Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 22.7A Transfer Pricing Decisions LO22-1, LO22-6 Tots-To-Go, Inc., has two divisions-the seat division and the stroller division. The seat division supplies the seat frames

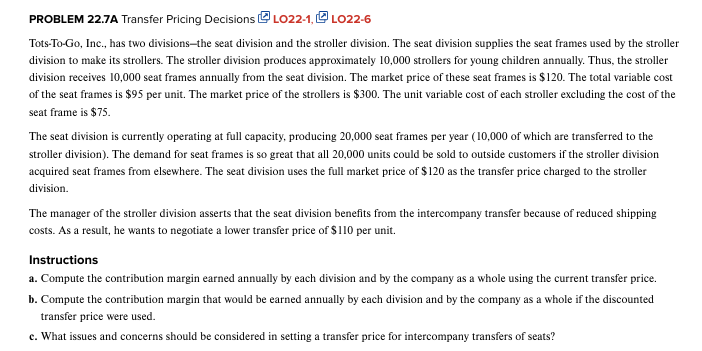

PROBLEM 22.7A Transfer Pricing Decisions LO22-1, \LO22-6 Tots-To-Go, Inc., has two divisions-the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young children annually. Thus, the stroller division receives 10,000 seat frames annually from the seat division. The market price of these seat frames is $120. The total variable cost of the seat frames is $95 per unit. The market price of the strollers is $300. The unit variable cost of each stroller excluding the cost of the seat frame is $75. The seat division is currently operating at full capacity, producing 20,000 seat frames per year ( 10,000 of which are transferred to the stroller division). The demand for seat frames is so great that all 20,000 units could be sold to outside customers if the stroller division acquired seat frames from elsewhere. The seat division uses the full market price of $120 as the transfer price charged to the stroller division. The manager of the stroller division asserts that the seat division benefits from the intercompany transfer because of reduced shipping costs. As a result, he wants to negotiate a lower transfer price of $110 per unit. Instructions a. Compute the contribution margin earned annually by each division and by the company as a whole using the current transfer price. b. Compute the contribution margin that would be earned annually by each division and by the company as a whole if the discounted transfer price were used. c. What issues and concerns should be considered in setting a transfer price for intercompany transfers of seats? PROBLEM 22.7A Transfer Pricing Decisions LO22-1, \LO22-6 Tots-To-Go, Inc., has two divisions-the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young children annually. Thus, the stroller division receives 10,000 seat frames annually from the seat division. The market price of these seat frames is $120. The total variable cost of the seat frames is $95 per unit. The market price of the strollers is $300. The unit variable cost of each stroller excluding the cost of the seat frame is $75. The seat division is currently operating at full capacity, producing 20,000 seat frames per year ( 10,000 of which are transferred to the stroller division). The demand for seat frames is so great that all 20,000 units could be sold to outside customers if the stroller division acquired seat frames from elsewhere. The seat division uses the full market price of $120 as the transfer price charged to the stroller division. The manager of the stroller division asserts that the seat division benefits from the intercompany transfer because of reduced shipping costs. As a result, he wants to negotiate a lower transfer price of $110 per unit. Instructions a. Compute the contribution margin earned annually by each division and by the company as a whole using the current transfer price. b. Compute the contribution margin that would be earned annually by each division and by the company as a whole if the discounted transfer price were used. c. What issues and concerns should be considered in setting a transfer price for intercompany transfers of seats

PROBLEM 22.7A Transfer Pricing Decisions LO22-1, \LO22-6 Tots-To-Go, Inc., has two divisions-the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young children annually. Thus, the stroller division receives 10,000 seat frames annually from the seat division. The market price of these seat frames is $120. The total variable cost of the seat frames is $95 per unit. The market price of the strollers is $300. The unit variable cost of each stroller excluding the cost of the seat frame is $75. The seat division is currently operating at full capacity, producing 20,000 seat frames per year ( 10,000 of which are transferred to the stroller division). The demand for seat frames is so great that all 20,000 units could be sold to outside customers if the stroller division acquired seat frames from elsewhere. The seat division uses the full market price of $120 as the transfer price charged to the stroller division. The manager of the stroller division asserts that the seat division benefits from the intercompany transfer because of reduced shipping costs. As a result, he wants to negotiate a lower transfer price of $110 per unit. Instructions a. Compute the contribution margin earned annually by each division and by the company as a whole using the current transfer price. b. Compute the contribution margin that would be earned annually by each division and by the company as a whole if the discounted transfer price were used. c. What issues and concerns should be considered in setting a transfer price for intercompany transfers of seats? PROBLEM 22.7A Transfer Pricing Decisions LO22-1, \LO22-6 Tots-To-Go, Inc., has two divisions-the seat division and the stroller division. The seat division supplies the seat frames used by the stroller division to make its strollers. The stroller division produces approximately 10,000 strollers for young children annually. Thus, the stroller division receives 10,000 seat frames annually from the seat division. The market price of these seat frames is $120. The total variable cost of the seat frames is $95 per unit. The market price of the strollers is $300. The unit variable cost of each stroller excluding the cost of the seat frame is $75. The seat division is currently operating at full capacity, producing 20,000 seat frames per year ( 10,000 of which are transferred to the stroller division). The demand for seat frames is so great that all 20,000 units could be sold to outside customers if the stroller division acquired seat frames from elsewhere. The seat division uses the full market price of $120 as the transfer price charged to the stroller division. The manager of the stroller division asserts that the seat division benefits from the intercompany transfer because of reduced shipping costs. As a result, he wants to negotiate a lower transfer price of $110 per unit. Instructions a. Compute the contribution margin earned annually by each division and by the company as a whole using the current transfer price. b. Compute the contribution margin that would be earned annually by each division and by the company as a whole if the discounted transfer price were used. c. What issues and concerns should be considered in setting a transfer price for intercompany transfers of seats Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started