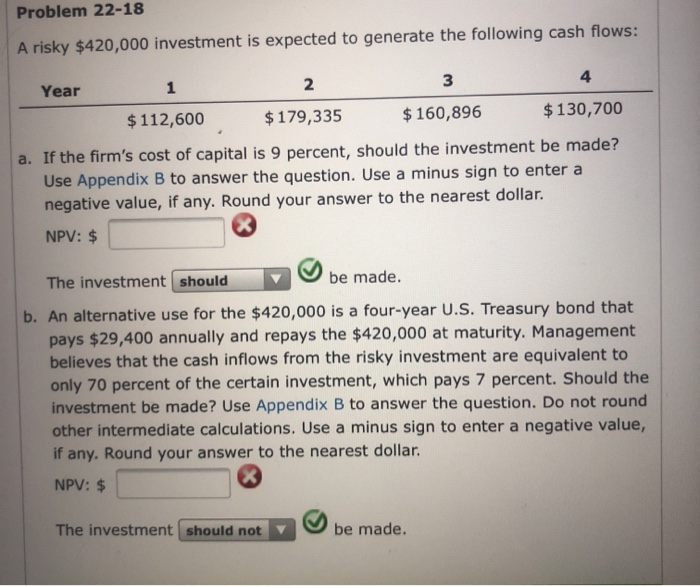

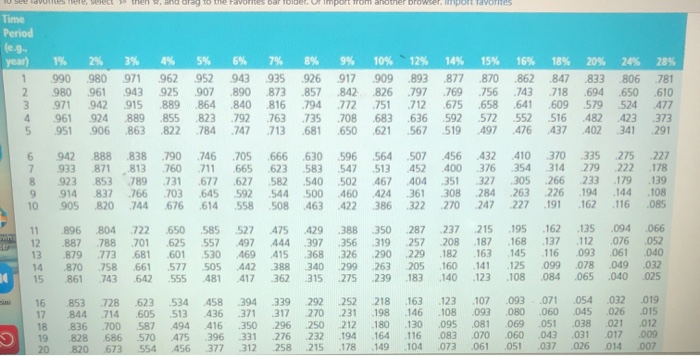

Problem 22-18 A risky $420,000 investment is expected to generate the following cash flows: Year 1 2 $ 112,600 $ 179,335 $160,896 $130,700 a. If the firm's cost of capital is 9 percent, should the investment be made? Use Appendix B to answer the question. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar. NPV: $ The investment should o be made. b. An alternative use for the $420,000 is a four-year U.S. Treasury bond that pays $29,400 annually and repays the $420,000 at maturity. Management believes that the cash inflows from the risky investment are equivalent to only 70 percent of the certain investment, which pays 7 percent. Should the investment be made? Use Appendix B to answer the question. Do not round other intermediate calculations. Use a minus sign to enter a negative value, if any, Round your answer to the nearest dollar. NPV: $ The investment should not be made. 10 See d es Here Select them , and are to the Favorites Dar Tolber. Uimport rom another browser Dort lavorites Time Period | | 990 980 971 962 952 943 935 926 917 980 961943 925 907890 87857842 1971 942915 889 864 840 816 94 72 961 924 889 85 823792763 35 700 95 906 863 822 784 747713 681 650 2 10%12% 909 93 877 826 2797 769 751712 1.675 683636 592 62| 567 59 15% % 870 862 756 43 658 64 572 552 497476 % 0% 847 4833 718 694 600 59 516 482 437 402 2% 28% 806 781 650 610 4 5 34 291 6 1 3 432 410 370 335 275 354 314 29 222 305 266 233 179 28 263 226 19 144 247227 191 162 16 227 178 139 106 085 942 888 838 790 46 105 666 630506 554 933 81 86 760 1.665 623583 547 513 923853 79 131 582 | 94 837766702 | 645592544 500 460 424 10905 820 744676 614558 1508 422 1386 1896 804 22 650 58552) 4529 1.388 0 12 .887788701.625.557497444 139 1879 3 681601 530 469 415 200 1870 58 .66] 57] 505442 388 | 263 15 .86] 743 642 5 48 417 1362 507 46 452 404 35 | 361 1308 | 270 28/ 237 57 208 229 | 182 2005 160 140 25 15 162 135 004 066 187 | 168 137 112 076 052 163 145 116 093 061040 ) 200078 04902 123 108 08 065 040 025 gal | 16 53728 623 534 7 844 14 605 13 18836700 587 494 | 19876686 570 475 | 20820673 54 56 458 30 39 202252 218 163 23 107 03 07 05 436 371 37 20 31 198 146 108 093080 060 045 16 350 296 | 250 212 | 180 130 095 081.09.05] 038 19631] 276 23290 164 116083070 060 043 03] 377 12 58 215 178 19 104 073 06/ 05] 037 076 012 019 026 015 021 012 027 09 0 007