Answered step by step

Verified Expert Solution

Question

1 Approved Answer

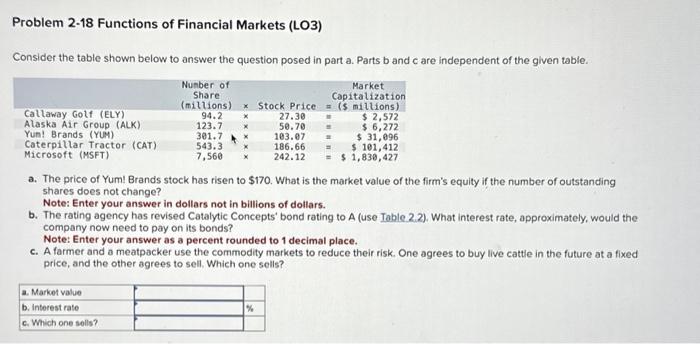

Problem 2-18 Functions of Financial Markets (L03) Consider the table shown below to answer the question posed in part a. Parts b and c are

Problem 2-18 Functions of Financial Markets (L03) Consider the table shown below to answer the question posed in part a. Parts b and c are independent of the given table. Market Capitalization Callaway Golf (ELY) Alaska Air Group (ALK) Yum! Brands (YUM) Caterpillar Tractor (CAT) Microsoft (MSFT) Number of Share (millions) X Stock Price = ($ millions) 94.2 X = 123.7 301.7 543.3 = = $ 31,096 X X X X = $ 101,412 = $ 1,830,427 7,560 a. Market value b. Interest rate c. Which one sells? 27.30 50.70 103.07 186.66 242.12 a. The price of Yum! Brands stock has risen to $170. What is the market value of the firm's equity if the number of outstanding shares does not change? $ 2,572 $ 6,272 Note: Enter your answer in dollars not in billions of dollars. b. The rating agency has revised Catalytic Concepts' bond rating to A (use Table 2.2). What interest rate, approximately, would the company now need to pay on its bonds? Note: Enter your answer as a percent rounded to 1 decimal place. c. A farmer and a meatpacker use the commodity markets to reduce their risk. One agrees to buy live cattle in the future at a fixed price, and the other agrees to sell. Which one sells? %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started