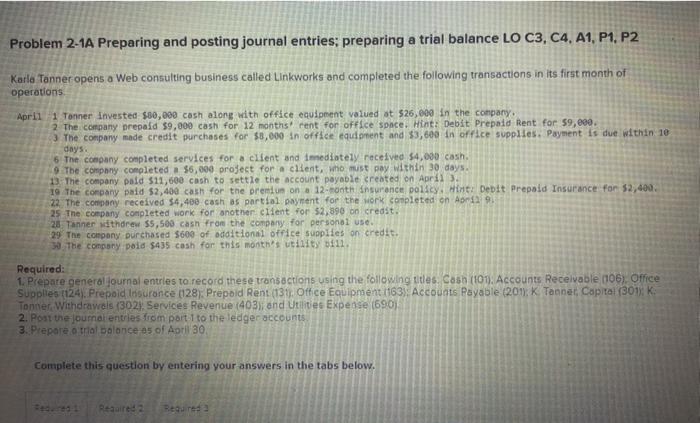

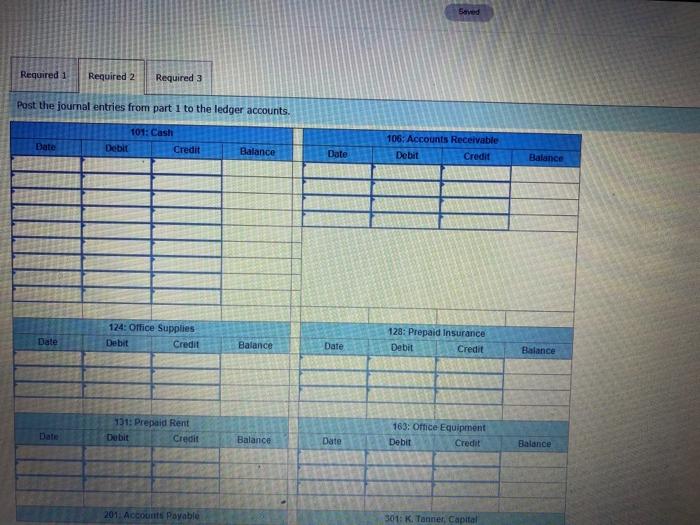

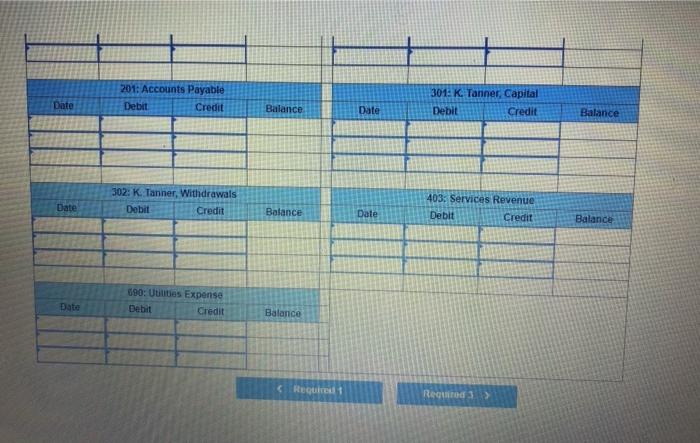

Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Karla Tanner opens a Web consulting business called Linkworks and completed the following transactions in its first month of operations April 1 Tonner invested $80,000 cash along with office equipment valued at $26,000 in the company. 2. The company prepaid $9,000 cash for 12 months' rent for office space. Hint: Debit Prepaid Rent for 59,000 3 The company made credit purchases for $3,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days. 6 The company completed services for a client and immediately received $4,000 cash. 9 The company completed a $6,000 project for a client, who must pay within 30 days. 13. The company paid $11,600 cash to settle the account payable created on April ). 19 The company paid $2,400 cash for the prentun on a 12-month insurance policy. Wint: Debit Prepaid Insurance for $2,400 22. The company received $4,400 cash as partial payment for the work completed on Art 25 The company completed work for another client for 52,890 on credst. 28 Tanner withdrew $5,500 cash from the company for personal use. 29 The company purchased $600 of additional office supplies on credit. The company paid $435 cash for this month's utility bill. Required: 1. Prepare general journal entries to record these transactions using the following titles Cash (101) Accounts Receivable 006). Office Supplies (124). Prepaid trourance (128). Prepold Rent (134, Office Equipment 1163) Accounts Payable (2017: K Tanner, Capital (3018: K: Tonner Withdrawals (302), Services Revenue (403) and Utilities Expense (690) 2. Post the journal entries from port to the ledger accounts 3. Prepare o trial balance as of April 30 Complete this question by entering your answers in the tabs below. Reare: 2 Required a Seved Required 1 Required 2 Required 3 Post the journal entries from part 1 to the ledger accounts. 101: Cash Debit Credit Date Balance 106: Accounts Receivable Debit Credit Date Balance 124: Office Supplies Debit Credit Date 128: Prepaid Insurance Debit Credit Balance Date Balance 131: Prepaid Rent Debit Credit 163: Office Equipment Debit Credit Balance Date Balance 201 Accounts Payable 301: K. Tanner, Capital 201: Accounts Payable Debit Credit Date 301: K. Tanner, Capital Debit Credit Balance Date Balance 302: K. Tanner, Withdrawals Debit Credit Date Balance 403. Services Revenue Debit Credit Date Balance 690: Uutis Expense Debit Credit Date Balance