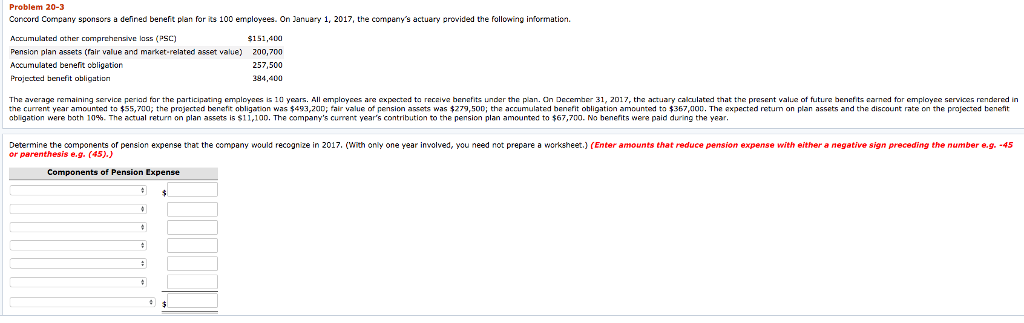

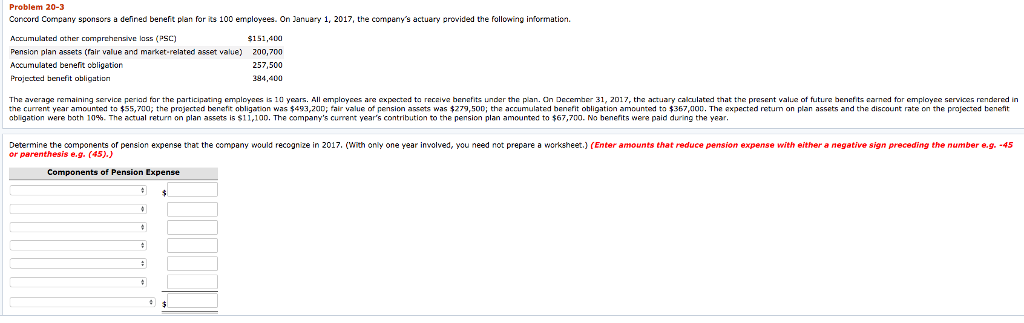

Problem 20-3 Concord Company sponsors a defined benefit plan for its 100 employees. On January 1, 2017, the companys actuary provided the following information.

Accumulated other comprehensive loss (PSC) $151,400

Pension plan assets (fair value and market-related asset value) 200,700

Accumulated benefit obligation 257,500

Projected benefit obligation 384,400

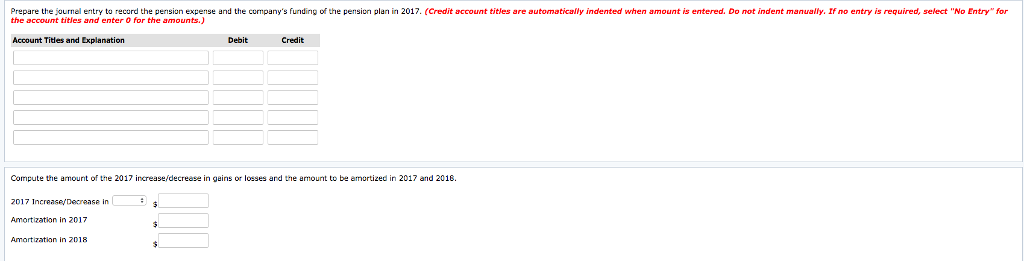

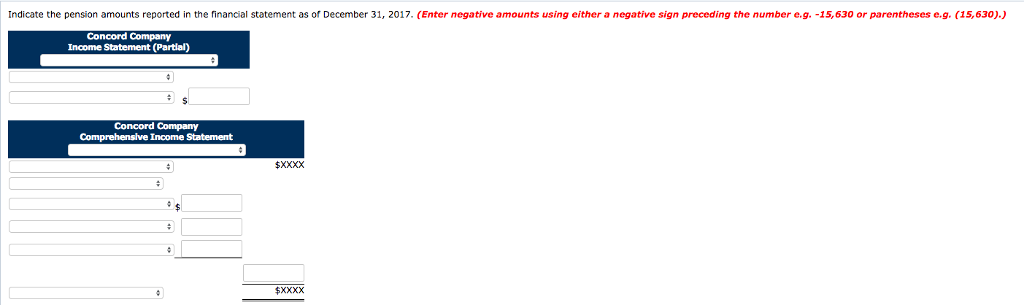

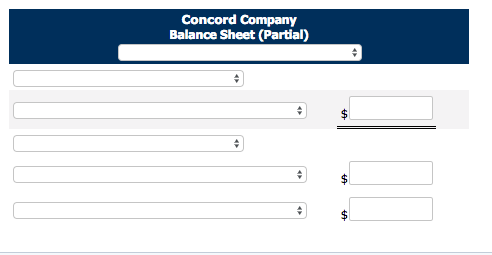

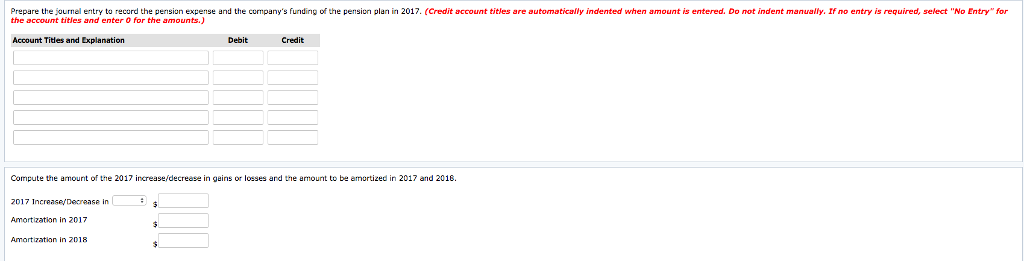

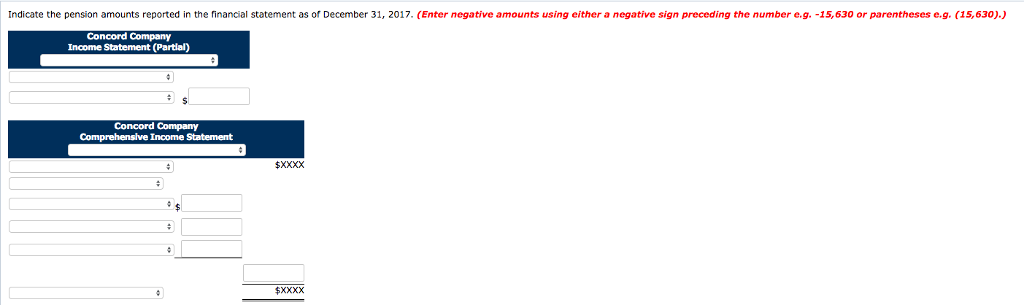

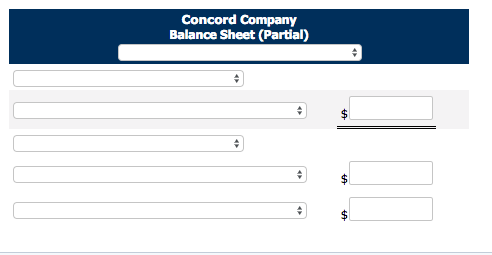

The average remaining service period for the participating employees is 10 years. All employees are expected to receive benefits under the plan. On December 31, 2017, the actuary calculated that the present value of future benefits earned for employee services rendered in the current year amounted to $55,700; the projected benefit obligation was $493,200; fair value of pension assets was $279,500; the accumulated benefit obligation amounted to $367,000. The expected return on plan assets and the discount rate on the projected benefit obligation were both 10%. The actual return on plan assets is $11,100. The companys current years contribution to the pension plan amounted to $67,700. No benefits were paid during the year.

Problem 20-3 Conoord Company sponsors a defined benefit plan for its 100 employees. On Januay 1, 2017, the comperny's actuary provided the following information. Accumulated other comprehensive lass (PSC) Pension plan assets (fair value and market-related asset value) 200,700 Accumulated benefnt cbligation Projected benefit obligation $151,400 257,500 94,400 Tha average remaining service periad far the participating employacs is10 years. All employces are expected ta recaive benefits undar the plan. an December 31, 2017, the actuary calulated that the present value of futura benefits aarned for employse services rendared in the current year amounted to 55 7 ? the pr ecta here t nbligation wa??493 za fair value of pension a ts was 279 50 tha accumulated benefit ohli ation amounted to?367 n The pected tum on plan assets and the discount rate on the ro e ed bene t obigation were both 10% The actual return on plan assets is $11,100The company's current year's contribution to the pension plan amounted to $67,700. No benefits were paid during the year Determine the components of pension expense thar the company would recognize in 2017, (with only one year involved, you need not prepare a worksheet.) (Enter amounts that reduce pension expense with either a or parenthesis e.g. (45).) negative sign preceding the number e.g -45 Components of Pension Expense Problem 20-3 Conoord Company sponsors a defined benefit plan for its 100 employees. On Januay 1, 2017, the comperny's actuary provided the following information. Accumulated other comprehensive lass (PSC) Pension plan assets (fair value and market-related asset value) 200,700 Accumulated benefnt cbligation Projected benefit obligation $151,400 257,500 94,400 Tha average remaining service periad far the participating employacs is10 years. All employces are expected ta recaive benefits undar the plan. an December 31, 2017, the actuary calulated that the present value of futura benefits aarned for employse services rendared in the current year amounted to 55 7 ? the pr ecta here t nbligation wa??493 za fair value of pension a ts was 279 50 tha accumulated benefit ohli ation amounted to?367 n The pected tum on plan assets and the discount rate on the ro e ed bene t obigation were both 10% The actual return on plan assets is $11,100The company's current year's contribution to the pension plan amounted to $67,700. No benefits were paid during the year Determine the components of pension expense thar the company would recognize in 2017, (with only one year involved, you need not prepare a worksheet.) (Enter amounts that reduce pension expense with either a or parenthesis e.g. (45).) negative sign preceding the number e.g -45 Components of Pension Expense