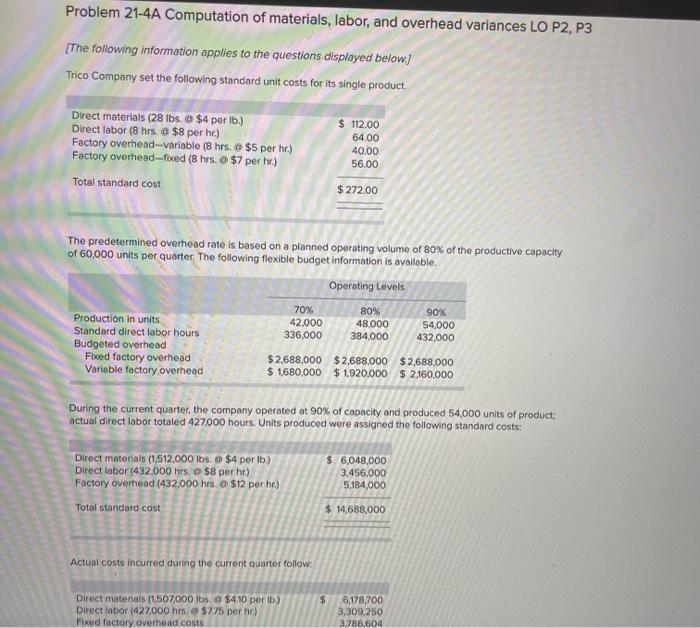

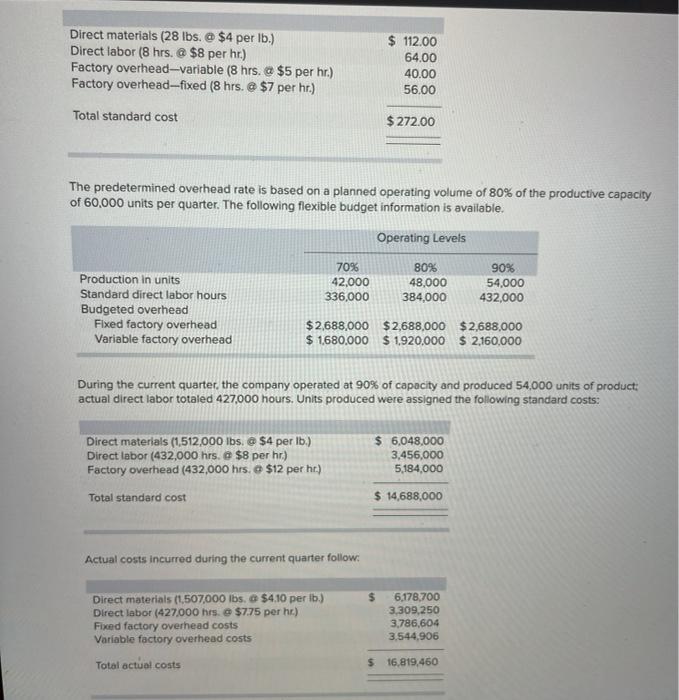

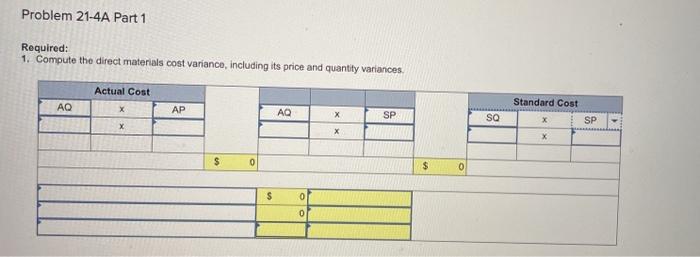

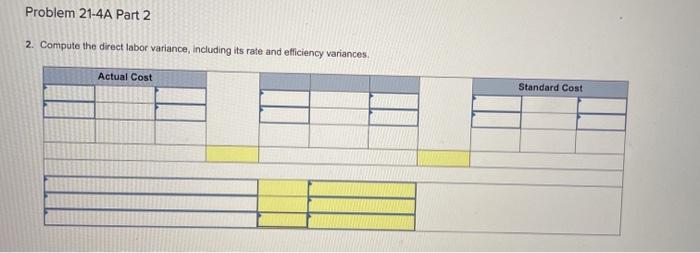

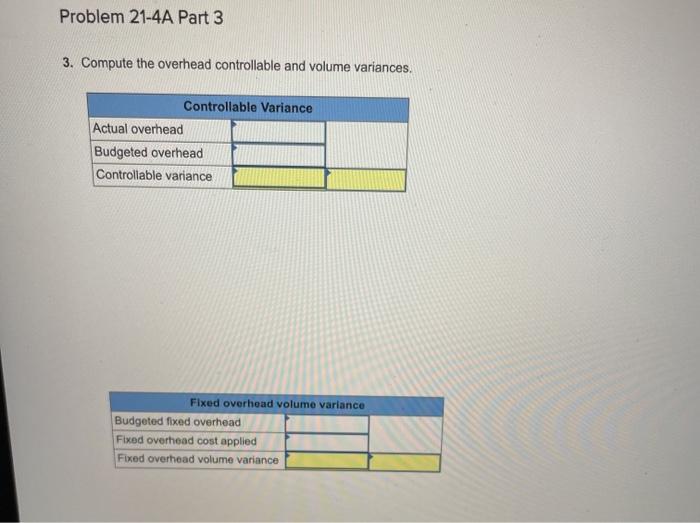

Problem 21-4A Computation of materials, labor, and overhead variances LO P2, P3 [The following information applies to the questions displayed below) Trico Company set the following standard unit costs for its single product. Direct materials (28 lbs. o $4 per 15.) Direct labor (8 hrs. a $8 per hr) Factory overhead-variable (8 hrs. $5 per hr.) Factory overhead-foed (8 hrs. o $7 per hr.) Total standard cost $ 112.00 64.00 40.00 56.00 $ 272.00 The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information is available. Operating levels 70% 42.000 336,000 80% 48.000 384,000 Production in units Standard direct labor hours Budgeted overhead Fixed factory overhead Variable factory overhead 90% 54,000 432,000 $ 2,688,000 $2,688,000 $2,688,000 $ 1680,000 $ 1,920,000 $ 2,160,000 During the current quarter, the company operated at 90% of capacity and produced 54,000 units of product; actual direct labor totaled 427000 hours. Units produced were assigned the following standard costs: Direct materials (1.512,000 lbs. o $4 per lb) Direct lobor (432,000 hrs. o $8 per he) Factory overhead (432,000 hrs. $12 per hc) Total standard cost $ 6,048,000 3.456,000 5,184,000 $ 14,688,000 Actual costs incurred during the current quarter follow: $ Direct matenals (1,507,000 lbs. o $410 per lb) Direct labor (427,000 hrs $7.75 per hr.) Fixed factory overhead costs 6,178,700 3,309.250 3.786,604 Direct materials (28 lbs. @ $4 per lb.) Direct labor (8 hrs. @ $8 per hr.) Factory overhead-variable (8 hrs. a $5 per hr.) Factory overhead-fixed (8 hrs. @ $7 per hr.) $ 112.00 64.00 40.00 56.00 Total standard cost $ 272.00 The predetermined overhead rate is based on a planned operating volume of 80% of the productive capacity of 60,000 units per quarter. The following flexible budget information is available. Operating Levels 70% 42,000 336,000 80% 48,000 384,000 90% 54,000 432,000 Production in units Standard direct labor hours Budgeted overhead Fixed factory overhead Variable factory overhead $ 2,688,000 $2,688,000 $2,688,000 $1,680.000 $ 1.920,000 $2,160,000 During the current quarter, the company operated at 90% of capacity and produced 54,000 units of product: actual direct labor totaled 427,000 hours. Units produced were assigned the following standard costs: Direct materials (1.512,000 lbs. @ $4 per 1b.) Direct labor (432,000 hrs. @ $8 per hr) Factory overhead (432,000 hrs. $12 per hr.) $ 6,048,000 3,456,000 5,184,000 Total standard cost $ 14,688,000 Actual costs incurred during the current quarter follow. $ Direct materials (1,507,000 lbs. c $4.10 perib) Direct labor (427,000 hrs. @ $7.75 per hr) Fixed factory overhead costs Variable factory overhead costs 6,178,700 3,309,250 3,786,604 3,544,906 Total actual costs $ 16,819,460 Problem 21-4A Part 1 Required: 1. Compute the direct materials cost variance, including its price and quantity variances Actual Cost Standard Cost AQ X AP AQ X SP so SP X X X $ 0 $ 0 S o o Problem 21-4A Part 2 2. Compute the direct labor variance, including its rate and efficiency variances Actual Cost Standard Cost Problem 21-4A Part 3 3. Compute the overhead controllable and volume variances, Controllable Variance Actual overhead Budgeted overhead Controllable variance Fixed overhead volume variance Budgeted fixed overhead Fixed overhead cost applied Fixed overhead volume variance