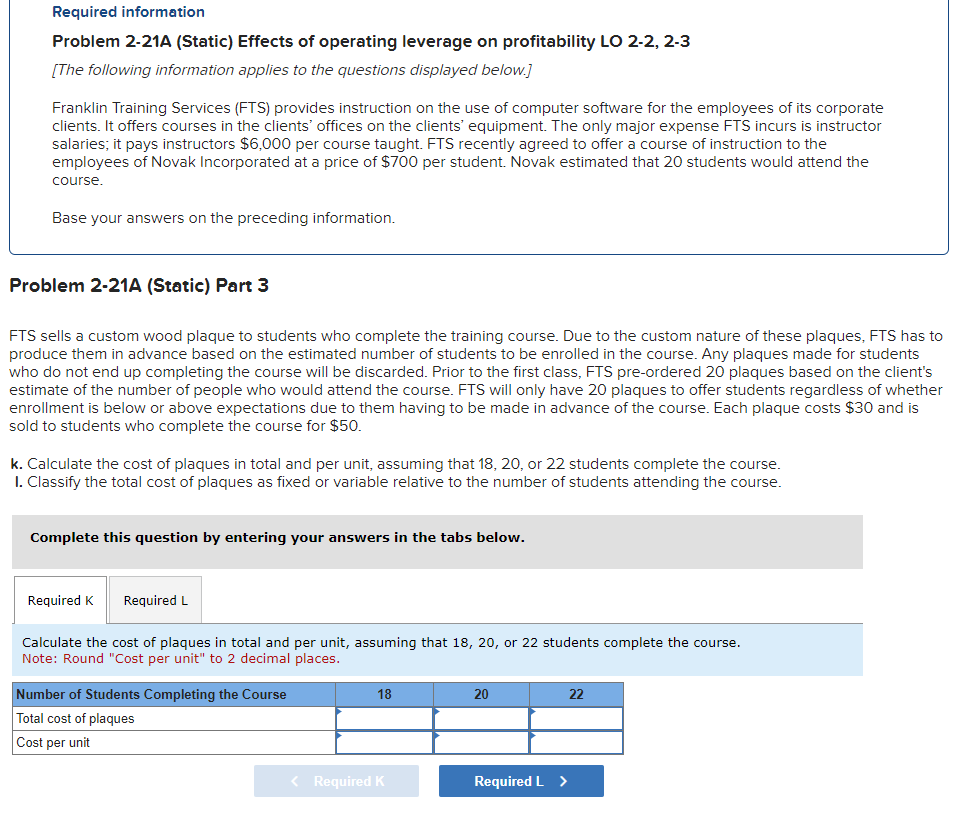

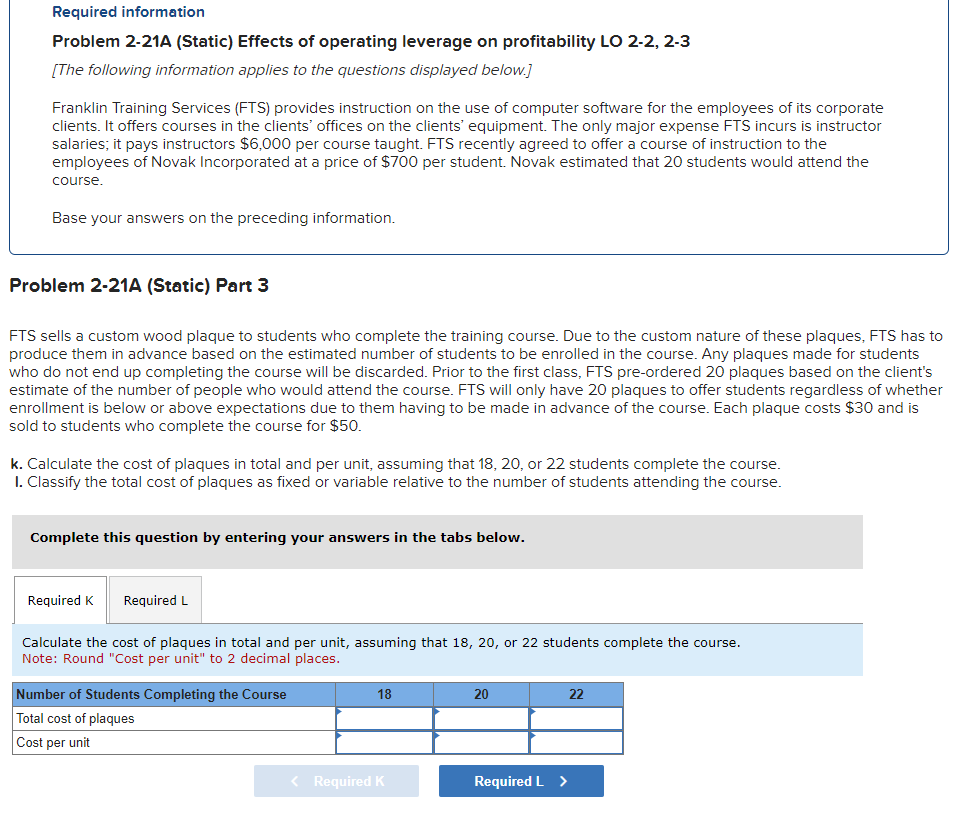

Problem 2-21A (Static) Effects of operating leverage on profitability LO 2-2, 2-3 [The following information applies to the questions displayed below.] Franklin Training Services (FTS) provides instruction on the use of computer software for the employees of its corporate clients. It offers courses in the clients' offices on the clients' equipment. The only major expense FTS incurs is instructor salaries; it pays instructors $6,000 per course taught. FTS recently agreed to offer a course of instruction to the employees of Novak Incorporated at a price of $700 per student. Novak estimated that 20 students would attend the course. Base your answers on the preceding information. Problem 2-21A (Static) Part 3 =TS sells a custom wood plaque to students who complete the training course. Due to the custom nature of these plaques, FTS has produce them in advance based on the estimated number of students to be enrolled in the course. Any plaques made for students who do not end up completing the course will be discarded. Prior to the first class. FTS pre-ordered 20 plaques based on the client's estimate of the number of people who would attend the course. FTS will only have 20 plaques to offer students regardless of whethe enrollment is below or above expectations due to them having to be made in advance of the course. Each plaque costs $30 and is sold to students who complete the course for $50. k. Calculate the cost of plaques in total and per unit, assuming that 18,20 , or 22 students complete the course. I. Classify the total cost of plaques as fixed or variable relative to the number of students attending the course. Complete this question by entering your answers in the tabs below. Calculate the cost of plaques in total and per unit, assuming that 18,20 , or 22 students complete the course. Note: Round "Cost per unit" to 2 decimal places. Problem 2-21A (Static) Effects of operating leverage on profitability LO 2-2, 2-3 [The following information applies to the questions displayed below.] Franklin Training Services (FTS) provides instruction on the use of computer software for the employees of its corporate clients. It offers courses in the clients' offices on the clients' equipment. The only major expense FTS incurs is instructor salaries; it pays instructors $6,000 per course taught. FTS recently agreed to offer a course of instruction to the employees of Novak Incorporated at a price of $700 per student. Novak estimated that 20 students would attend the course. Base your answers on the preceding information. Problem 2-21A (Static) Part 3 =TS sells a custom wood plaque to students who complete the training course. Due to the custom nature of these plaques, FTS has produce them in advance based on the estimated number of students to be enrolled in the course. Any plaques made for students who do not end up completing the course will be discarded. Prior to the first class. FTS pre-ordered 20 plaques based on the client's estimate of the number of people who would attend the course. FTS will only have 20 plaques to offer students regardless of whethe enrollment is below or above expectations due to them having to be made in advance of the course. Each plaque costs $30 and is sold to students who complete the course for $50. k. Calculate the cost of plaques in total and per unit, assuming that 18,20 , or 22 students complete the course. I. Classify the total cost of plaques as fixed or variable relative to the number of students attending the course. Complete this question by entering your answers in the tabs below. Calculate the cost of plaques in total and per unit, assuming that 18,20 , or 22 students complete the course. Note: Round "Cost per unit" to 2 decimal places