Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2-1 (Static) Accounting cycle through unadjusted trial balance [LO2-3, 2-4] Halogen Laminated Products Company began business on January 1, 2024. During January, the following

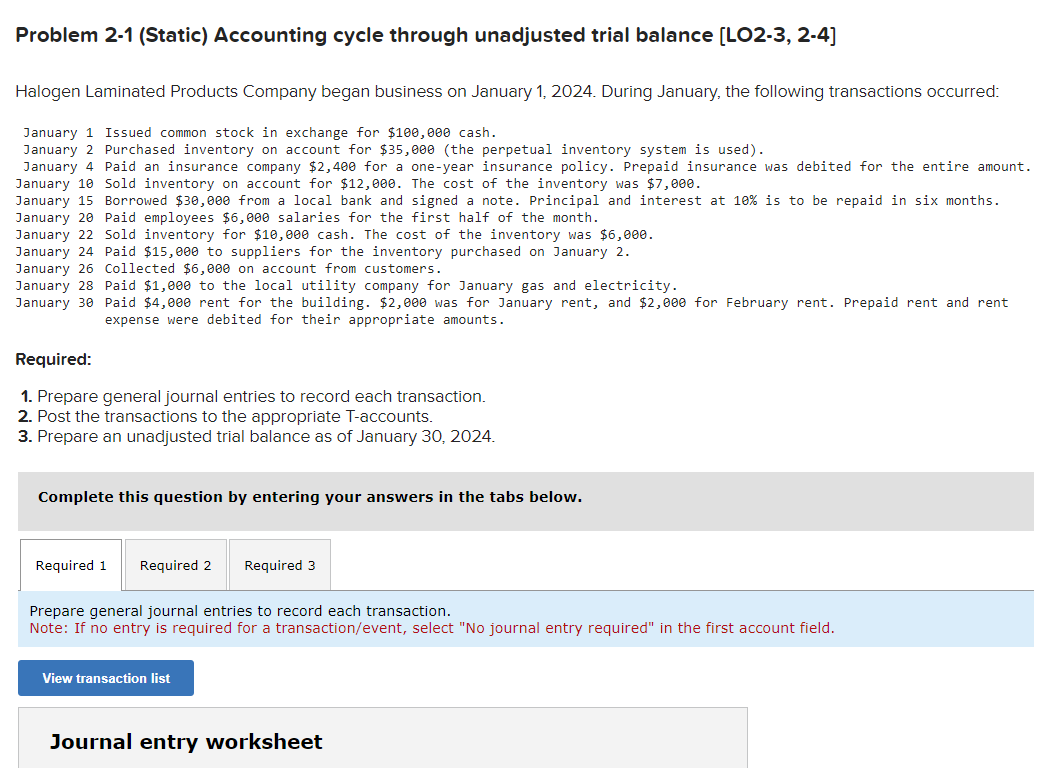

Problem 2-1 (Static) Accounting cycle through unadjusted trial balance [LO2-3, 2-4] Halogen Laminated Products Company began business on January 1, 2024. During January, the following transactions occurred: January 1 Issued common stock in exchange for $100,000 cash. January 2 Purchased inventory on account for $35,000 (the perpetual inventory system is used). January 4 Paid an insurance company $2,400 for a one-year insurance policy. Prepaid insurance was debited for the entire amount. January 10 Sold inventory on account for $12,000. The cost of the inventory was $7,000. January 15 Borrowed $30,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six months. January 20 Paid employees $6,000 salaries for the first half of the month. January 22 Sold inventory for $10,000 cash. The cost of the inventory was $6,000. January 24 Paid $15,000 to suppliers for the inventory purchased on January 2 . January 26 collected $6,000 on account from customers. January 28 Paid $1,00 to the local utility company for January gas and electricity. January 30 Paid $4,000 rent for the building. $2,000 was for January rent, and $2,000 for February rent. Prepaid rent and rent expense were debited for their appropriate amounts. Required: 1. Prepare general journal entries to record each transaction. 2. Post the transactions to the appropriate T-accounts. 3. Prepare an unadjusted trial balance as of January 30, 2024. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet

Problem 2-1 (Static) Accounting cycle through unadjusted trial balance [LO2-3, 2-4] Halogen Laminated Products Company began business on January 1, 2024. During January, the following transactions occurred: January 1 Issued common stock in exchange for $100,000 cash. January 2 Purchased inventory on account for $35,000 (the perpetual inventory system is used). January 4 Paid an insurance company $2,400 for a one-year insurance policy. Prepaid insurance was debited for the entire amount. January 10 Sold inventory on account for $12,000. The cost of the inventory was $7,000. January 15 Borrowed $30,000 from a local bank and signed a note. Principal and interest at 10% is to be repaid in six months. January 20 Paid employees $6,000 salaries for the first half of the month. January 22 Sold inventory for $10,000 cash. The cost of the inventory was $6,000. January 24 Paid $15,000 to suppliers for the inventory purchased on January 2 . January 26 collected $6,000 on account from customers. January 28 Paid $1,00 to the local utility company for January gas and electricity. January 30 Paid $4,000 rent for the building. $2,000 was for January rent, and $2,000 for February rent. Prepaid rent and rent expense were debited for their appropriate amounts. Required: 1. Prepare general journal entries to record each transaction. 2. Post the transactions to the appropriate T-accounts. 3. Prepare an unadjusted trial balance as of January 30, 2024. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record each transaction. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started