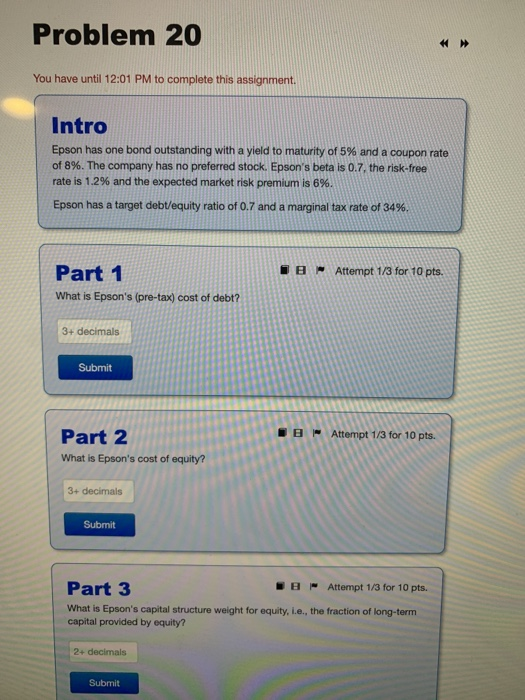

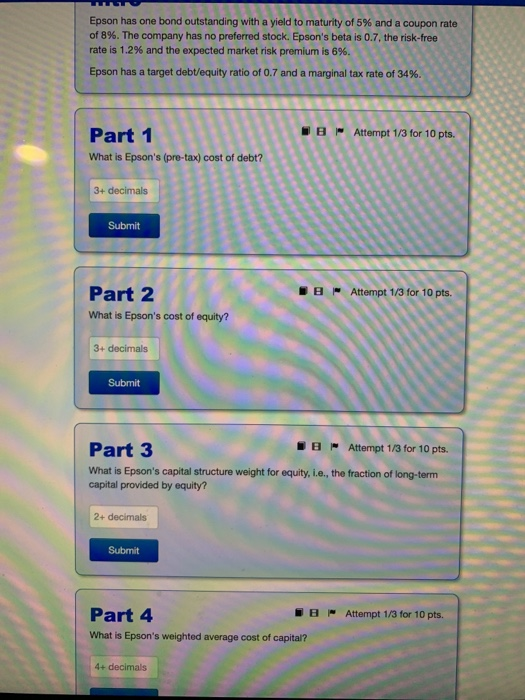

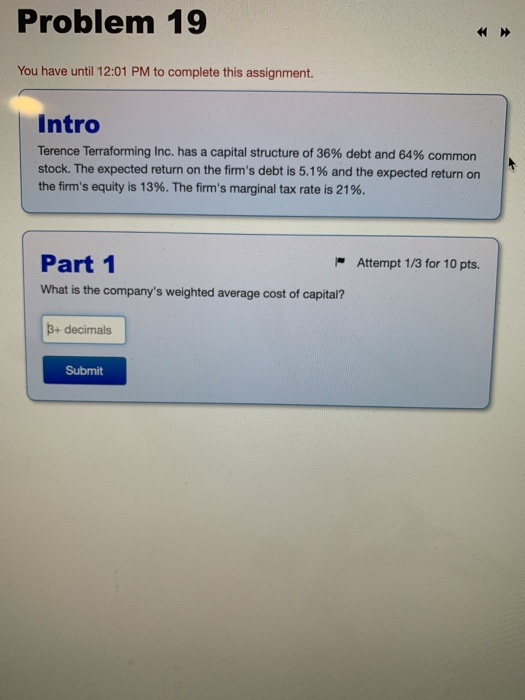

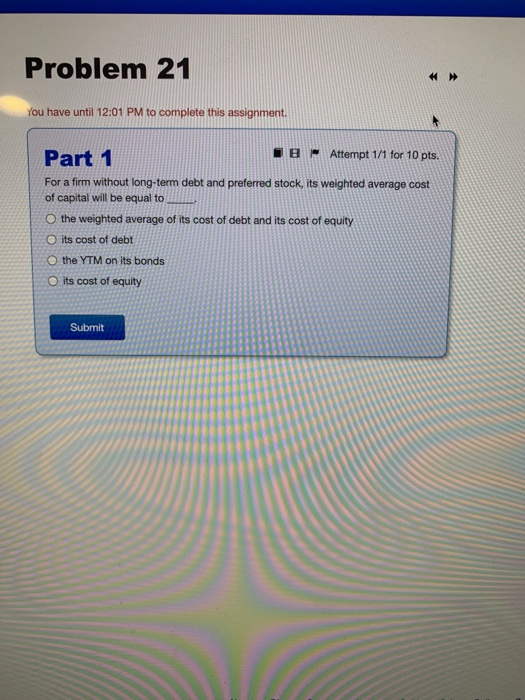

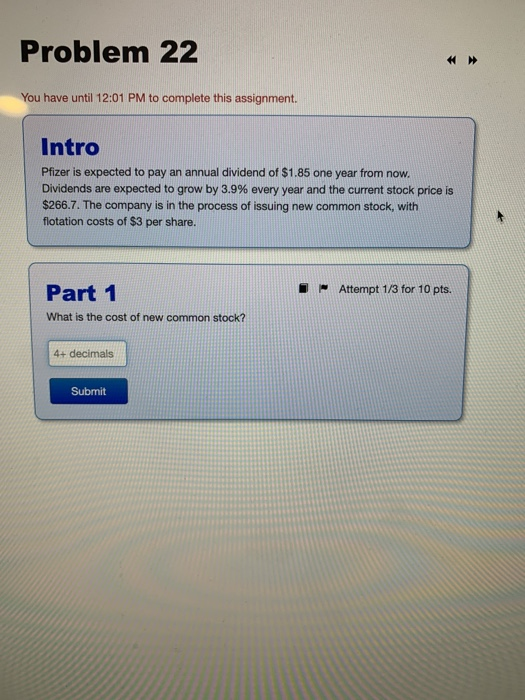

Problem 20 You have until 12:01 PM to complete this assignment. Intro Epson has one bond outstanding with a yield to maturity of 5% and a coupon rate of 8%. The company has no preferred stock. Epson's beta is 0.7, the risk-free rate is 1.2% and the expected market risk premium is 6%. Epson has a target debt/equity ratio of 0.7 and a marginal tax rate of 34%. To Attempt 1/3 for 10 pts. Part 1 What is Epson's (pre-tax) cost of debt? 3+ decimals Submit O Attempt 1/3 for 10 pts. Part 2 What is Epson's cost of equity? 3+ decimals Submit Part 3 - Attempt 1/3 for 10 pts. What is Epson's capital structure weight for equity, i.e., the fraction of long-term capital provided by equity? 2+ decimals Submit Epson has one bond outstanding with a yield to maturity of 5% and a coupon rate of 8%. The company has no preferred stock. Epson's beta is 0.7, the risk-free rate is 1.2% and the expected market risk premium is 6%. Epson has a target debt/equity ratio of 0.7 and a marginal tax rate of 34%. WB Attempt 1/3 for 10 pts. Part 1 What is Epson's (pre-tax) cost of debt? 3+ decimals Submit BB Attempt 1/3 for 10 pts. Part 2 What is Epson's cost of equity? 3+ decimals Submit Part 3 - Attempt 1/3 for 10 pts. What is Epson's capital structure weight for equity, i.e., the fraction of long-term capital provided by equity? 2+ decimals Submit Part 4 B Attempt 1/3 for 10 pts. What is Epson's weighted average cost of capital? 4+ decimals Problem 19 You have until 12:01 PM to complete this assignment. Intro Terence Terraforming Inc. has a capital structure of 36% debt and 64% common stock. The expected return on the firm's debt is 5.1% and the expected return on the firm's equity is 13%. The firm's marginal tax rate is 21%. Part 1 - Attempt 1/3 for 10 pts. What is the company's weighted average cost of capital? B+ decimals Submit Problem 21 >> You have until 12:01 PM to complete this assignment. Part 1 Attempt 1/1 for 10 pts. For a firm without long-term debt and preferred stock, its weighted average cost of capital will be equal to O the weighted average of its cost of debt and its cost of equity its cost of debt the YTM on its bonds O its cost of equity Submit Problem 22 You have until 12:01 PM to complete this assignment. Intro Pfizer is expected to pay an annual dividend of $1.85 one year from now. Dividends are expected to grow by 3.9% every year and the current stock price is $266.7. The company is in the process of issuing new common stock, with flotation costs of $3 per share. I Attempt 1/3 for 10 pts. Part 1 What is the cost of new common stock? 4+ decimals Submit