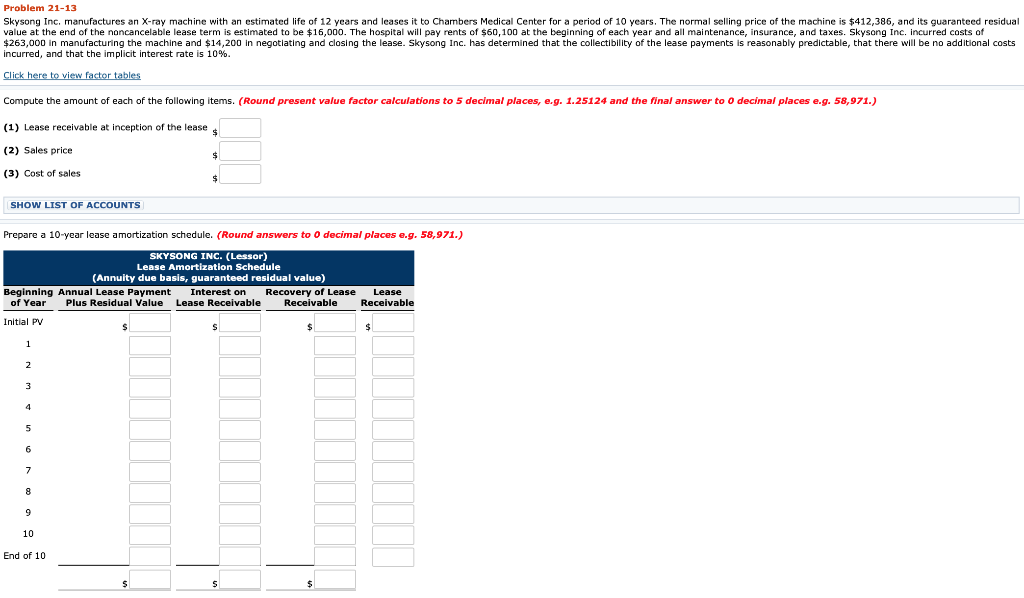

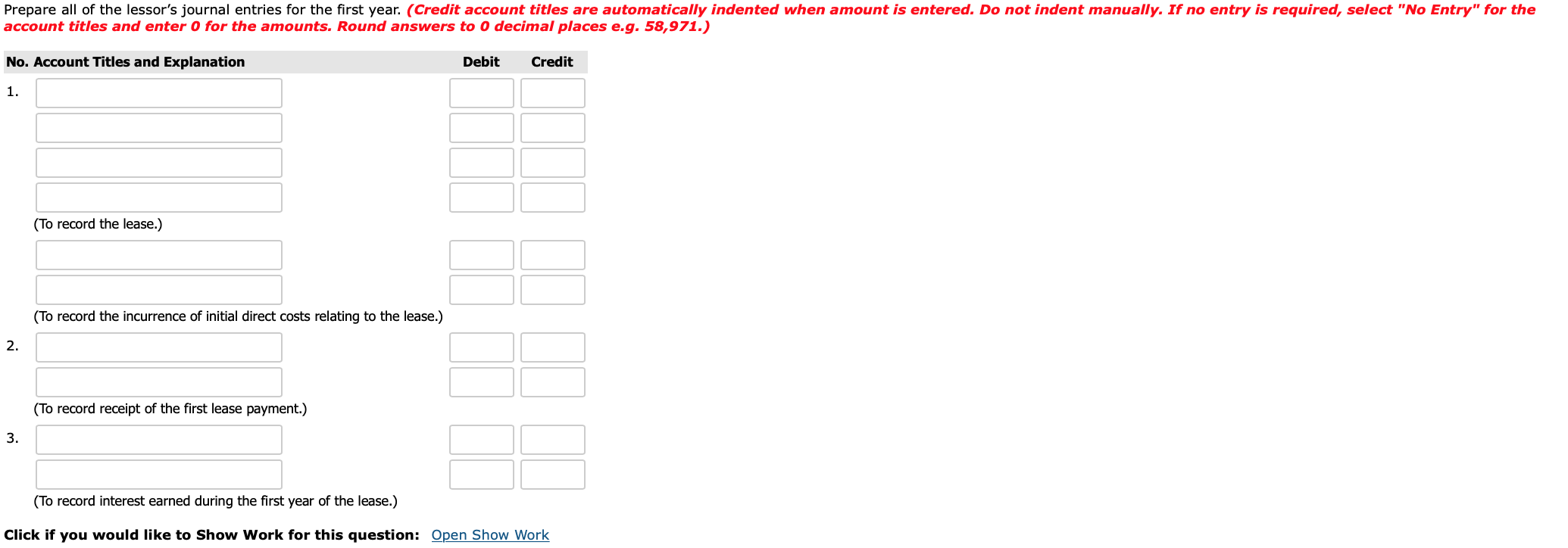

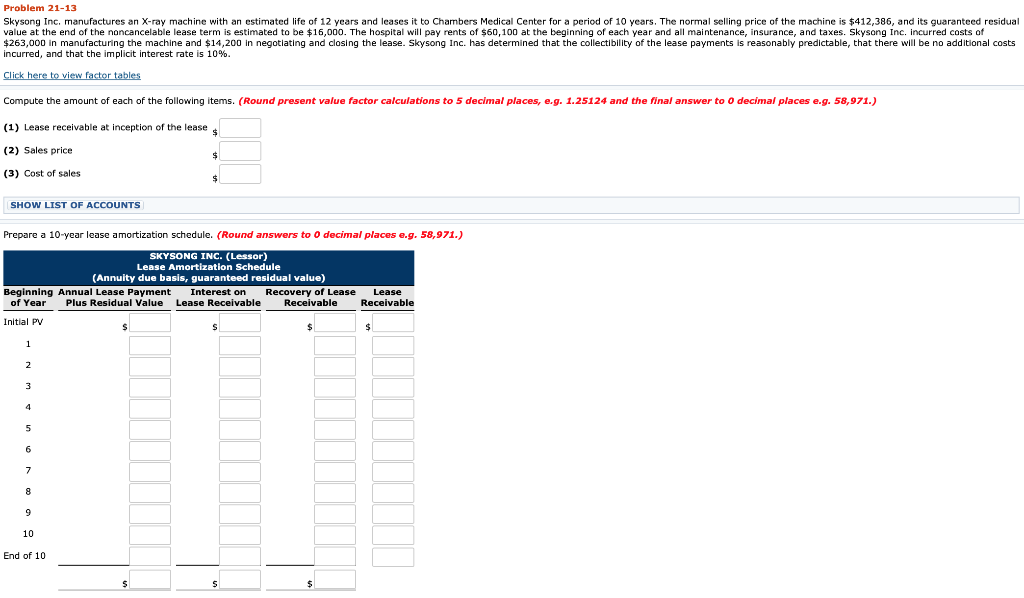

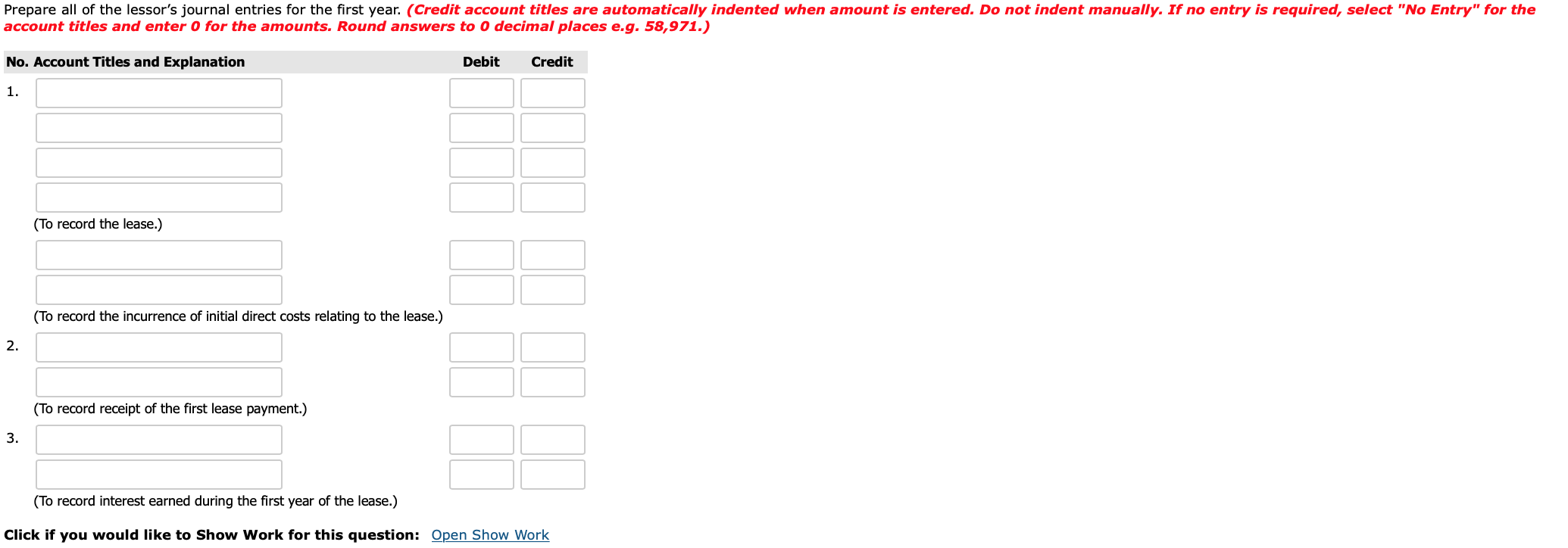

Problem 21-13 Skysong Inc, manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $412,386, and its guaranteed residual value at the end of the noncancelable lease term is estimated to be $16,000. The hospital will pay rents of $60,100 at the beginning of each year and all maintenance, insurance, and taxes. Skysong Inc. incurred costs of $263,000 in manufacturing the machine and $14,200 in negotiating and closing the lease. Skysong Inc. has determined that the collectibility of the lease payments is reasonably predictable, that there will be no additional costs incurred, and that the implicit interest rate is 10%. Click here to view factor tables Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971.) (1) Lease receivable at inception of the lease (2) Sales price (3) Cost of sales SHOW LIST OF ACCOUNTS Prepare a 10-year lease amortization schedule. (Round answers to o decimal places e.g. 58,971.) SKYSONG INC. (Lessor) Lease Amortization Schedule (Annuity due basis, guaranteed residual value) Beginning Annual Lease Payment Interest on Recovery of Lease Lease of Year Plus Residual Value Lease Receivable Receivable Receivable Initial PV End of 10 Prepare all of the lessor's journal entries for the first year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to O decimal places e.g. 58,971.) No. Account Titles and Explanation Debit Credit (To record the lease.) (To record the incurrence of initial direct costs relating to the lease.) (To record receipt of the first lease payment.) 3. (To record interest earned during the first year of the lease.) Click if you would like to Show Work for this question: Open Show Work Problem 21-13 Skysong Inc, manufactures an X-ray machine with an estimated life of 12 years and leases it to Chambers Medical Center for a period of 10 years. The normal selling price of the machine is $412,386, and its guaranteed residual value at the end of the noncancelable lease term is estimated to be $16,000. The hospital will pay rents of $60,100 at the beginning of each year and all maintenance, insurance, and taxes. Skysong Inc. incurred costs of $263,000 in manufacturing the machine and $14,200 in negotiating and closing the lease. Skysong Inc. has determined that the collectibility of the lease payments is reasonably predictable, that there will be no additional costs incurred, and that the implicit interest rate is 10%. Click here to view factor tables Compute the amount of each of the following items. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971.) (1) Lease receivable at inception of the lease (2) Sales price (3) Cost of sales SHOW LIST OF ACCOUNTS Prepare a 10-year lease amortization schedule. (Round answers to o decimal places e.g. 58,971.) SKYSONG INC. (Lessor) Lease Amortization Schedule (Annuity due basis, guaranteed residual value) Beginning Annual Lease Payment Interest on Recovery of Lease Lease of Year Plus Residual Value Lease Receivable Receivable Receivable Initial PV End of 10 Prepare all of the lessor's journal entries for the first year. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to O decimal places e.g. 58,971.) No. Account Titles and Explanation Debit Credit (To record the lease.) (To record the incurrence of initial direct costs relating to the lease.) (To record receipt of the first lease payment.) 3. (To record interest earned during the first year of the lease.) Click if you would like to Show Work for this question: Open Show Work