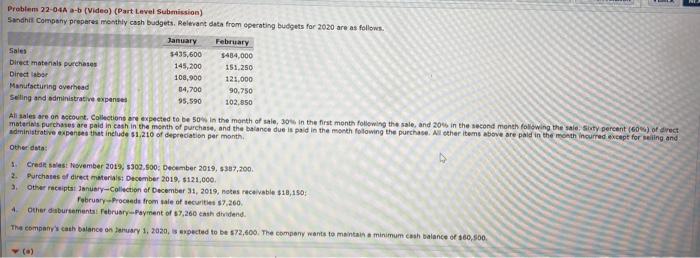

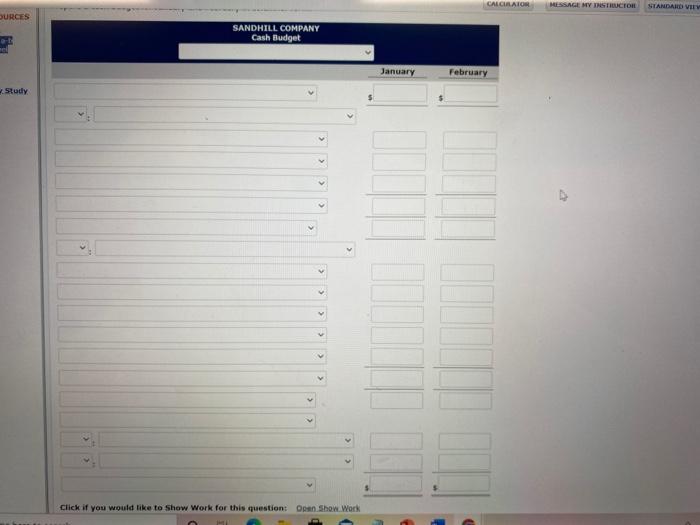

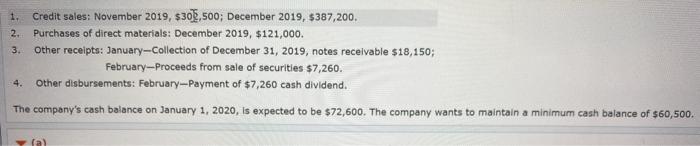

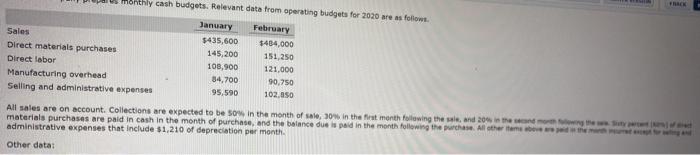

Problem 22-04-b (Video) (Part Level Submission) Sandhil Company prepared monthly cash budgets. Relevant data from operating budgets for 2020 are as follows. January February Sales 5435,600 $414,000 birect materials purchases 145,200 151.250 Direct labor 108,900 12.000 Manufacturing overhead 04,700 90.750 Selling and administrative expenses 95.590 102.650 All sales are on account. Collections are expected to be 50% in the month of sale, 30 in the first month following the sale, and 20% in the second month following the sale ty percent (60%) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for sing and administrative expenses that include 51,210 of deprecation per month Other data: 1 Credit sest November 2019, 5309,500: December 2019, 6587,200 2. Purchases of direct materials: December 2019, 5121,000 3. other receipts January-Collection of December 31, 2019, notas receivable $18.150 February Proceeds from sale of securities 87,260 4 Other disbursement february Payment of 57,260 cai didend The company's cash balance on January 1, 2020, expected to be 572,600. The company wants to maintain a minimum cash balance of $60.500 y (0) CALCULATON MESSAGE HY INSTRUCTOR STANDARDI VIET OURCES SANDHILL COMPANY Cash Budget January February Study > > C Click if you would like to Show Work for this question: On Show Work 1. Credit sales: November 2019, 530,500; December 2019, $387,200. 2. Purchases of direct materials: December 2019, $121,000. 3. Other receipts: January-Collection of December 31, 2019, notes receivable $18,150; February--Proceeds from sale of securities $7,260. 4. Other disbursements: February-Payment of $7,260 cash dividend. The company's cash balance on January 1, 2020, is expected to be $72,600. The company wants to maintain a minimum cash balance of $60,500. fal monthly cash budgets. Relevant data from operating budgets for 2020 are as follow January February Sales 5435,600 $404,000 Direct materials purchases 145,200 151.250 Direct labor 108,900 121.000 Manufacturing overhead 34,700 90.750 Selling and administrative expenses 95,590 102,050 All sales are on account. Collections are expected to be so in the month of sale, 30% in the first month following the sale and 20% in the materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items administrative expenses that include $1,210 of depreciation per month other data