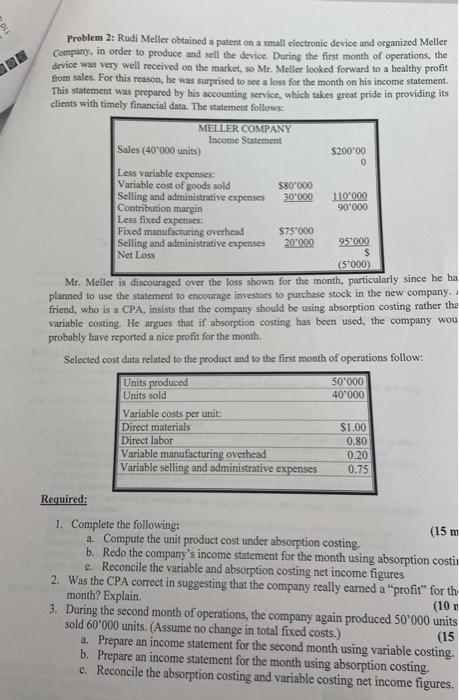

Problem 2: Rudi Meller obtained a patent on a small electronic device and organized Meller Company, in order to produce and sell the device. During the first month of operations, the device was very well received on the market, so Mr. Meller looked forward to a healthy profit from sales. For this reason, he was surprised to see a loss for the month on his income statement. This statement was prepared by his accounting service, which takes great pride in providing its clients with timely financial data. The statement follows: MELLER COMPANY Income Statement Sales (40'000 units) $200'00 0 Less variable expenses. Variable cost of goods sold $80 000 Selling and administrative expenses 30'000 110'000 Contribution margin 90'000 Less fixed expenses manufacturing overhead 575'000 Selling and administrative expenses 20 000 951000 Net Loss $ (5'000) Mr. Meller is discouraged over the loss shown for the month, particularly since he ha planned to use the statement to encourage investors to purchase stock in the new company. friend, who is a CPA, insists that the company should be using absorption costing rather tha variable costing. He argues that if absorption costing has been used, the company wou probably have reported a nice profit for the month. Selected cost data related to the product and to the first month of operations follow: Units produced 50'000 Units sold 40'000 Variable costs per unit: Direct materials $1.00 Direct labor 0.80 Variable manufacturing overhead 0.20 Variable selling and administrative expenses 0.75 Required: 1. Complete the following: (15 m a Compute the unit product cost under absorption costing. b. Redo the company's income statement for the month using absorption costi c. Reconcile the variable and absorption costing net income figures 2. Was the CPA correct in suggesting that the company really earned a "profit" forth month? Explain (10. 3. During the second month of operations, the company again produced 50'000 units sold 60'000 units. (Assume no change in total fixed costs.) (15 a. Prepare an income statement for the second month using variable costing, b. Prepare an income statement for the month using absorption costing. c. Reconcile the absorption costing and variable costing net income figures