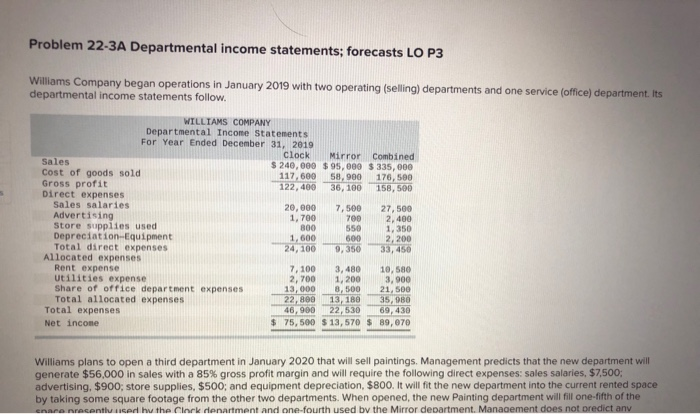

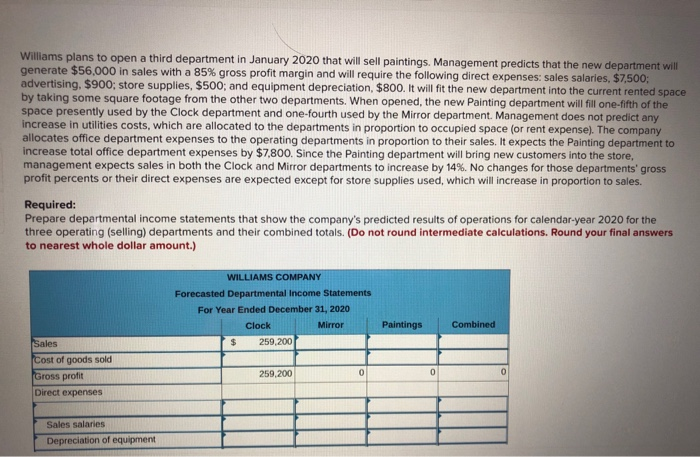

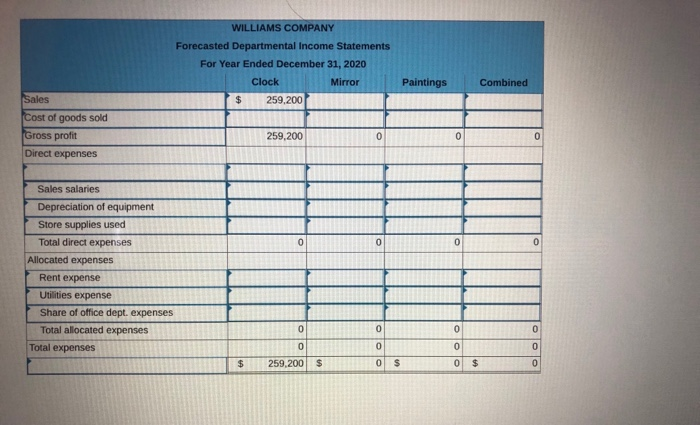

Problem 22-3A Departmental income statements; forecasts LO P3 Williams Company began operations in January 2019 with two operating (selling) departments and one service (office) department. Its departmental income statements follow. WILLIAMS COMPANY Departmental Income Statements For Year Ended December 31, 2019 Clock Mirror Combined Sales $ 240,000 $ 95,000 $335,000 Cost of goods sold 117,600 58,900 176,500 Gross profit 122,400 36,100 158,500 Direct expenses Sales salaries 20.000 7,500 27,500 Advertising 1.700 700 2.400 Store supplies used 550 1.350 Depreciation-equipment 1,600 600 2,200 Total direct expenses 24, 100 9,350 33, 450 Allocated expenses Rent expense 3,480 10 Utilities expense 2,700 1,200 3,900 Share of office department expenses 13,000 3,500 21,500 Total allocated expenses 22.800 13180 353 90 Total expenses 46,900 22,530 69,430 Net income 75,500 $13,570 $ 89,070 300 7.100 Williams plans to open a third department in January 2020 that will sell paintings, Management predicts that the new department will generate $56,000 in sales with a 85% gross profit margin and will require the following direct expenses: sales salaries, $7,500; advertising, $900; store supplies, $500; and equipment depreciation, $800. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new Painting department will fill one-fifth of the enaranacanti ed hu the Cinek denartment and one-fourth used by the Mirror department Management does not predict any Williams plans to open a third department in January 2020 that will sell paintings. Management predicts that the new department will generate $56,000 in sales with a 85% gross profit margin and will require the following direct expenses: sales salaries. $7,500 advertising, $900: store supplies, $500; and equipment depreciation, $800. It will fit the new department into the current rented space by taking some square footage from the other two departments. When opened, the new Painting department will fill one-fifth of the space presently used by the Clock department and one-fourth used by the Mirror department Management does not predict any increase in utilities costs, which are allocated to the departments in proportion to occupied space for rent expense). The company allocates office department expenses to the operating departments in proportion to their sales. It expects the Painting department to increase total office department expenses by $7,800. Since the Painting department will bring new customers into the store, management expects sales in both the Clock and Mirror departments to increase by 14%. No changes for those departments' gross profit percents or their direct expenses are expected except for store supplies used, which will increase in proportion to sales. Required: Prepare departmental income statements that show the company's predicted results of operations for calendar-year 2020 for the three operating (selling) departments and their combined totals. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.) WILLIAMS COMPANY Forecasted Departmental Income Statements For Year Ended December 31, 2020 Clock Mirror 259,200 Paintings Combined Sales Cost of goods sold Gross profit Direct expenses 259,200 0 0 0 Sales salaries Depreciation of equipment WILLIAMS COMPANY Forecasted Departmental Income Statements For Year Ended December 31, 2020 Clock Mirror 259,200 Paintings Combined Sales Cost of goods sold Gross profit Direct expenses 259,200 Sales salaries Depreciation of equipment Store supplies used Total direct expenses Allocated expenses Rent expense Utilities expense Share of office dept. expenses Total allocated expenses Total expenses 259,200 $ 0