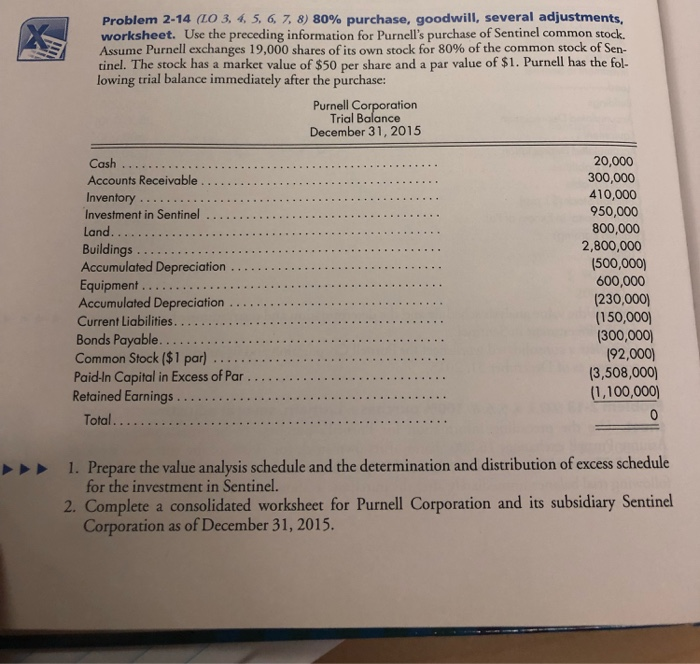

Problem 2-14 (LO 3, 4, 5, 6, 7, 8) 80% purchase, goodwill, several adjustments, worksheet. Use the preceding information for Purnell's purchase of Sentinel common stock. Assume Purnell exchanges 19,000 shares of its own stock for 80% of the common stock of Sen- tinel. The stock has a market value of $50 per share and a par value of $1. Purnell has the fol- lowing trial balance immediately after the purchase: Purnell Corporation Trial Balance December 31, 2015 Cash ...... Accounts Receivable..... Inventory ......... Investment in Sentinel ......... Land. Buildings ... Accumulated Depreciation ........ Equipment. .. .. .. .. Accumulated Depreciation ....... Current Liabilities. ........... Bonds Payable................. Common Stock ($1 par) .......... Paid In Capital in Excess of Par ........... Retained Earnings .......... Total........... 20,000 300,000 410,000 950,000 800,000 2,800,000 (500,000) 600,000 (230,000) (150,000) (300,000) 192,000) (3,508,000) 11,100,000) 1. Prepare the value analysis schedule and the determination and distribution of excess schedule for the investment in Sentinel. 2. Complete a consolidated worksheet for Purnell Corporation and its subsidiary Sentinel Corporation as of December 31, 2015. Problem 2-14 (LO 3, 4, 5, 6, 7, 8) 80% purchase, goodwill, several adjustments, worksheet. Use the preceding information for Purnell's purchase of Sentinel common stock. Assume Purnell exchanges 19,000 shares of its own stock for 80% of the common stock of Sen- tinel. The stock has a market value of $50 per share and a par value of $1. Purnell has the fol- lowing trial balance immediately after the purchase: Purnell Corporation Trial Balance December 31, 2015 Cash ...... Accounts Receivable..... Inventory ......... Investment in Sentinel ......... Land. Buildings ... Accumulated Depreciation ........ Equipment. .. .. .. .. Accumulated Depreciation ....... Current Liabilities. ........... Bonds Payable................. Common Stock ($1 par) .......... Paid In Capital in Excess of Par ........... Retained Earnings .......... Total........... 20,000 300,000 410,000 950,000 800,000 2,800,000 (500,000) 600,000 (230,000) (150,000) (300,000) 192,000) (3,508,000) 11,100,000) 1. Prepare the value analysis schedule and the determination and distribution of excess schedule for the investment in Sentinel. 2. Complete a consolidated worksheet for Purnell Corporation and its subsidiary Sentinel Corporation as of December 31, 2015