Problem: 22-13 Abandonment value - Take another look at the perpetual crusher example in Section 22-3. Construct a sensitivity analysis showing how the value of the abandonment put changes depending on the standard deviation of the project and the exercise price.

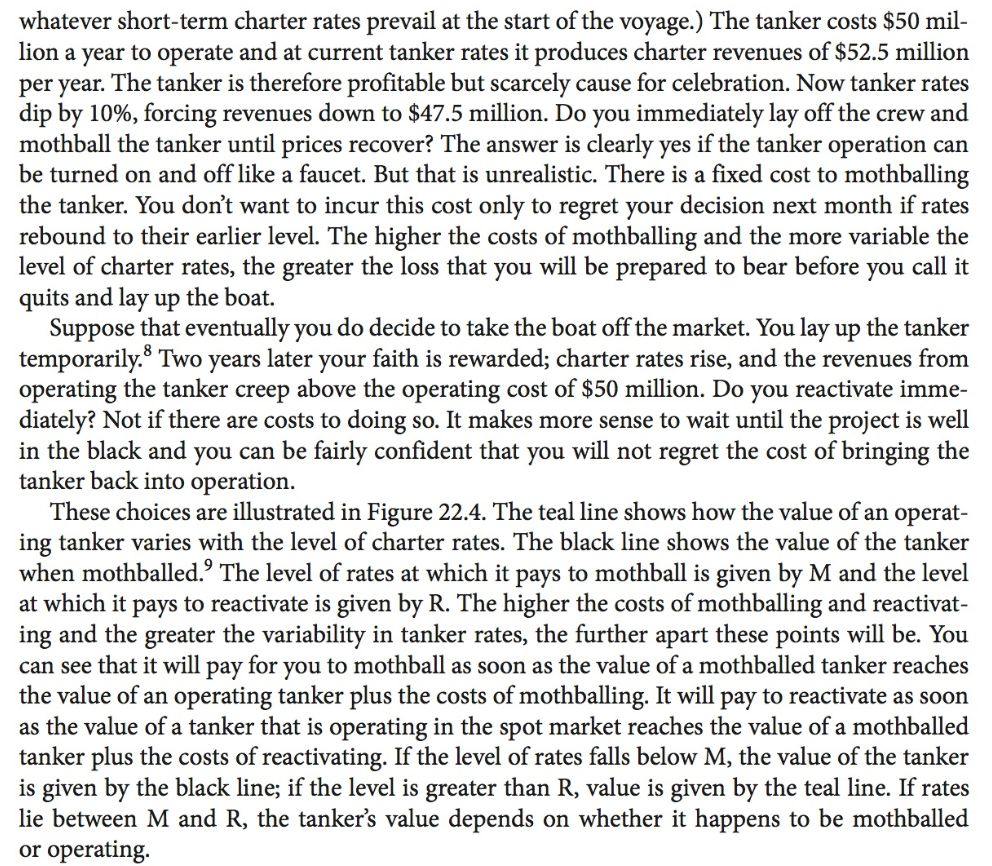

22-3 The Abandonment option Expansion value is important. When investments turn out well, the quicker and easier the business can be expanded, the better. But suppose bad news arrives, and cash flows are far below expectations. In that case it is useful to have the option to bail out and recover the value of the projects plant, equipment, or other assets. The option to abandon is equivalent to a put option. You exercise that abandonment option if the value recovered from the project's assets is greater than the present value of continuing the project for at least one more period. Bad News for the Perpetual Crusher We introduced the perpetual crusher project in Chapter 19 to illustrate the use of the weighted average cost of capital (WACC). The project cost $12.5 million and generated expected perpetual cash flows of $1.125 million per year. With WACC 09, the project was worth PV 1.125/.09 $12.5 million. Subtracting the investment of $12.5 million gave NPV 0. Several years later, the crusher has not panned out. Cash flows are still expected to be perpetual but are now running at only $450,000 a year. The crusher is now worth only $450,000/.09 $5 million. Is this bad news terminal? 22-3 The Abandonment option Expansion value is important. When investments turn out well, the quicker and easier the business can be expanded, the better. But suppose bad news arrives, and cash flows are far below expectations. In that case it is useful to have the option to bail out and recover the value of the projects plant, equipment, or other assets. The option to abandon is equivalent to a put option. You exercise that abandonment option if the value recovered from the project's assets is greater than the present value of continuing the project for at least one more period. Bad News for the Perpetual Crusher We introduced the perpetual crusher project in Chapter 19 to illustrate the use of the weighted average cost of capital (WACC). The project cost $12.5 million and generated expected perpetual cash flows of $1.125 million per year. With WACC 09, the project was worth PV 1.125/.09 $12.5 million. Subtracting the investment of $12.5 million gave NPV 0. Several years later, the crusher has not panned out. Cash flows are still expected to be perpetual but are now running at only $450,000 a year. The crusher is now worth only $450,000/.09 $5 million. Is this bad news terminal