Problem 22-02

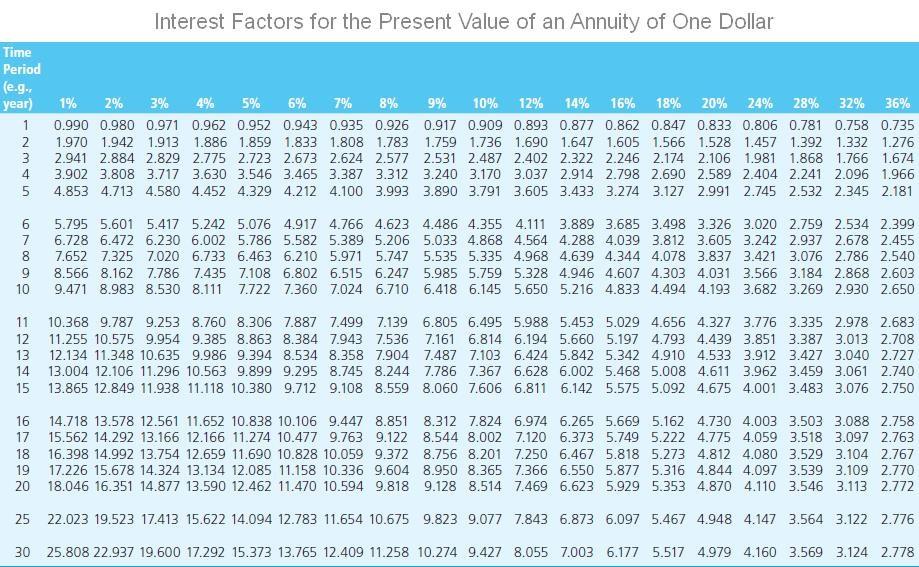

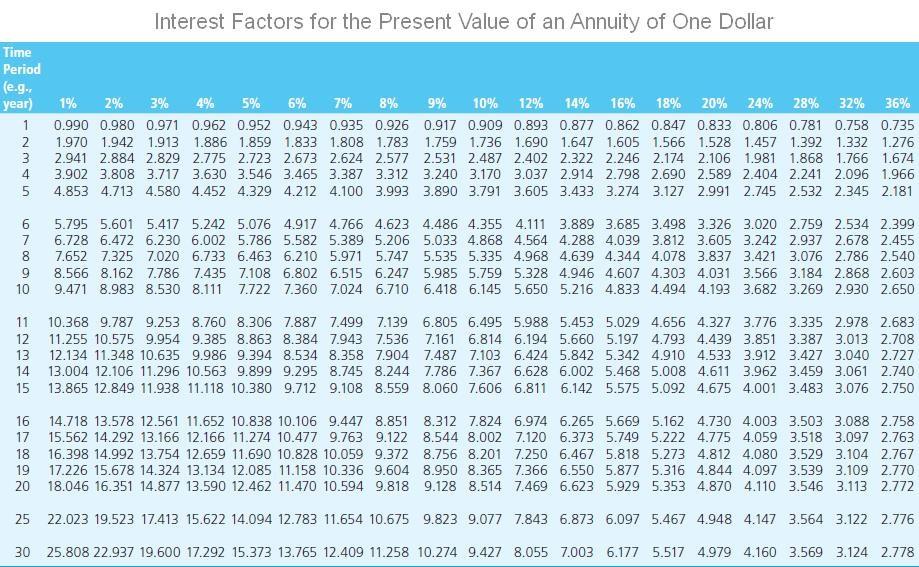

Appendix D:

Dropdowns:

a:

Based on the internal rate of return, should the firm make the investment?

The investment [should be, should not be] b.

Based on the internal rate of return, should the firm make the investment?

The investment [should be, should not be]

c.

- Do the net present value and the internal rate of return suggest the same courses of action?

The net present value and the internal rate of return suggest [the same, different] courses of action.

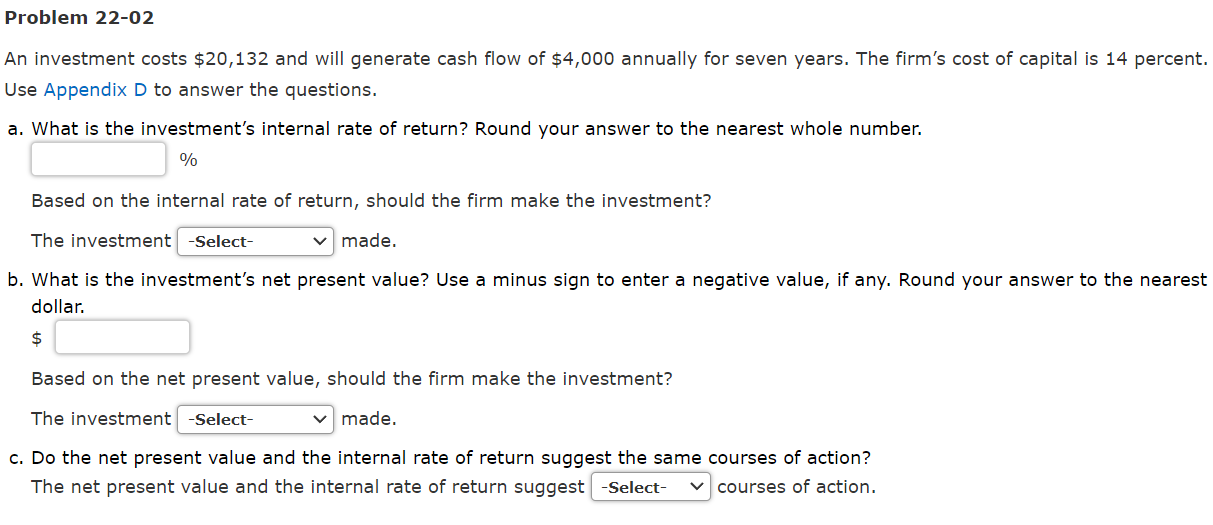

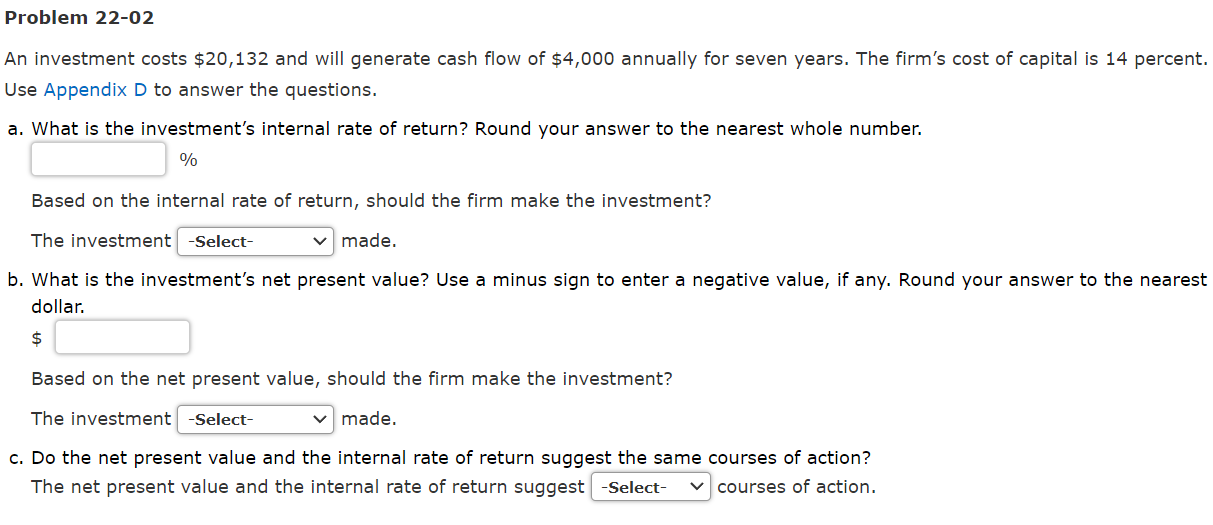

Problem 22-02 An investment costs $20,132 and will generate cash flow of $4,000 annually for seven years. The firm's cost of capital is 14 percent. Use Appendix D to answer the questions. a. What is the investment's internal rate of return? Round your answer to the nearest whole number. % Based on the internal rate of return, should the firm make the investment? The investment -Select- b. What is the investment's net present value? Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar. $ made. Based on the net present value, should the firm make the investment? The investment -Select- made. c. Do the net present value and the internal rate of return suggest the same courses of action? The net present value and the internal rate of return suggest -Select- courses of action. Time Period (e.g., year) 12345 6 7 8 9 10 Interest Factors for the Present Value of an Annuity of One Dollar 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 18% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.690 1.647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.246 2.174 2.106 1.981 1.868 1.766 1.674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2.589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.532 2.345 2.181 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4.623 4.486 4.355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2.534 2.399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.564 4.288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 4.968 4.639 4.344 4.078 3.837 3.421 3.076 2.786 2.540 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.985 5.759 5.328 4.946 4.607 4.303 4.031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.650 5.216 4.833 4.494 4.193 3.682 3.269 2.930 2.650 6.805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3.335 2.978 2.683 7.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3.387 3.013 2.708 7.487 7.103 6.424 5.842 5.342 4.910 4.533 3.912 3.427 3.040 2.727 7.786 7.367 6.628 6.002 5.468 5.008 4.611 3.962 3.459 3.061 2.740 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3.076 2.750 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 13 12.134 11.348 10.635 9.986 9.394 8.534 8.358 7.904 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 15 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.060 7.606 8.312 7.824 6.974 6.265 5.669 5.162 4.730 4.003 3.503 3.088 2.758 8.544 8.002 7.120 6.373 5.749 5.222 4.775 4.059 3.518 3.097 2.763 8.756 8.201 7.250 6.467 5.818 5.273 4.812 4.080 3.529 3.104 2.767 8.950 8.365 7.366 6.550 5.877 5.316 4.844 4.097 3.539 3.109 2.770 9.128 8.514 7.469 6.623 5.929 5.353 4.870 4.110 3.546 3.113 2.772 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6.873 6.097 5.467 4.948 4.147 3.564 3.122 2.776 30 25.808 22.937 19.600 17.292 15.373 13.765 12.409 11.258 10.274 9.427 8.055 7.003 6.177 5.517 4.979 4.160 3.569 3.124 2.778