Answered step by step

Verified Expert Solution

Question

1 Approved Answer

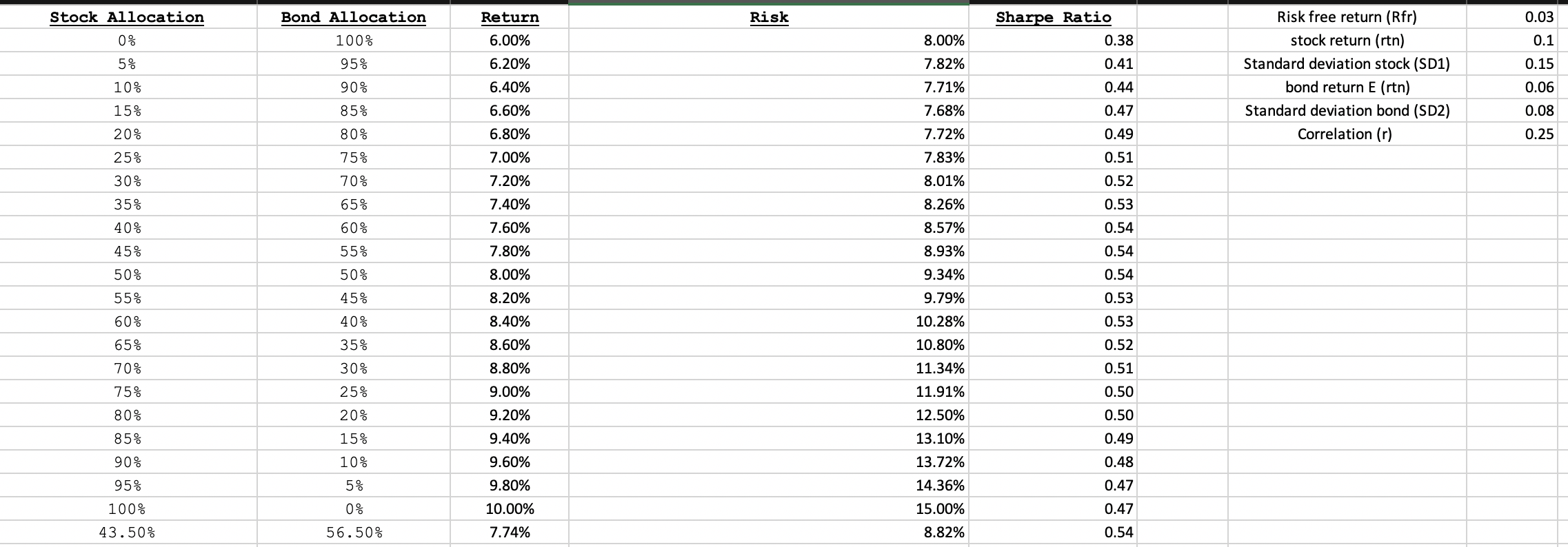

PROBLEM 2 TABLE 4) Using the table created in Problem #2 above, the Sharpe Ratio of Stocks is 0.4667; the Sharpe Ratio of Bonds is

PROBLEM 2 TABLE

4) Using the table created in Problem #2 above, the Sharpe Ratio of Stocks is 0.4667; the Sharpe Ratio of Bonds is 0.375; and the Sharpe Ratio of the optimal combination of stocks & bonds is 0.5374.

Why does combining stocks & bonds result in a higher Sharpe Ratio than either asset by itself? In other words, what mechanism allows that phenomenon to occur? Hint: No calculations are needed. (10 pts)

Stock Allocation Risk Sharpe Ratio 0.03 Bond Allocation 100% 0% 8.00% 0.38 0.1 5% 95% 7.82% 0.41 0.15 Return 6.00% 6.20% 6.40% 6.60% 6.80% Risk free return (Rfr) stock return (rtn) Standard deviation stock (SD1) bond return E (rtn) Standard deviation bond (SD2) Correlation (r) 10% 90% 0.44 0.06 0.08 15% 85% 0.47 20% 80% 0.49 0.25 75% 7.00% 0.51 7.71% 7.68% 7.72% 7.83% 8.01% 8.26% 8.57% 8.93% 25% 30% 35% 40% 70% 65% 7.20% 7.40% 7.60% 7.80% 0.52 0.53 0.54 60% 45% 55% 0.54 50% 50% 9.34% 0.54 8.00% 8.20% 45% 0.53 40% 8.40% 0.53 55% 60% 65% 70% 35% 30% 8.60% 8.80% 9.79% 10.28% 10.80% 11.34% 11.91% 0.52 0.51 75% 9.00% 25% 20% 0.50 0.50 80% 85% 15% 9.20% 9.40% 9.60% 12.50% 13.10% 13.72% 0.49 90% 10% 0.48 95% 5% 9.80% 14.36% 0.47 0.47 100% 0% 56.50% 10.00% 7.74% 15.00% 8.82% 43.50% 0.54Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started