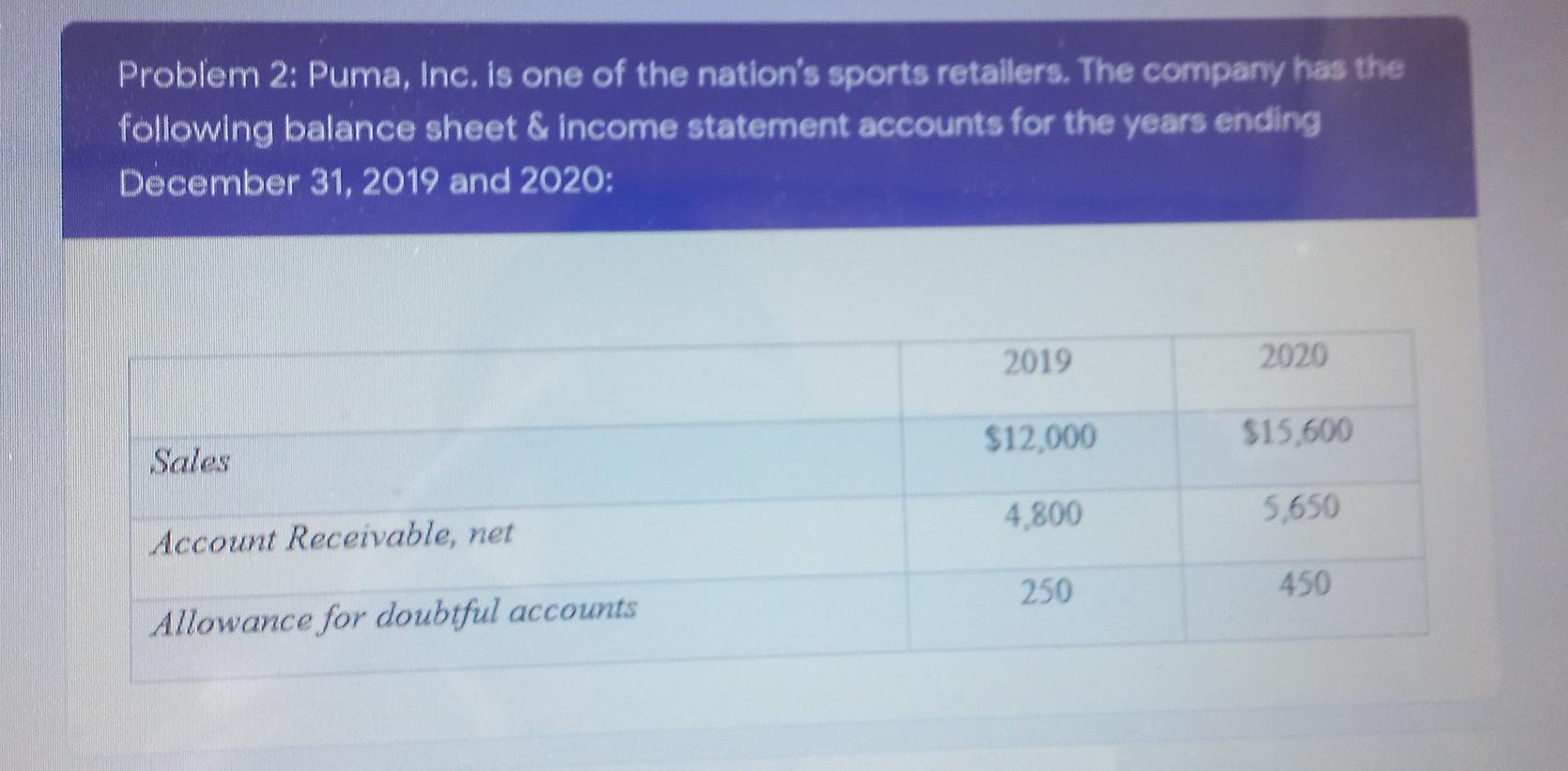

Problem 2: Puma, Inc. is one of the nation's sports retailers. The company has the following balance sheet & income statement accounts for the years

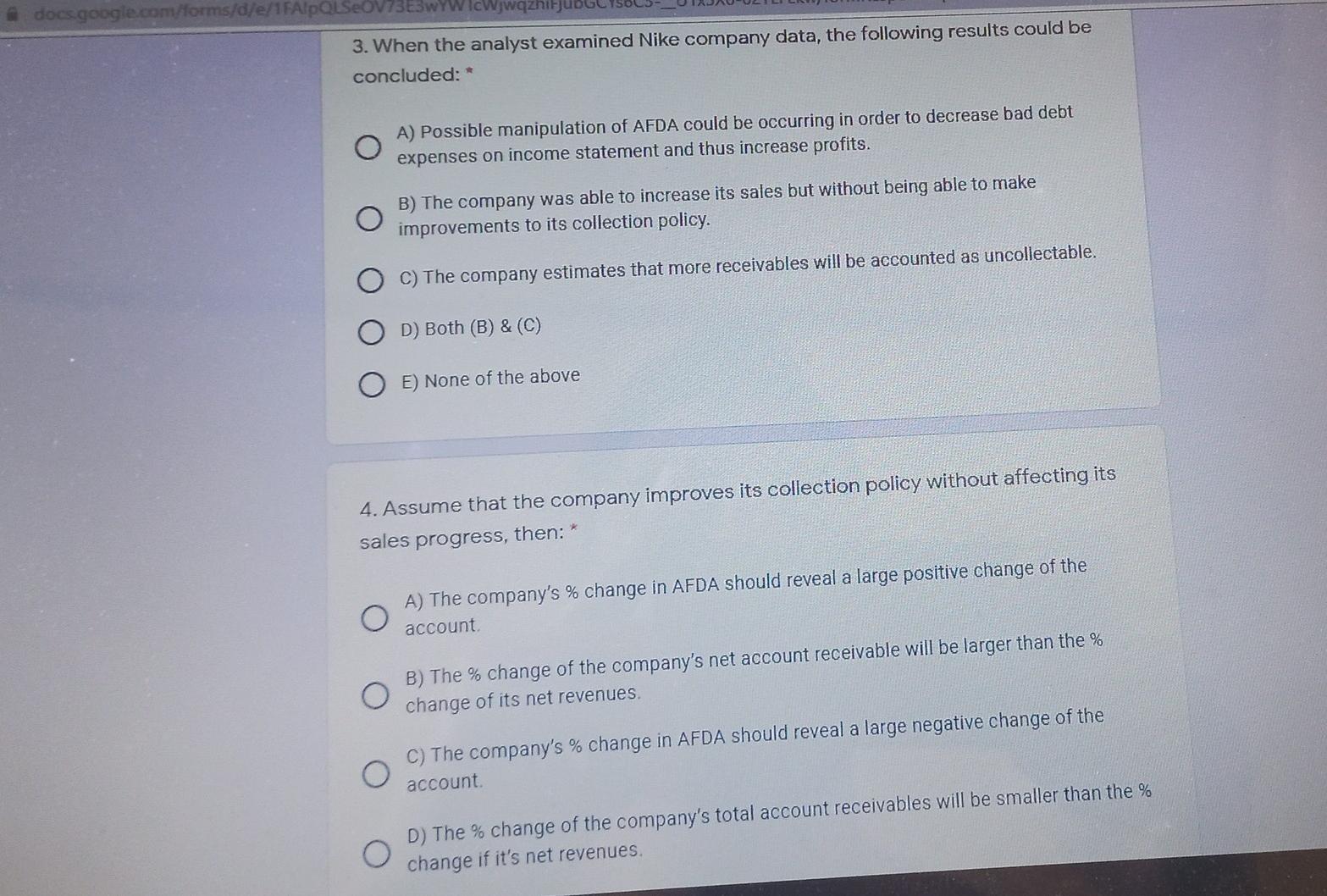

Problem 2: Puma, Inc. is one of the nation's sports retailers. The company has the following balance sheet & income statement accounts for the years ending December 31, 2019 and 2020: 2019 2020 $12,000 $15.600 Sales 4.800 5,650 Account Receivable, net 250 450 Allowance for doubtful accounts docs.google.com/forms/d/e/1FAIpQLSeOV75E3wYWIcWj 3. When the analyst examined Nike company data, the following results could be concluded: * A) Possible manipulation of AFDA could be occurring in order to decrease bad debt expenses on income statement and thus increase profits. O B) The company was able to increase its sales but without being able to make improvements to its collection policy. C) The company estimates that more receivables will be accounted as uncollectable. D) Both (B) & (C) O E) None of the above 4. Assume that the company improves its collection policy without affecting its sales progress, then:* A) The company's % change in AFDA should reveal a large positive change of the account O B) The % change of the company's net account receivable will be larger than the % change of its net revenues. O C) The company's % change in AFDA should reveal a large negative change of the account. D) The % change of the company's total account receivables will be smaller than the % change if it's net revenues

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started