Question

Problem 21-40 (LO. 3, 7, 9, 12) Bryan and Cody each contributed $120,000 to the newly formed BC Partnership in exchange for a 50% interest.

Problem 21-40 (LO. 3, 7, 9, 12)

Bryan and Cody each contributed $120,000 to the newly formed BC Partnership in exchange for a 50% interest. The partnership used the available funds to acquire equipment costing $200,000 and to fund current operating expenses. The partnership agreement provides that depreciation will be allocated 80% to Bryan and 20% to Cody. All other items of income and loss will be allocated equally between the partners.

Upon liquidation of the partnership, property will be distributed to the partners in accordance with their 704(b) book capital account balances. Any partner with a negative capital account must contribute cash in the amount of the negative balance to restore the capital account to $0.

In its first year, the partnership reported an ordinary loss (before depreciation) of $80,000 and depreciation expense of $36,000. In its second year, the partnership reported $40,000 of income from operations (before depreciation), and it reported depreciation expense of $57,600.

I just need the answer for part C. Also, please explain.

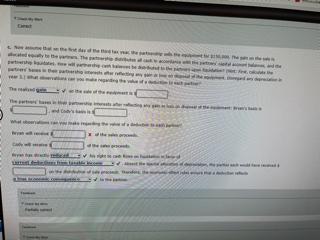

c. Now assume that on the first day of the third tax year, the partnership sells the equipment for $150,000. The gain on the sale is allocated equally to the partners. The partnership distributes all cash in accordance with the partners' capital account balances, and the partnership liquidates. How will partnership cash balances be distributed to the partners upon liquidation? (Hint: First, calculate the partners' bases in their partnership interests after reflecting any gain or loss on disposal of the equipment. Disregard any depreciation in year 3.) What observations can you make regarding the value of a deduction to each partner?

c. Now assume that on the first day of the third tax year, the partnership sells the equipment for $150,000. The gain on the sale is allocated equally to the partners. The partnership distributes all cash in accordance with the partners' capital account balances, and the partnership liquidates. How will partnership cash balances be distributed to the partners upon liquidation? (Hint: First, calculate the partners' bases in their partnership interests after reflecting any gain or loss on disposal of the equipment. Disregard any depreciation in year 3.) What observations can you make regarding the value of a deduction to each partner?

The realized gain on the sale of the equipment is $------------- ?????

The partners' bases in their partnership interests after reflecting any gain or loss on disposal of the equipment: Bryan's basis is $--------------------? and Cody's basis is $-----------------?

What observations can you make regarding the value of a deduction to each partner?

| Bryan will receive $------------------??? of the sales proceeds. |

| Cody will receive $-------------------??? of the sales proceeds. |

-THI - ma

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started