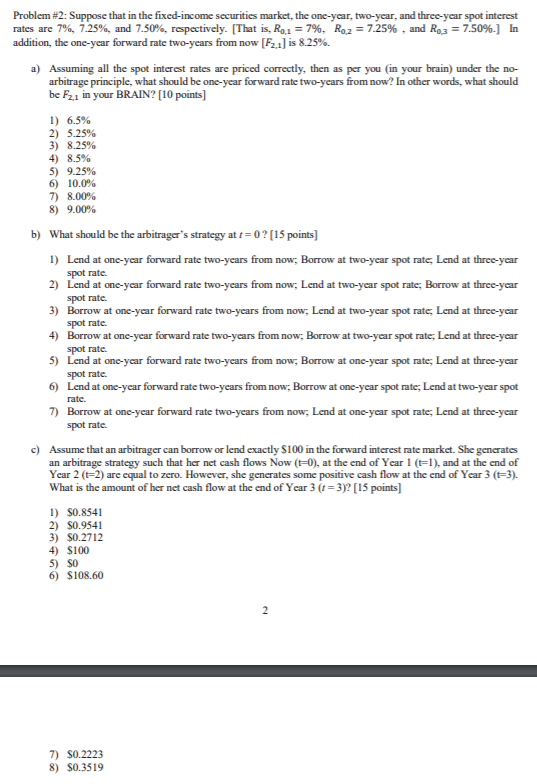

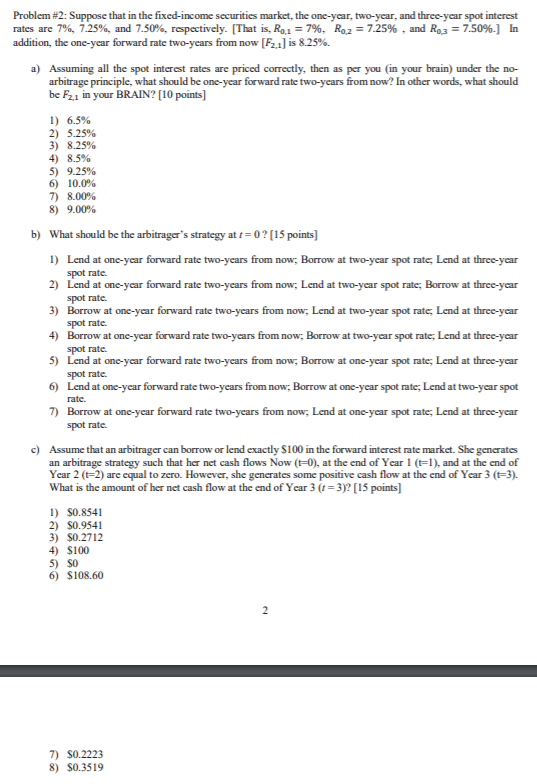

Problem #2: Suppose that in the fixed-income securities market, the one-year, two-year, and three-year spot interest rates are 7%, 7.25%, and 7.50%, respectively. [That is, R., 1 = 7%, Ro2 = 7.25%, and RO3 = 7.50%.] In addition, the one-year forward rate two-years from now [F21) is 8.25%. a) Assuming all the spot interest rates are priced correctly, then as per you in your brain) under the no- arbitrage principle, what should be one-year forward rate two-years from now? In other words, what should be F2 in your BRAIN? [10 points] 1) 6.5% 2) 5.25% 3) 8.25% 4) 8.5% 5) 9.25% 6) 10.0% 7) 8.00% 8) 9.00% b) What should be the arbitrager's strategy at t=0? (15 points) 1) Lend at one-year forward rate two-years from now, Borrow at two-year spot rate, Lend at three-year spot rate 2) Lend at one-year forward rate two-years from now, Lend at two-year spot rate; Borrow at three-year spot rate. 3) Borrow at one-year forward rate two-years from now, Lend at two-year spot rate, Lend at three-year spot rate. 4) Borrow at one-year forward rate two-years from now, Borrow at two-year spot rate; Lend at three-year spot rate. 5) Lend at one-year forward rate two-years from now, Borrow at one-year spot rate; Lend at three-year spot rate. 6) Lend at one-year forward rate two-years from now, Borrow at one-year spot rate, Lend at two-year spot rate. 7) Borrow at one-year forward rate two-years from now, Lend at one-year spot rate; Lend at three-year spot rate c) Assume that an arbitrager can borrow or lend exactly $100 in the forward interest rate market. She generates an arbitrage strategy such that her net cash flows Now (t=0), at the end of Year 1 (t-1), and at the end of Year 2 (t=2) are equal to zero. However, she generates some positive cash flow at the end of Year 3 (t=3). What is the amount of her net cash flow at the end of Year 3 t = 3)? (15 points 1) $0.8541 2) $0.9541 3) S0.2712 4) $100 5) SO 6) $108.60 7) $0.2223 8) $0.3519 Problem #2: Suppose that in the fixed-income securities market, the one-year, two-year, and three-year spot interest rates are 7%, 7.25%, and 7.50%, respectively. [That is, R., 1 = 7%, Ro2 = 7.25%, and RO3 = 7.50%.] In addition, the one-year forward rate two-years from now [F21) is 8.25%. a) Assuming all the spot interest rates are priced correctly, then as per you in your brain) under the no- arbitrage principle, what should be one-year forward rate two-years from now? In other words, what should be F2 in your BRAIN? [10 points] 1) 6.5% 2) 5.25% 3) 8.25% 4) 8.5% 5) 9.25% 6) 10.0% 7) 8.00% 8) 9.00% b) What should be the arbitrager's strategy at t=0? (15 points) 1) Lend at one-year forward rate two-years from now, Borrow at two-year spot rate, Lend at three-year spot rate 2) Lend at one-year forward rate two-years from now, Lend at two-year spot rate; Borrow at three-year spot rate. 3) Borrow at one-year forward rate two-years from now, Lend at two-year spot rate, Lend at three-year spot rate. 4) Borrow at one-year forward rate two-years from now, Borrow at two-year spot rate; Lend at three-year spot rate. 5) Lend at one-year forward rate two-years from now, Borrow at one-year spot rate; Lend at three-year spot rate. 6) Lend at one-year forward rate two-years from now, Borrow at one-year spot rate, Lend at two-year spot rate. 7) Borrow at one-year forward rate two-years from now, Lend at one-year spot rate; Lend at three-year spot rate c) Assume that an arbitrager can borrow or lend exactly $100 in the forward interest rate market. She generates an arbitrage strategy such that her net cash flows Now (t=0), at the end of Year 1 (t-1), and at the end of Year 2 (t=2) are equal to zero. However, she generates some positive cash flow at the end of Year 3 (t=3). What is the amount of her net cash flow at the end of Year 3 t = 3)? (15 points 1) $0.8541 2) $0.9541 3) S0.2712 4) $100 5) SO 6) $108.60 7) $0.2223 8) $0.3519