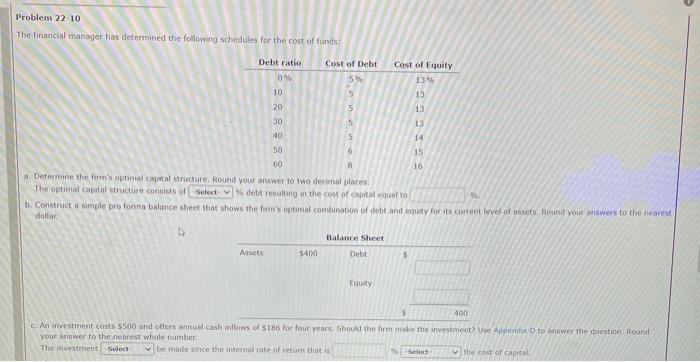

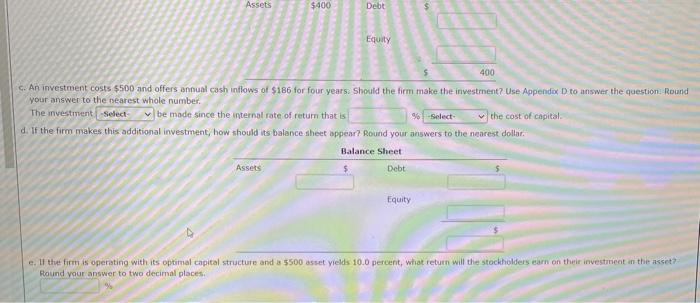

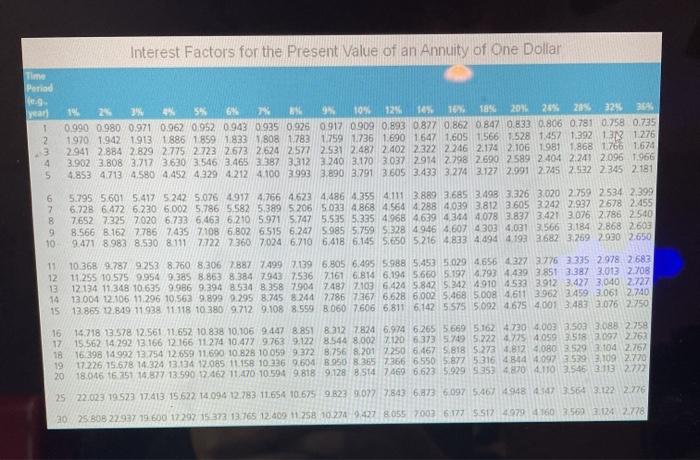

Problem 22-10 The financial manager has determined the following schedules for the cost of funds Debt ratio Cost of Debt Cost of Equity 094 5% 13 10 5 13 20 5 13 30 5 13 40 14 50 6 15 60 16 a. Determine the firm's optimal capital structure. Round your answer to two decimal places The optimal capital structure consists of Select Ndebt resulting in the cost of capital equal to b. Construct a simple pro forma balance sheet that shows the firm's optimal combination of debt and equity for its current level of assets Round your answers to the nearest dollar Balance Sheet Debt Assets $400 $ EY $ 400 c. An investment costs $500 and offers annual cash inflows of $166 for four years. Should the firm make the investment Use Appeade to answer the question Round your answer to the nearest whole number The investment Sect be mader since the internal rate of return that is % the cost of capital Assets $400 Debt Equity 400 c. An investment costs $500 and offers annual cash inflows of $186 for four years. Should the firm make the investment? Use Appendo D to answer the question. Round your answer to the nearest whole number The investment -Select- y be made since the internal rate of return that is -Select the cost of capital d. If the firm makes this additional investment, how should its balance sheet appear? Round your answers to the nearest dollar Balance Sheet Assets Debt Equity e. If the film is operating with its optimal capital structure and a 5500 asset yields 10.0 percent, what return will the stockholders earn on their investment in the asset? Round your answer to two decimal places Interest Factors for the Present Value of an Annuity of One Dollar Period year 3 2 3 4 5 19 5% 6% 7% AX 9 10% 12 14% 16 18 20% 20% 28% 32 36% 0.990 0,980 0,971 0.962 0.952 0943 0935 0.926 0917 0909 0,893 0.877 0.862 0 847 0.833 0.806 0.781 0.758 0.735 1970 1942 1913 1886 1859 1833 808 1783 1759 1736 1.690 1647 1605 1566 1.528 147 1.392 IN 1276 2941 2884 2.829 2775 2723 2673 2624 2577 2.531 2.487 2.402 2322 2246 2.174 2.106 1981 1.868 1766 1674 3.902 3.808 3.717 3630 3.546 3.465 3.387 3312 3.240 3.170 3.037 2914 2.798 2690 2589 2.404 2.241 2.096 1.966 4.853 4 713 4.580 4.452 4.329 4212 4100 3993 3.890 3.791 3.605 3.433 3.274 3.127 2.991 2.745 2.522 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5242 5.076 4917 4.766 4623 4:486 4355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2534 2.399 6.728 6.472 6.2306 002 5.786 5582 5.389 5206 5033 4.868 4.564 4.288 4039 3.812 3605 3242 2.937 2678 2.455 76527325 7020 6.733 6.463 6210 5.971 5.747 5.535 5.335 4 968 4639 4344 4078 3.832 3.421 3.076 2.786 2.500 8.566 8.162 7786 7435 7108 6.802 6515 6.247 S.985 5.759 $ 328 49.46 4.607 4303 4.031 3.566 3.184 2.868 2603 9.471 8.983 8.530 8.111 7722 7360 7.024 6.710 6.418 6.145 5.6505.216 4833 4.494 4.193 3.682 3.269 2.930 2.650 11 10.368 9.787 9.253 8.750 8.306 887 7499 7.139 6.805 6.495 5.988 5,453 5029 4.656 327 3.776 3.335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.196 5.660 5.1974.793 4.439 3851 3.387 3013 2.708 15 12.134 11348 10.6359.986 9.394 8.34 8.358 7904 7487 2103 6.424 5 842 5.342 4.910 4533 3912 3.427 3.040 2.727 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7367 6.628 6002 5.468 5.008 4,611 3.962 3.459 3.061 2.740 15 13.865 12.849 11938 11118 10 3809712 9.108 8.559 8060 7.606 6.811 6.142 5 575 5.092 4675 4001 3.483 0.076 2.750 16 14718 13.578 12.561 11.652 10 838 10.106 9.447 8851 8312 7824 6.974 6265 5669 5.162 47304003: 3.503 3.088 2.758 17 15 562 14.292 13.166 12 166 11274 10.477 9763 9.122 8544 8.002 7.120 6373 5.79 5.222 4775 4059 3.518 3.097 2763 18 16.398 14.992 13.754 12.659 11690 10828 10 059 9 372 8.756 8.2017.250 6.467 5.818 5.273 812 4.0803529 2.104 2767 19 17.226 15.678 14 374 13.134 12.085 11.158 10 336 9.604 3.950 8 365 366 6550 5.877 5316 4 4 4097 3539 3.109 2.770 2018.046 16.751 14.877 13.590.17.462 11,470 10.594 9.818 9.128 8.514 7469 6.623 5.929 Sas 4.870 4.11035463.113 2.722 25 22.023 19523 17.413 15.622 14.094 12.783 11654 10.675 98239.072 7.843 6.8736 097 5.46 948 447 3.564 3.122 2.776 20 25 BOB 22937 19.600 12 297 15373 13.165 12.40 11.258 102749.427 8055 7003 6.177 SS124.97941602509 3.124 2.778