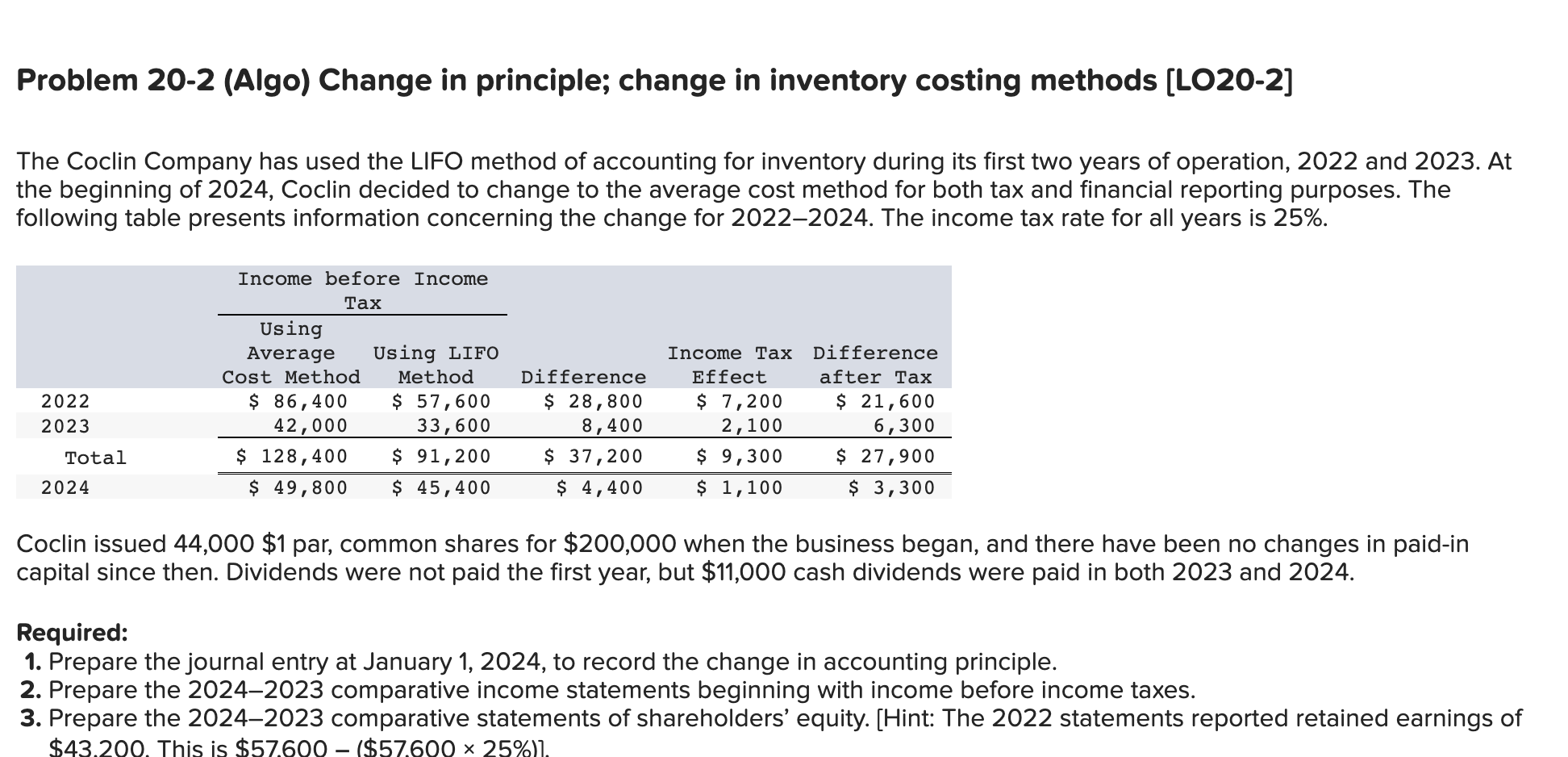

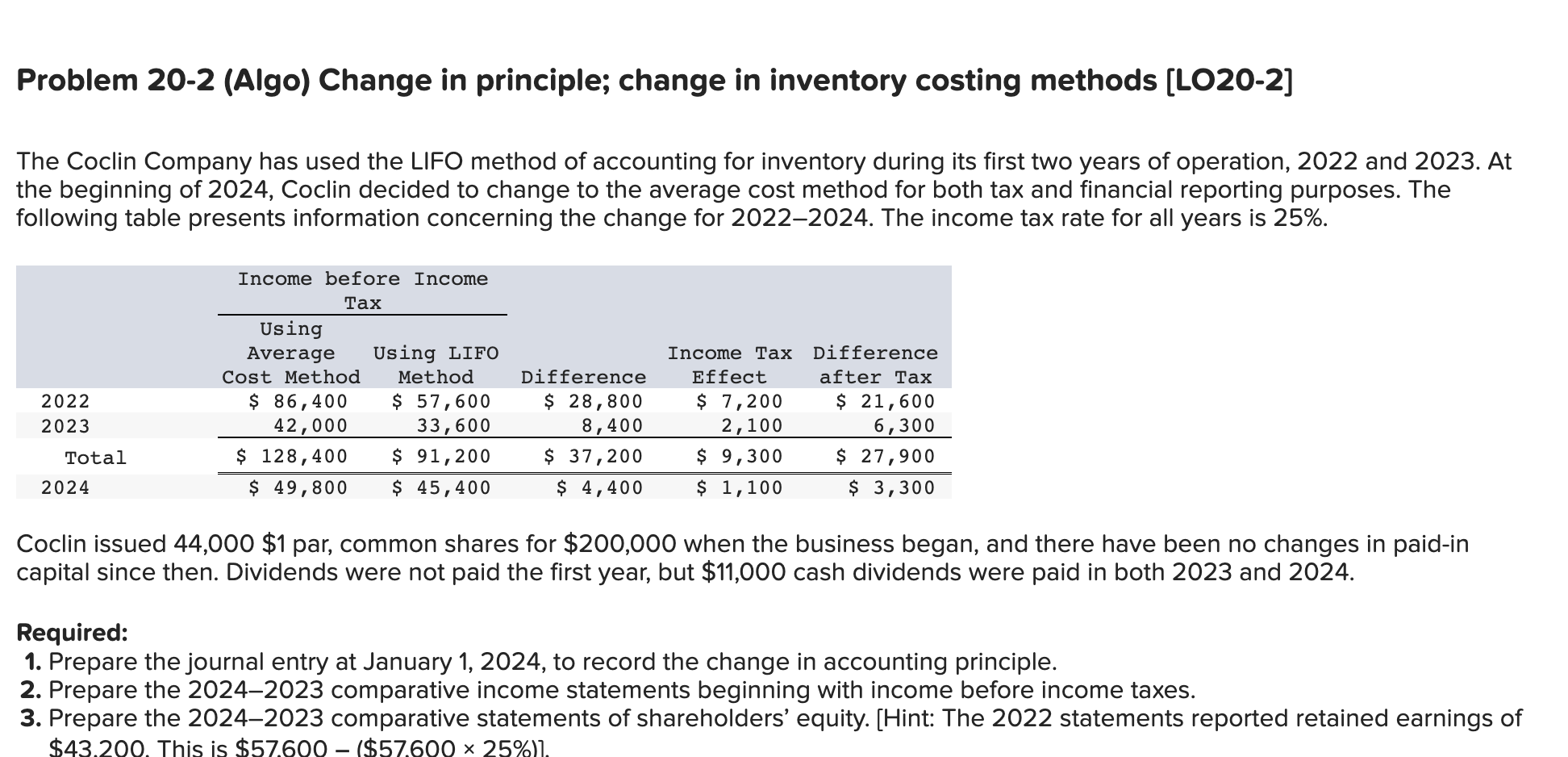

Problem 20-2 (Algo) Change in principle; change in inventory costing methods [LO20-2] The Coclin Company has used the LIFO method of accounting for inventory during its first two years of operation, 2022 and 2023 . At the beginning of 2024 , Coclin decided to change to the average cost method for both tax and financial reporting purposes. The following table presents information concerning the change for 2022-2024. The income tax rate for all years is 25%. Coclin issued 44,000$1 par, common shares for $200,000 when the business began, and there have been no changes in paid-in capital since then. Dividends were not paid the first year, but $11,000 cash dividends were paid in both 2023 and 2024. Required: 1. Prepare the journal entry at January 1,2024 , to record the change in accounting principle. 2. Prepare the 2024-2023 comparative income statements beginning with income before income taxes. 3. Prepare the 2024-2023 comparative statements of shareholders' equity. [Hint: The 2022 statements reported retained earnings of $43.200. This is $57.600($57.60025%)1. Problem 20-2 (Algo) Change in principle; change in inventory costing methods [LO20-2] The Coclin Company has used the LIFO method of accounting for inventory during its first two years of operation, 2022 and 2023 . At the beginning of 2024 , Coclin decided to change to the average cost method for both tax and financial reporting purposes. The following table presents information concerning the change for 2022-2024. The income tax rate for all years is 25%. Coclin issued 44,000$1 par, common shares for $200,000 when the business began, and there have been no changes in paid-in capital since then. Dividends were not paid the first year, but $11,000 cash dividends were paid in both 2023 and 2024. Required: 1. Prepare the journal entry at January 1,2024 , to record the change in accounting principle. 2. Prepare the 2024-2023 comparative income statements beginning with income before income taxes. 3. Prepare the 2024-2023 comparative statements of shareholders' equity. [Hint: The 2022 statements reported retained earnings of $43.200. This is $57.600($57.60025%)1