Answered step by step

Verified Expert Solution

Question

1 Approved Answer

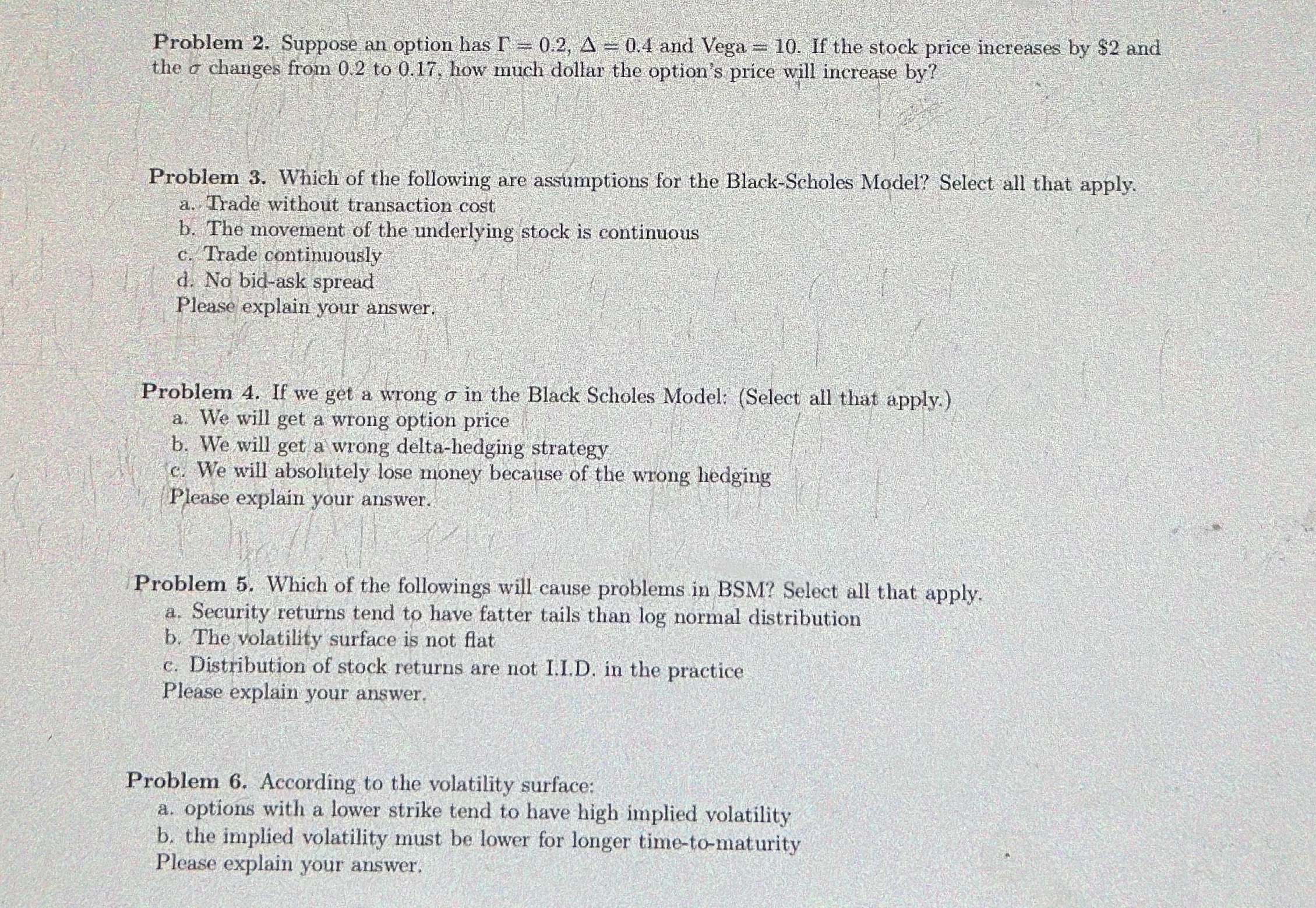

Problem 2 . Suppose an option has = 0 . 2 , = 0 . 4 and Vega = 1 0 . If the stock

Problem Suppose an option has and Vega If the stock price increases by $ and the changes from to how much dollar the option's price will increase by

Problem Which of the following are assumptions for the BlackScholes Model? Select all that apply.

a Trade without transaction cost

b The movement of the underlying stock is continuous

c Trade continuously

d No bidask spread

Please explain your answer.

Problem If we get a wrong in the Black Scholes Model: Select all that apply.

a We will get a wrong option price

b We will get a wrong deltahedging strategy

c We will absolutely lose money because of the wrong hedging

Please explain your answer.

Problem Which of the followings will cause problems in BSM Select all that apply.

a Security returns tend to have fatter tails than normal distribution

b The volatility surface is not flat

c Distribution of stock returns are not I.I.D in the practice

Please explain your answer.

Problem According to the volatility surface:

a options with a lower strike tend to have high implied volatility

b the implied volatility must be lower for longer timetomaturity

Please explain your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started