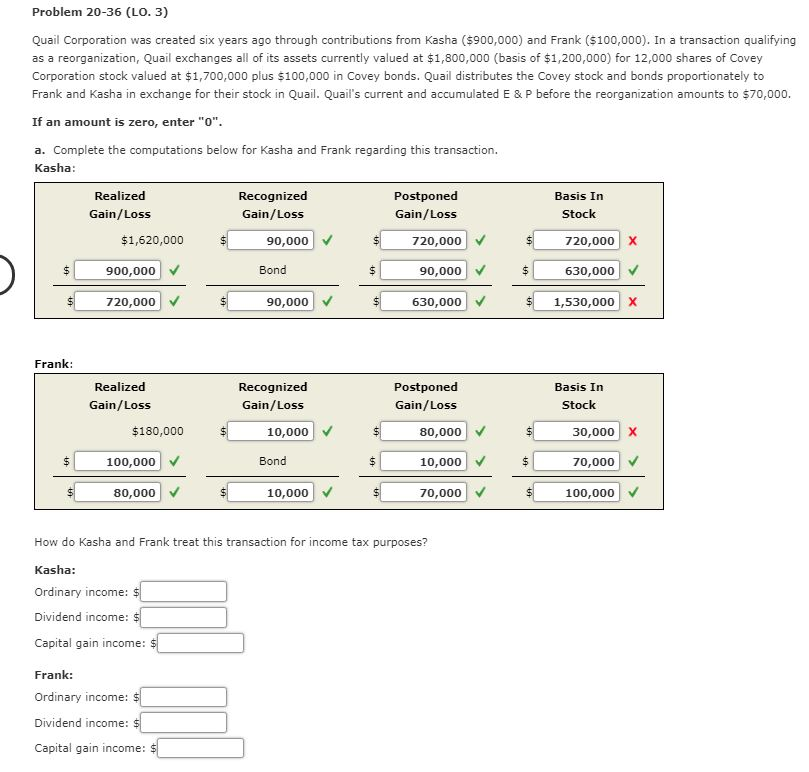

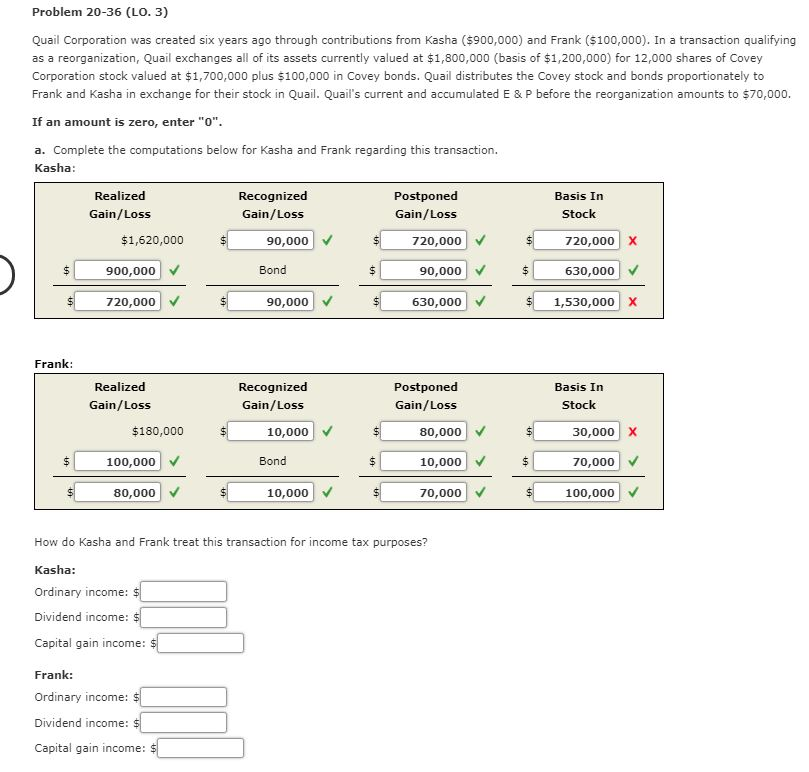

Problem 20-36 (LO. 3) Quail Corporation was created six years ago through contributions from Kasha (5900,000) and Frank ($100,000). In a transaction qualifying as a reorganization, Quail exchanges all of its assets currently valued at $1,800,000 (basis of $1,200,000) for 12,000 shares of Covey Corporation stock valued at $1,700,000 plus $100,000 in Covey bonds. Quail distributes the Covey stock and bonds proportionately to Frank and Kasha in exchange for their stock in Quail. Quail's current and accumulated E&P before the reorganization amounts to $70,000. If an amount is zero, enter "o". a. Complete the computations below for Kasha and Frank regarding this transaction. Kasha: Realized Recognized Postponed Basis In Gain/Loss Gain/Loss Gain/Loss Stock $1,620,000 90,000 720,000 720,000 X $ 900,000 Bond $ 90,000 630,000 $ 720,000 $ 90,000 $ 630,000 $ 1,530,000 x Frank: Realized Gain/Loss Recognized Gain/Loss Postponed Gain/Loss Basis In Stock $180,000 $ 10,000 80,000 30,000 x $ 100,000 Bond $ 10,000 $ 70,000 80,000 10,000 70,000 100,000 How do Kasha and Frank treat this transaction for income tax purposes? Kasha: Ordinary income: Dividend income: $ Capital gain income: $ Frank: Ordinary income: $ Dividend income: $ Capital gain income: $ Problem 20-36 (LO. 3) Quail Corporation was created six years ago through contributions from Kasha (5900,000) and Frank ($100,000). In a transaction qualifying as a reorganization, Quail exchanges all of its assets currently valued at $1,800,000 (basis of $1,200,000) for 12,000 shares of Covey Corporation stock valued at $1,700,000 plus $100,000 in Covey bonds. Quail distributes the Covey stock and bonds proportionately to Frank and Kasha in exchange for their stock in Quail. Quail's current and accumulated E&P before the reorganization amounts to $70,000. If an amount is zero, enter "o". a. Complete the computations below for Kasha and Frank regarding this transaction. Kasha: Realized Recognized Postponed Basis In Gain/Loss Gain/Loss Gain/Loss Stock $1,620,000 90,000 720,000 720,000 X $ 900,000 Bond $ 90,000 630,000 $ 720,000 $ 90,000 $ 630,000 $ 1,530,000 x Frank: Realized Gain/Loss Recognized Gain/Loss Postponed Gain/Loss Basis In Stock $180,000 $ 10,000 80,000 30,000 x $ 100,000 Bond $ 10,000 $ 70,000 80,000 10,000 70,000 100,000 How do Kasha and Frank treat this transaction for income tax purposes? Kasha: Ordinary income: Dividend income: $ Capital gain income: $ Frank: Ordinary income: $ Dividend income: $ Capital gain income: $