Answered step by step

Verified Expert Solution

Question

1 Approved Answer

problem 2 Question 1 3. Please calculate the required return on common stock (ko) before and after the recapitalization 4. What is the WACC before

problem 2 Question 1

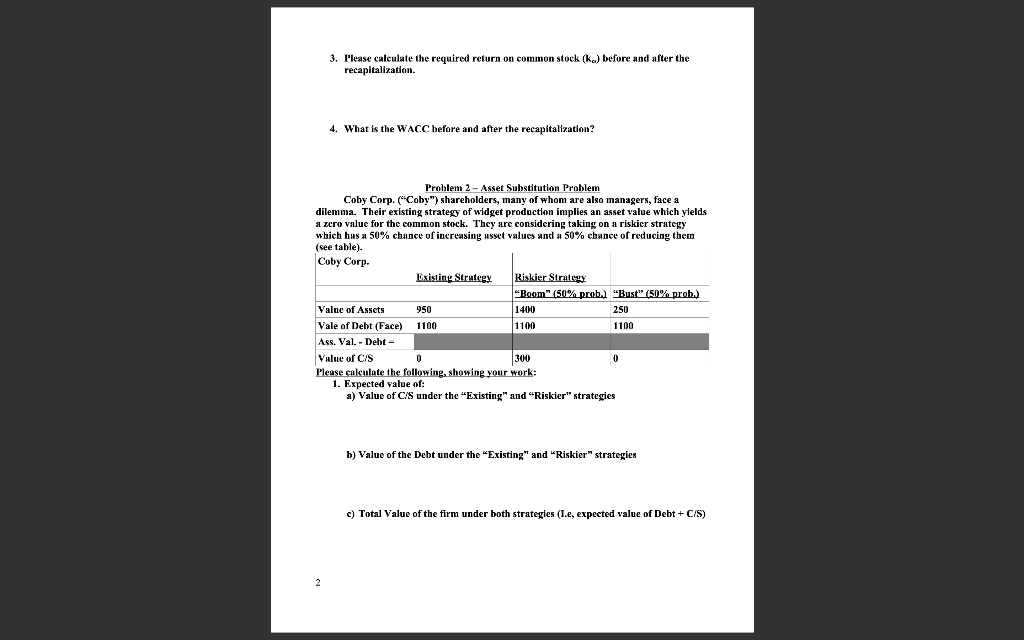

3. Please calculate the required return on common stock (ko) before and after the recapitalization 4. What is the WACC before and after the recapitalization? Problem 2 - Asset Substitution Problem Coby Corp. ("Coby") shareholders, many of whom are also managers, face a dilemma. Their existing strategy of widget production implies an asset value which yields a zero value for the common stock. They are considering taking on a riskier strategy which has a 50% chance of increasing asset values and a 50% chance of reducing them (see table) Coby Corp- Existing Strategy Riskier Strategy Room" (50% prob.) "Bust" (50% prob.) Value of Assets 950 1400 250 Vale of Debt (Face) 1100 1100 1100 Ass. Val. - Debt Value of C/S 300 Please calculate the following, showing your work: 1. Expected value of: a) Value of C/S under the "Existing" and "Riskier" strategies 0 b) Value of the Debt under the "Existing" and "Riskier" strategies c) Total Value of the firm under both strategies (I.e, expected value of Debt + C/S) 3. Please calculate the required return on common stock (ko) before and after the recapitalization 4. What is the WACC before and after the recapitalization? Problem 2 - Asset Substitution Problem Coby Corp. ("Coby") shareholders, many of whom are also managers, face a dilemma. Their existing strategy of widget production implies an asset value which yields a zero value for the common stock. They are considering taking on a riskier strategy which has a 50% chance of increasing asset values and a 50% chance of reducing them (see table) Coby Corp- Existing Strategy Riskier Strategy Room" (50% prob.) "Bust" (50% prob.) Value of Assets 950 1400 250 Vale of Debt (Face) 1100 1100 1100 Ass. Val. - Debt Value of C/S 300 Please calculate the following, showing your work: 1. Expected value of: a) Value of C/S under the "Existing" and "Riskier" strategies 0 b) Value of the Debt under the "Existing" and "Riskier" strategies c) Total Value of the firm under both strategies (I.e, expected value of Debt + C/S)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started