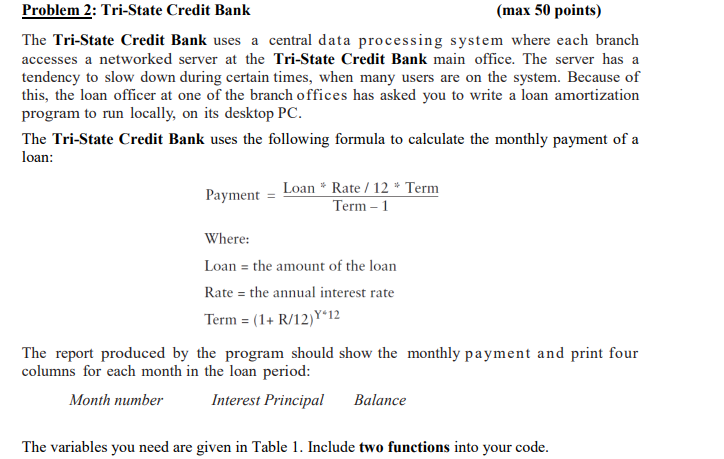

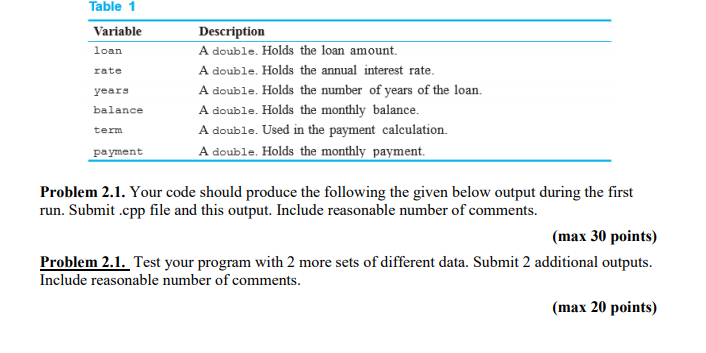

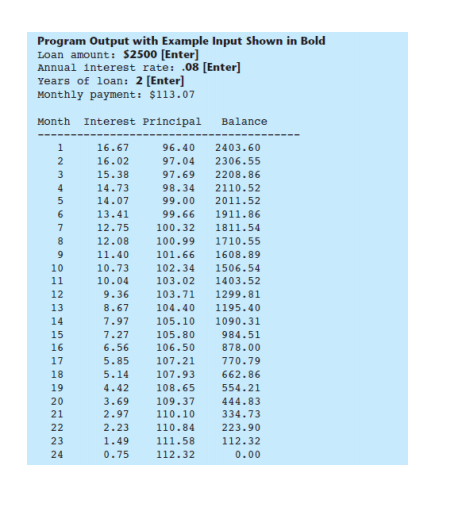

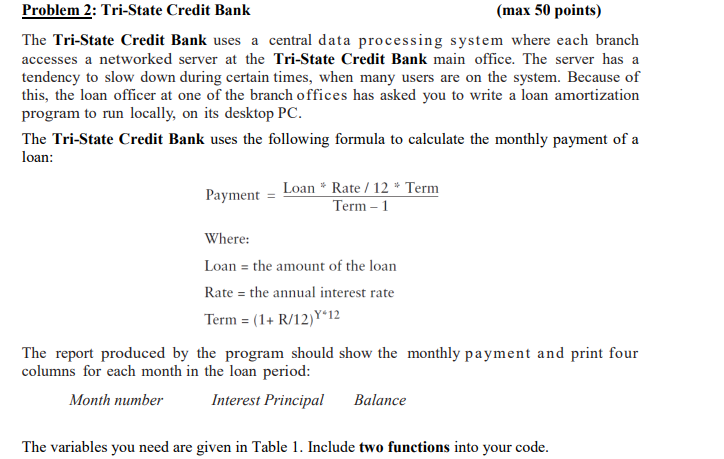

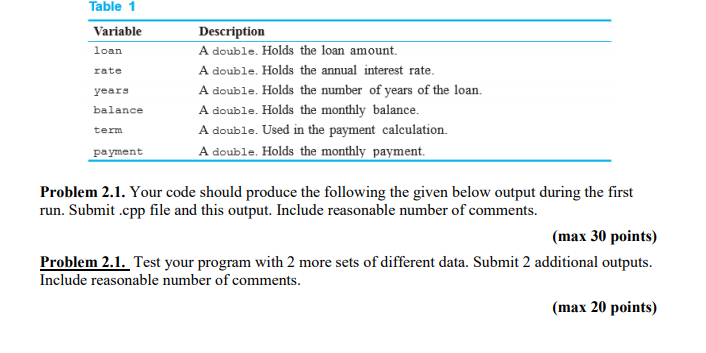

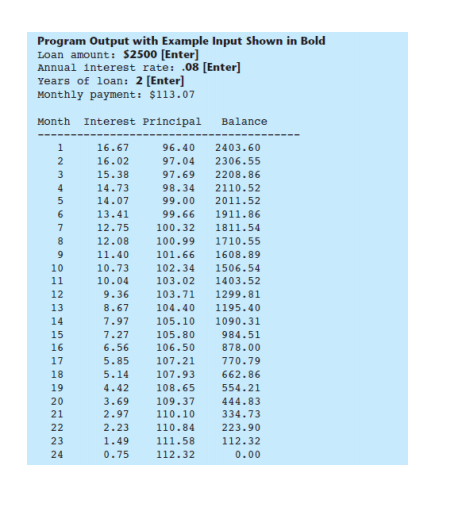

Problem 2: Tri-State Credit Bank (max 50 points) The Tri-State Credit Bank uses a central data processing system where each branch accesses a networked server at the Tri-State Credit Bank main office. The server has a tendency to slow down during certain times, when many users are on the system. Because of this, the loan officer at one of the branch offices has asked you to write a loan amortization program to run locally, on its desktop PC. The Tri-State Credit Bank uses the following formula to calculate the monthly payment of a loan: Payment = Loan * Rate /12 * Term Term - 1 Where: Loan = the amount of the loan Rate = the annual interest rate Term = (1+R/12) Y12 The report produced by the program should show the monthly payment and print four columns for each month in the loan period: Month number Interest Principal Balance The variables you need are given in Table 1. Include two functions into your code. Table 1 Variable loan rate years balance Description A double. Holds the loan amount. A double. Holds the annual interest rate. A double. Holds the number of years of the loan. A double. Holds the monthly balance. A double. Used in the payment calculation. A double. Holds the monthly payment. term payment Problem 2.1. Your code should produce the following the given below output during the first run. Submit.cpp file and this output. Include reasonable number of comments. (max 30 points) Problem 2.1. Test your program with 2 more sets of different data. Submit 2 additional outputs. Include reasonable number of comments. (max 20 points) Program Output with Example Input Shown in Bold Loan amount: $2500 [Enter] Annual interest rate: .08 [Enter] Years of loan: 2 (Enter] Monthly payment: $113.07 Month Interest Principal Balance 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 16.67 16.02 15.38 14.73 14.07 13.41 12.75 12.08 11.40 10.73 10.04 9.36 8.67 7.97 7.27 6.56 5.85 5.14 4.42 3.69 2.97 2.23 1.49 0.75 96.40 97.04 97.69 98.34 99.00 99.66 100.32 100.99 101.66 102.34 103.02 103.71 104.40 105.10 105.80 106.50 107.21 107.93 108.65 109.37 110.10 110.84 111.58 112.32 2403.60 2306.55 2208.86 2110.52 2011.52 1911.86 1811.54 1710.55 1608.89 1506.54 1403.52 1299.81 1195.40 1090.31 984.51 878.00 770.79 662.86 554.21 444.83 334.73 223.90 112.32 0.00