Question

Problem 2.1 Balance out the Balance Sheet correctly. You will to manually adjust either/both two line items in the Balance Sheet. - These two line

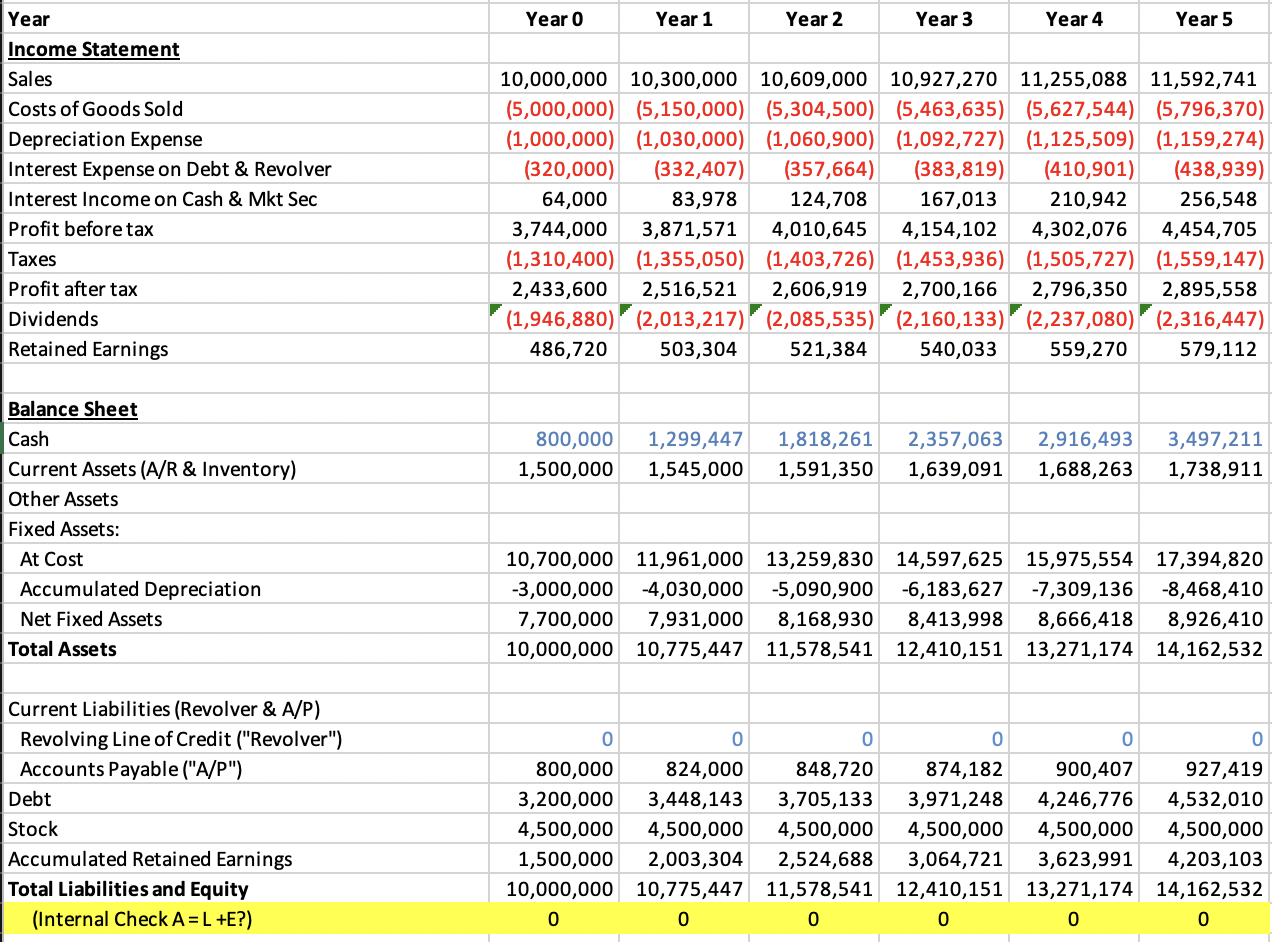

Problem 2.1 Balance out the Balance Sheet correctly. You will to manually adjust either/both two line items in the Balance Sheet.

- These two line items are: CASH & EQUIVALENTS ON THE ASSET SIDE AND "REVOLVING LINE OF CREDIT" ON THE LIABILITY SIDE WITHIN CURRENT ASSETS.

Your manual adjustments are based upon the following considerations:

- If assets are less than (Liabilities + Equity), then you must increase the cash & equivalents until assets equal (Liabilities + Equity) for that year. Do this for each of the 5 years shown.

- If assets are greater than (Liabilities + Equity), then you must increase the revolving line until (Liabilities + Equity) equal assets that year. Do this for each of the five years shown.

Please show your work/calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started