Answered step by step

Verified Expert Solution

Question

1 Approved Answer

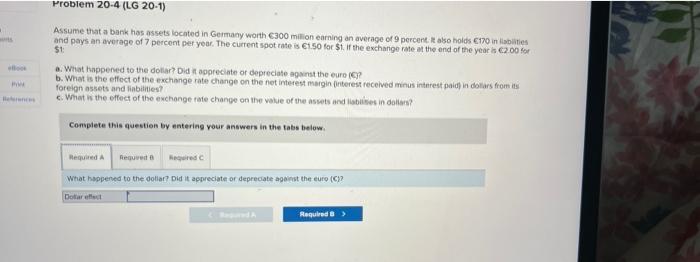

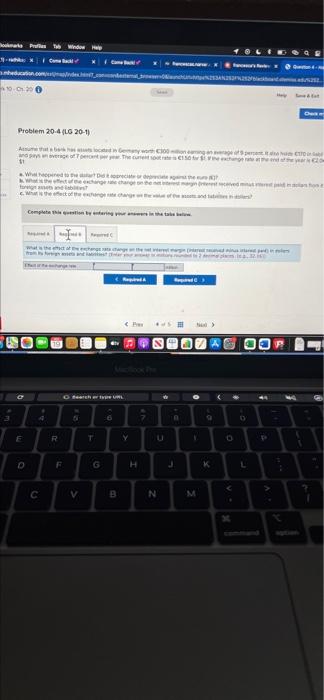

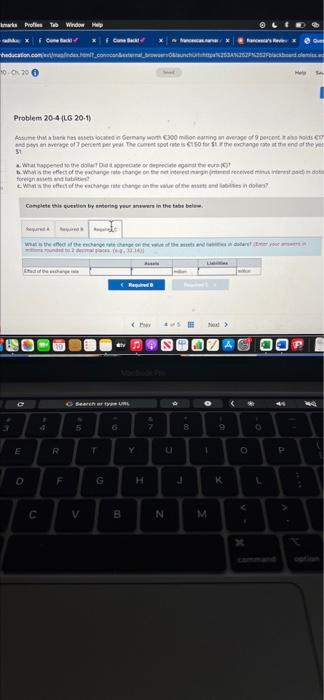

Problem 20-4 (LG 20-1) Assume that a bank has assets located in Germany worth C300 millionering an average of 9 percent. It also holds 170

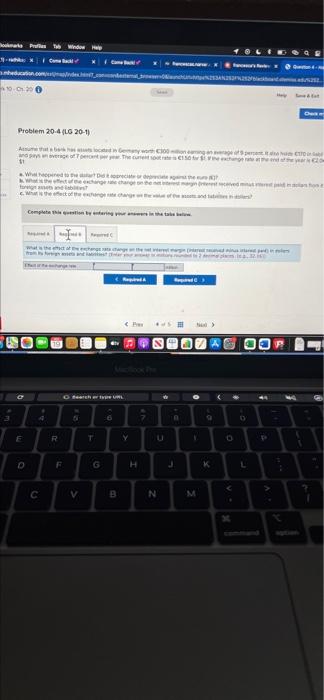

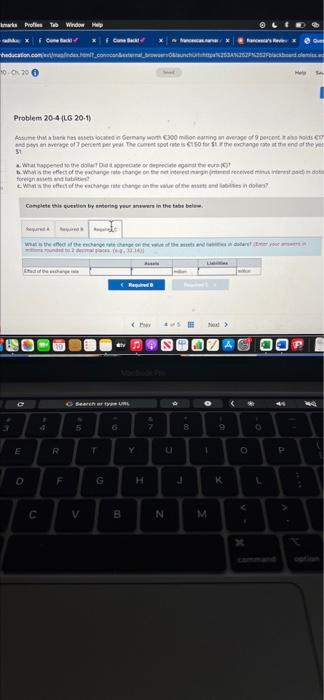

Problem 20-4 (LG 20-1) Assume that a bank has assets located in Germany worth C300 millionering an average of 9 percent. It also holds 170 in oblities and pays an average of 7 percent per your. The current spot rate is 1.50 for $1. If the exchange rate at the end of the year is 2.00 for $1: a. What happened to the dollar? Did It appreciate or depreciate against the euro (67 b. What is the effect of the exchange rate change on the net interest margin feterest received minus interest paich in dollars from its foreign assets and libilities? What the offect of the exchange rate change on the value of the assets and tables in dollars? Complete this question by entering your answers in the tabs below Required Request a required What happened to the dollar? Did It appreciate or depreciate against the euro (C? Dollar Required make Profiles Window X 00 Problem 20-4LG 20-1) Ang TO OTO. 11 What we rest De E R T Y U O F H K A C V. B N Imate Profet The Wadow Comba * f Comet education.com adas.com.concordia berwacha 020 Fachard.com Problem 20-4LG 20-1 Assume theres Germany worn 6300 miliona everage of percent tregon serie 7 percent year the current toutes 150 frangere end of the 31 tapo te determine Warse elector recretarieved into chefen Concies ention by entering you were in the label that .

Problem 20-4 (LG 20-1) Assume that a bank has assets located in Germany worth C300 millionering an average of 9 percent. It also holds 170 in oblities and pays an average of 7 percent per your. The current spot rate is 1.50 for $1. If the exchange rate at the end of the year is 2.00 for $1: a. What happened to the dollar? Did It appreciate or depreciate against the euro (67 b. What is the effect of the exchange rate change on the net interest margin feterest received minus interest paich in dollars from its foreign assets and libilities? What the offect of the exchange rate change on the value of the assets and tables in dollars? Complete this question by entering your answers in the tabs below Required Request a required What happened to the dollar? Did It appreciate or depreciate against the euro (C? Dollar Required make Profiles Window X 00 Problem 20-4LG 20-1) Ang TO OTO. 11 What we rest De E R T Y U O F H K A C V. B N Imate Profet The Wadow Comba * f Comet education.com adas.com.concordia berwacha 020 Fachard.com Problem 20-4LG 20-1 Assume theres Germany worn 6300 miliona everage of percent tregon serie 7 percent year the current toutes 150 frangere end of the 31 tapo te determine Warse elector recretarieved into chefen Concies ention by entering you were in the label that .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started