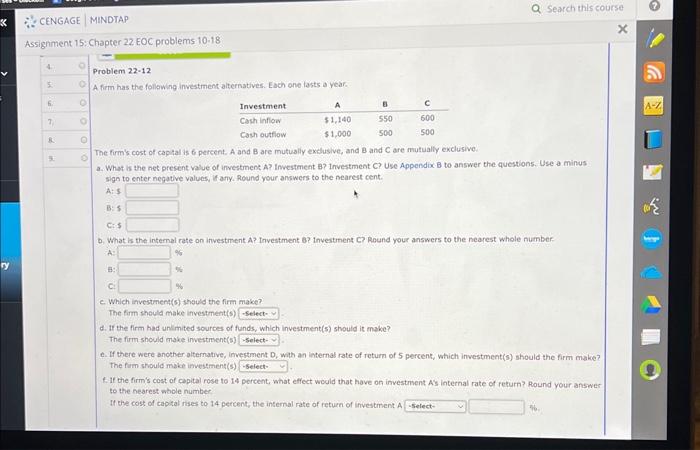

Problem 22-12 A firm has the following investment alternatives. Each one tasts a year. The firm's cost of captal is 6 percent. A and B are mutualiy exslusive, and B and C are mutually exclusive. a. What is the net present value of arvestment A? Investment a? Investment C Use Appendix B to answer the questions. Use a minus sign to enter negative values, if aryy, Round your answers to the nearest cent. Ais B: 3 C:s b. What is the internal rate on investment A? tnvestment B? Investment C ? Round your answers to the nearest whole number. A= B: C: c. Which investment(s) thauld the firm make? The firm shecld make investment(s) d. If the firm had unilmited sources of funds, which investment(s) stvouid it make? The firm should make investment(s) c. If there were another alternative, invertment D, with an iaternab rate of return of 5 percent, which investment(s) should the firm make? the firm should make imvestment(s) f. If the firm's cost of capital rose to 14 percent, what effect would that have on investment As internal rate of rekurn? Round your answes to the nearest whole nimber If the cost of capital rises to 14 percent, the insernal rate of return of ifvestment A Problem 22-12 A firm has the following investment alternatives. Each one tasts a year. The firm's cost of captal is 6 percent. A and B are mutualiy exslusive, and B and C are mutually exclusive. a. What is the net present value of arvestment A? Investment a? Investment C Use Appendix B to answer the questions. Use a minus sign to enter negative values, if aryy, Round your answers to the nearest cent. Ais B: 3 C:s b. What is the internal rate on investment A? tnvestment B? Investment C ? Round your answers to the nearest whole number. A= B: C: c. Which investment(s) thauld the firm make? The firm shecld make investment(s) d. If the firm had unilmited sources of funds, which investment(s) stvouid it make? The firm should make investment(s) c. If there were another alternative, invertment D, with an iaternab rate of return of 5 percent, which investment(s) should the firm make? the firm should make imvestment(s) f. If the firm's cost of capital rose to 14 percent, what effect would that have on investment As internal rate of rekurn? Round your answes to the nearest whole nimber If the cost of capital rises to 14 percent, the insernal rate of return of ifvestment A